UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| x | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

United States Steel Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

|

United States Steel Corporation |

Notice of Annual Meeting

of Stockholders and Proxy Statement

2014

Tuesday, April 29, 2014

10:00 a.m. Eastern Time

33rd Floor

U. S. Steel Tower

600 Grant Street

Pittsburgh, PA 15219

Please vote promptly either by:

u telephone,

u the Internet, or

u marking, signing and returning your proxy or voting instruction card.

| United States Steel Corporation | Mario Longhi | |

| 600 Grant Street | President | |

| Pittsburgh, PA 15219-2800 | and Chief Executive Officer |

March 14, 2014

Dear Fellow U. S. Steel Stockholder:

We will hold the annual meeting of stockholders of United States Steel Corporation on the 33rd floor of the U. S. Steel Tower, 600 Grant Street, Pittsburgh, Pennsylvania 15219, on Tuesday, April 29, 2014, at 10:00 a.m. Eastern Time.

At this meeting, the agenda will include the following:

| • | Election of the four nominees for Class I directors recommended by the Board of Directors and identified in the Corporation’s proxy statement. |

| • | Ratification of the appointment of PricewaterhouseCoopers LLP as the Corporation’s independent registered public accounting firm for 2014. |

| • | Advisory vote to approve executive compensation. |

| • | Approval of the Amendment and Restatement of the 2005 Stock Incentive Plan. |

| • | Approval of the amendment to the Restated Certificate of Incorporation to declassify the Board of Directors and provide for the annual election of directors. |

Your stockholder vote is important and we strongly urge you to cast your vote, whether or not you plan to attend the meeting. You can vote either by telephone, over the Internet or by marking, signing and returning your proxy or voting instruction card.

Sincerely,

Table of Contents

| Notice of Annual Meeting of Stockholders | 5 | |||

| Proxy Statement | 6 | |||

| 6 | ||||

| 10 | ||||

| 16 | ||||

| 17 | ||||

| 18 | ||||

| 20 | ||||

| 20 | ||||

| 21 | ||||

| 21 | ||||

| 22 | ||||

| 24 | ||||

| Proposal No. 2 - Ratification of Appointment of Independent Registered Public Accounting Firm |

29 | |||

| 29 | ||||

| Proposal No. 4 - Amendment and Restatement of the 2005 Stock Incentive Plan |

30 | |||

| 41 | ||||

| Information Regarding the Independence of the Independent Registered Public Accounting Firm |

43 | |||

| 44 | ||||

| 44 | ||||

| 45 | ||||

| 46 | ||||

| 47 | ||||

| 47 | ||||

| 47 | ||||

| 48 | ||||

| Executive Compensation Program |

51 | |||

| 56 | ||||

| 59 | ||||

| 68 | ||||

| 70 | ||||

| 73 | ||||

| 74 | ||||

| 76 | ||||

| 76 | ||||

| 81 | ||||

| 83 | ||||

| 83 | ||||

| 86 | ||||

| 92 |

3

| 97 | ||||

| 97 | ||||

| 98 | ||||

| 98 | ||||

| Appendix A - Amendment and Restatement of 2005 Stock Incentive Plan |

A-1 | |||

| Appendix B - Amended and Restated Article Seventh of the Restated Certificate of Incorporation |

B-1 |

4

Notice of Annual Meeting of Stockholders

on April 29, 2014

We will hold our 2014 annual meeting of stockholders on the 33rd floor of the U. S. Steel Tower, 600 Grant Street, Pittsburgh, Pennsylvania 15219 on Tuesday, April 29, 2014, at 10:00 a.m. Eastern Time, in order to do the following:

| Ÿ | vote on the four nominees for Class I directors recommended by the Board of Directors and identified in the Corporation’s proxy statement, |

| Ÿ | vote on the ratification of the appointment of PricewaterhouseCoopers LLP as the Corporation’s independent registered public accounting firm for 2014, |

| Ÿ | conduct an advisory vote to approve executive compensation, |

| Ÿ | vote on the Amendment and Restatement of the 2005 Stock Incentive Plan, |

| Ÿ | vote on the amendment to the Restated Certificate of Incorporation to declassify the Board of Directors and provide for the annual election of directors, |

| Ÿ | transact any other business that properly comes before the meeting. |

You are entitled to vote at the meeting if you were an owner of record of United States Steel Corporation common stock at the close of business on February 28, 2014.

Every shareholder must present a form of government-issued photo identification in order to be admitted to the annual meeting. If your shares are held in street name (that is through a bank, broker, nominee or other intermediary), you must also bring proof of ownership with you to the meeting. A recent account statement, letter or proxy from your broker, nominee or other intermediary will suffice. Although not required for admission to the meeting, if you received an attendance card, please bring it with you.

By order of the Board of Directors,

Joseph A. Napoli

Secretary

Dated: March 14, 2014

United States Steel Corporation

600 Grant Street

Pittsburgh, PA 15219-2800

Important Notice Regarding the Availability of Proxy Materials for

the Annual Meeting of Stockholders to Be Held on April 29, 2014

The proxy statement and the annual report of the Corporation are available at www.ReadMaterial.com/X

5

6

7

8

9

The Board of Directors and its Committees

Under our by-laws and the laws of Delaware, U. S. Steel’s state of incorporation, the business and affairs of U. S. Steel are managed under the direction of the Board of Directors. The Board met nine times in 2013. The non-employee directors hold regularly scheduled executive sessions without management. Effective as of January 1, 2014, David S. Sutherland, an independent director, was elected the chairman of the Board of Directors. The directors spend considerable time preparing for Board and committee meetings, and they attend as many meetings as possible. During 2013, all of the directors attended in excess of 75 percent of the meetings of the Board and the committees on which they served. The directors are expected to attend the annual meeting of stockholders. Eleven of the twelve directors who were on the Board at the time attended the 2013 stockholders meeting.

| Independence |

The following non-employee directors are independent within the definitions of independence of both the New York Stock Exchange listing standards and the Securities and Exchange Commission (the “SEC”) standards for audit committee members: Dan O. Dinges, John G. Drosdick, John J. Engel, Richard A. Gephardt, Murry S. Gerber, Thomas W. LaSorda, Charles R. Lee, Robert A. McDonald, Glenda G. McNeal, Seth E. Schofield, David S. Sutherland and Patricia A. Tracey. In addition, the Board has affirmatively determined that none of the directors or nominees for director has a material relationship with the Corporation (either directly or as a partner, shareholder or officer of an organization that has a relationship with the Corporation). The Board made such determination based on all relevant facts and circumstances, including the categorical standards for independence adopted by the Board. Under those standards, no director is independent if: |

| a. | within the previous three years: |

| 1. | he or she has been an employee, or an immediate family member (as defined below) has been an executive officer, of the Corporation; |

| 2. | he or she, or an immediate family member, has received more than $120,000 in any twelve-month period in direct compensation from the Corporation, other than director and committee fees and pension or other forms of deferred compensation for prior service (provided such compensation is not contingent in any way on continued service); or |

| 3. | he or she has been employed, or an immediate family member has been employed, as an executive officer of another company where any of the Corporation’s present executives serve on that company’s compensation committee; |

| b. | he or she is a current employee, or an immediate family member is a current executive officer, of a company that has made payments to, or received payments from, the Corporation for property or services in an amount which, in any of the last three fiscal years, exceeded the greater of $1 million or 2 percent of such other company’s gross revenues; or |

| c. | (1) he or she or an immediate family member is a current partner of a firm that is the Corporation’s internal or external auditor; (2) he or she is a current employee of such a firm; (3) he or she has an immediate family member who is a current employee of such a firm and personally works on the Corporation’s audit; or (4) he or she or an immediate family member was within the last three years a partner or employee of such a firm and personally worked on the Corporation’s audit within that time. |

| “Immediate family member” includes a person’s spouse, parents, children, siblings, mother and father-in-law, sons and daughters-in-law, brothers and sisters-in-law, and anyone (other than domestic employees) who shares such person’s home. It does not |

10

| include individuals who are no longer immediate family members as a result of legal separation or divorce, or those who have died or become incapacitated. |

| In making its determination of director independence, the Board of Directors considered the fact that U. S. Steel purchased certain goods and services from WESCO International, Inc. in 2013. Mr. Engel, a Class III director, is the Chairman, President and Chief Executive Officer of WESCO. The Board determined that Mr. Engel did not have a direct or indirect material interest in these transactions and that the transactions were undertaken in the ordinary course of business. In addition, the amount of payments made by U. S. Steel were significantly less than 2% of WESCO’s annual gross revenues. As a result, the Board concluded that these transactions would not affect Mr. Engel’s independence. |

| The Board also determined that (i) no member of the Compensation & Organization Committee has a relationship to the Corporation which is material to that director’s ability to be independent from management in connection with the duties of a compensation committee member, and (ii) each member of the Committee therefore satisfies the independence requirements of the NYSE listing standards. |

| Director Retirement Policy |

Our by-laws require non-employee directors to retire at the first annual meeting of stockholders after they turn 74, even if their terms have not expired; however, the Board can grant exceptions to this policy on a case-by-case basis. The Board has granted such exceptions for Mr. Lee and Mr. Schofield, both of whom are 74. Mr. Lee and Mr. Schofield will now retire at the 2015 annual meeting of stockholders. Because of the extensive changes that took place to the Corporation’s senior management during 2013 (including a new Chief Executive Officer, Chief Financial Officer, General Counsel, Chief Information Officer and Chief Procurement Officer), the Board concluded that it was important to retain the services of these two experienced directors for an additional one year. |

| Employee directors must retire from the Board when they cease to be a principal officer of the Corporation, except that the Chief Executive Officer (“CEO”) may remain on the Board after retirement as an employee, at the Board’s request, through the last day of the month in which he or she turns 70. |

| Our by-laws also provide that directors who undergo a significant change in their business or professional careers should volunteer to resign from the Board. |

| Board Committees |

The Board has three principal committees, each of which is comprised exclusively of independent directors: the Audit Committee, the Compensation & Organization Committee and the Corporate Governance & Public Policy Committee. Each such committee has a written charter adopted by the Board, which is available on the Corporation’s website (www.ussteel.com) under “Investors” then “Corporate Governance.” Each committee may hire outside advisors, including counsel, at the Corporation’s expense. The Board also has an Executive Committee made up of Messrs. Sutherland and Longhi, the role of which is to act on, and report to the Board on, significant matters that may arise between Board meetings. The table below shows |

11

| the current committee memberships of each independent director and the number of meetings that each principal committee of the Board held in 2013. |

| Director | Audit Committee |

Compensation & Organization Committee |

Corporate Governance Committee | |||

| Dan O. Dinges |

X | X | ||||

| John G. Drosdick |

X* | |||||

| John J. Engel |

X* | |||||

| Richard A. Gephardt |

X* | |||||

| Murry S. Gerber |

X | X | ||||

| Thomas W. LaSorda |

X | X | ||||

| Charles R. Lee |

X | X | ||||

| Robert A. McDonald |

X | X | ||||

| Glenda G. McNeal |

X | X | ||||

| Seth E. Schofield |

X | |||||

| David S. Sutherland** |

||||||

| Patricia A. Tracey |

X | X | ||||

| Number of Meetings in 2013 |

7 | 10 | 7 |

* Chairman

** As Chairman of the Board, Mr. Sutherland is a non-voting, ex-officio member of each Committee.

| Audit Committee |

Pursuant to its Charter, the Audit Committee’s duties and responsibilities include the following: |

| Ÿ | reviewing and discussing with management and the independent registered public accounting firm matters related to the annual audited financial statements, quarterly financial statements, earnings press releases and the accounting principles and policies applied; |

| Ÿ | reviewing and discussing with management and the independent registered public accounting firm matters related to the Corporation’s internal control over financial reporting; |

| Ÿ | reviewing the responsibilities, staffing and performance of the Corporation’s internal audit function; |

| Ÿ | reviewing issues that arise with respect to the Corporation’s compliance with legal or regulatory requirements and corporate policies dealing with business conduct; |

| Ÿ | being directly responsible for the appointment (subject to shareholder ratification), compensation, retention, and oversight of the work of the Corporation’s independent registered public accounting firm (including resolution of disagreements between management and such firm regarding financial reporting), while possessing the sole authority to approve all audit engagement fees and terms as well as all non-audit engagements with such firm; and |

| Ÿ | discussing policies with respect to risk assessment and risk management. |

| The charter requires the Committee to perform an annual self-evaluation and to review its charter during its first meeting of each calendar year. |

| The charter requires the Committee to meet at least five times each year. The Committee met seven times in 2013. |

| The charter requires that the Committee be comprised of at least three directors, each of whom is independent and financially literate, and at least one of whom must have accounting or related financial management expertise. The charter also requires that no director who serves on the audit committees of more than two other public companies may serve on the Committee unless the Board determines that such simultaneous service will not impair the ability of such director to effectively serve on the Committee. The Board has determined that John J. Engel, the Committee’s |

12

| chairman, and Charles R. Lee meet the SEC’s definition of audit committee financial expert. Mr. Engel and Mr. Lee are independent, as that term is defined by the New York Stock Exchange and the SEC. |

| Compensation & Organization Committee |

Pursuant to its Charter, the Compensation & Organization Committee’s duties and responsibilities include the following: |

| Ÿ | determining and approving the CEO’s compensation level based on the evaluation of the CEO’s performance; |

| Ÿ | approving the compensation of the other executives of the Corporation; |

| Ÿ | with the Board, annually reviewing the Corporation’s executive management succession plans and the policies regarding succession in the event of an emergency or the retirement of the CEO; |

| Ÿ | administering the plans and programs under which short-term and long-term incentives are awarded to executives and approving such awards; |

| Ÿ | assessing whether the Corporation’s compensation and organization policies and practices for executives and non-executives are reasonably likely to create a risk that could have a material adverse effect on the Corporation; |

| Ÿ | considering the most recent shareholder advisory vote on executive compensation in connection with determining executive compensation policies and decisions; |

| Ÿ | reviewing with management and recommending to the Board the Compensation Discussion & Analysis and producing the Committee report for inclusion in the proxy statement; and |

| Ÿ | adopting and amending employee benefit plans and designating participants therein. |

| The Committee may, in its sole discretion, retain or obtain the advice of any compensation consultant, independent legal counsel, or other adviser to assist the Committee in fulfilling its duties and responsibilities. The Committee is directly responsible for the appointment, compensation (which shall be paid by the Corporation), and oversight of any such adviser and, before selecting an adviser, must take into consideration all factors relevant to such adviser’s independence, including without limitation the factors set forth in the New York Stock Exchange rules. |

| The charter requires the Committee to perform an annual self-evaluation and to review its charter during its first meeting of each calendar year. |

| The charter requires that the Committee be comprised of at least three directors, each of whom is independent. |

| The Committee’s processes for determining the amounts of compensation to pay the Corporation’s executives are provided below. Additional detail on the Committee’s processes can be found in the “Compensation Discussion & Analysis” section. |

| Ÿ | The charter requires the Committee to meet at least five times each year. The Committee met ten times in 2013. Committee agendas are established in consultation among management, the Committee chair and the Committee’s independent consultant. The Committee typically meets in executive session for at least a portion of each regular meeting. Generally, the CEO and the Senior Vice President – Human Resources and Administration attend Committee meetings but are not present for the executive sessions. |

| Ÿ | The Committee has retained Pay Governance as its independent consultant to assist the Committee in evaluating executive compensation programs and in setting executive officers’ compensation. The use of an independent consultant provides additional assurance that the Corporation’s executive compensation programs are reasonable and consistent with the Corporation’s objectives. The consultant reports directly to the Committee and does not perform services for management without |

13

| the express approval of the Committee (there were no services performed for management in 2013). The consultant regularly participates in Committee meetings, including executive sessions, and advises the Committee with respect to compensation trends and best practices, plan design, and the reasonableness of individual compensation awards. The Committee has concluded that there was no conflict of interest with Pay Governance during 2013. In reaching this conclusion, the Committee considered the factors set forth in the rules of the SEC and the New York Stock Exchange regarding compensation consultant independence. |

| Ÿ | With respect to the CEO’s compensation, the Committee makes its determinations based upon its evaluation of the CEO’s performance and with input from its consultant. Each year, the Committee reviews the CEO’s goals and objectives, and the evaluation of the CEO’s performance with respect to the prior year’s approved CEO goals and objectives, with the Board of Directors. The CEO does not participate in the presentations to, or discussions with, the Committee in connection with the setting of his compensation. |

| Ÿ | With the oversight of the CEO and the Senior Vice President – Human Resources and Administration, the Corporation’s compensation group formulates recommendations on matters of compensation philosophy, plan design, and the specific compensation recommendations for other executive officers. The CEO gives the Committee a compensation recommendation reflecting a performance assessment for each of the other executives. These recommendations are then considered by the Committee with the assistance of its compensation consultant. |

| For 2013, the Committee considered reports and analysis that it had requested of management and its independent consultant concerning risks associated with the Corporation’s compensation and organization policies and practices. The Committee concluded that the Corporation’s compensation and organization policies and practices for executives and non-executives are not reasonably likely to create a risk that could have a material adverse effect on the Corporation. |

| Corporate Governance & Public Policy Committee |

The Corporate Governance & Public Policy Committee serves as the Corporation’s nominating committee. Pursuant to its Charter, the duties and responsibilities of this Committee include: |

| Ÿ | identifying and evaluating nominees for director and selecting, or recommending that the Board select, the director nominees for the next annual meeting of shareholders; |

| Ÿ | making recommendations to the Board concerning the appropriate size and composition of the Board and its committees; |

| Ÿ | making recommendations to the Board concerning the compensation of non-employee directors; |

| Ÿ | recommending to the Board a set of corporate governance principles applicable to the Corporation, reviewing such principles at the Committee’s first meeting of each calendar year and recommending appropriate changes to the Board; |

| Ÿ | reviewing relationships with, and communications to and from, the investment community, including the Corporation’s stockholders; |

| Ÿ | reviewing matters and discussing risk relating to legislative, regulatory and public policy issues affecting the Corporation’s businesses and operations; |

| Ÿ | reviewing and approving codes of conduct applicable to employees of the Corporation and its principal operating units; and |

| Ÿ | assessing and making recommendations concerning overall corporate governance to the extent specific matters are not the assigned responsibility of other board committees. |

| The Committee establishes criteria for selecting new directors, which include (a) their independence, as defined by applicable law, stock exchange listing standards and the categorical standards listed in the Corporation’s Corporate Governance Principles, |

14

| (b) their business or professional experience, (c) their integrity and judgment, (d) their records of public service, (e) their ability to devote sufficient time to the affairs of the Corporation, (f) the diversity of backgrounds and experience they will bring to the Board, and (g) the needs of the Corporation from time to time. The Committee’s charter provides that all directors should be individuals of substantial accomplishment with demonstrated leadership capabilities and that they should represent all shareholders and not any special interest group or constituency. |

| In evaluating diversity, the Committee considers not only racial and gender diversity, but also the need for a Board that represents diverse experience at policy making levels in business, government and education and in industries that are relevant to the Corporation’s business operations. The director selection criteria described above, including diversity, are evaluated by the Committee each time a new candidate is considered for Board membership. In addition, at the end of each year, the Board of Directors conducts a thorough self-evaluation of its performance. This evaluation includes an assessment of whether the Board (i) has the appropriate mix of skills, experience and other characteristics, and (ii) is made up of a sufficiently diverse group of people (in terms of age, background, experience, gender and race). The biography of each nominee for election and each Continuing Director on pages 22-28 of this proxy statement includes a discussion of the attributes that each brings to the total mix of skills and experience of the Board. |

| The Committee will evaluate candidates for the Board of Directors recommended by stockholders using the same criteria that are described above. Stockholders wishing to recommend a candidate may submit a recommendation to the Secretary of the Corporation. That submission should include (i) the candidate’s name, address, occupation and share ownership; (ii) any other biographical information that will enable the Committee to evaluate the candidate in light of the foregoing criteria; and (iii) information concerning any relationship between the candidate and the shareholder making the recommendation. |

| The Corporation has an agreement with the United Steelworkers (the “USW”) that permits the USW to suggest two individuals for consideration for Board membership. The agreement recognizes that every director has a fiduciary duty to the Corporation and all of its stockholders, and that each individual recommended by the USW must meet the criteria described above. |

| The Committee’s charter gives the Committee the sole authority to retain and terminate any search firm to be used to identify director candidates, including sole authority to approve the search firm’s fees and other retention terms. |

| The charter requires the Committee to perform an annual self-evaluation and to review its charter during its first meeting of each calendar year. |

| The charter requires that the Committee be comprised of at least three directors, each of whom is independent. |

| The charter requires the Committee to meet at least four times each year. The Committee met seven times in 2013. |

15

| The Board regularly considers the appropriate leadership structure for the Corporation. It has concluded that the Corporation and its shareholders are best served by the Board retaining discretion to determine whether the same individual should serve as both Chief Executive Officer and Chairman of the Board, or whether the Chairman of the Board should be an independent director. The Board believes that it is important to retain the flexibility to make this determination at any given point in time based on what it believes will provide the best leadership structure for the Company, taking into account the needs of the Corporation at that time. |

| The Board has determined that the Corporation and its stockholders are currently best served by having Mr. Sutherland serve as the independent non-executive Chairman of the Board, and Mr. Longhi serve as the Chief Executive Officer. The Board believes that this structure allows Mr. Longhi to focus on strategy and the day-to-day operation of the business, while allowing Mr. Sutherland to focus on the leadership of the Board of Directors. |

| If the Chairman of the Board is not independent, the independent directors annually elect from among themselves a Lead Director. The duties of the Lead Director are as follows: |

| Ÿ | chair executive sessions of the non-employee directors; |

| Ÿ | serve as a liaison between the Chief Executive Officer and the independent directors; |

| Ÿ | approve Board meeting agendas and, in consultation with the Chief Executive Officer and the independent directors, approve Board meeting schedules to ensure there is sufficient time for discussion of all agenda items; |

| Ÿ | approve the type of information to be provided to directors for Board meetings; |

| Ÿ | be available for consultation and direct communication with the Corporation’s shareholders; |

| Ÿ | call meetings of the independent directors when necessary and appropriate; and |

| Ÿ | perform such other duties as the Board may from time to time designate. |

| If the Chairman of the Board is independent, the Chairman’s duties also include the duties of the Lead Director. |

16

Board’s Role in Risk Oversight

| Pursuant to its charter, the Audit Committee of the Board of Directors is responsible for reviewing and discussing the Corporation’s policies with respect to risk assessment and risk management, including the following: |

| Ÿ | the guidelines and policies that govern the process by which the assessment and management of the Corporation’s exposure to risk are handled by senior management, and |

| Ÿ | the Corporation’s major risk exposures and the steps management has taken to monitor and control such exposures. |

| Although the Audit Committee has primary responsibility for overseeing risk management, each of our other Board committees also considers the risks within their specific areas of responsibility. For example, the charter of the Compensation & Organization Committee gives it responsibility for assessing whether the Corporation’s compensation and organization policies and practices for executives and non-executives are reasonably likely to create a risk that could have a material adverse effect on the Corporation. Pursuant to its charter, the Corporate Governance & Public Policy Committee considers the risks associated with legislative, regulatory and public policy issues affecting the Corporation’s businesses and operations. Each committee periodically reports to the full Board of Directors on their respective activities, including, when appropriate, those activities related to risk assessment and risk management oversight. |

| The Board as a whole also considers risk assessment and management. For example, the Board annually reviews the Corporation’s strategic plan which includes a review of safety, environmental, operating and competitive matters; political and regulatory issues; employee and labor issues; and financial results and projections. |

| The Senior Vice President, Chief Risk Officer & Treasurer of the Corporation reports to the Executive Vice President and Chief Financial Officer and is responsible for the Corporation’s financial and business risk management, including the assessment, analysis and monitoring of business risk and opportunities and the identification of strategies for managing risk. The Chief Risk Officer provides regular reports to the Audit Committee and Board of Directors on these matters. |

| The Corporation believes that its leadership structure, as described above, supports the Board’s role in risk oversight. |

17

| Our by-laws provide that each non-employee director shall be paid allowances and attendance fees as the Board may from time to time determine. Directors who are employees of U. S. Steel receive no compensation for their service on the Board. |

| The objective of U. S. Steel’s director compensation programs is to enable the Corporation to attract and retain as directors individuals of substantial accomplishment with demonstrated leadership capabilities. In order to align the interests of directors with the interests of the shareholders, our non-employee directors also participate in the Deferred Compensation Program for Non-Employee Directors and the Non-Employee Director Stock Program, each of which is described below. |

| Non-employee directors are paid an annual retainer fee of $200,000. Until July 1, 2013, Committee Chairs and the Lead Director were paid an additional annual fee of $10,000. |

| Effective as of July 1, 2013, the amount of this additional annual fee was increased to $20,000 for Committee Chairs and $25,000 for the Lead Director. |

| Effective as of January 1, 2014, an additional annual fee of $50,000 is payable to the Chairman of the Board if he or she is not an employee of the Corporation. |

| No meeting fees or committee membership fees are paid. |

| Under our Deferred Compensation Program for Non-Employee Directors, each non-employee director is required to defer at least 50 percent of his or her retainer in the form of Common Stock Units and may elect to defer up to 100 percent. A Common Stock Unit is what is sometimes referred to as “phantom stock” because initially no stock is actually issued. Instead, we keep a book entry account for each director that shows how many Common Stock Units he or she has. When a director leaves the Board, he or she receives actual shares of common stock corresponding to the number of Common Stock Units in his or her account. The ongoing value of each Common Stock Unit equals the market price of the common stock. When dividends are paid on the common stock, we credit each account with equivalent amounts in additional Common Stock Units. If U. S. Steel were to undergo a change in control resulting in the removal of a non-employee director from the Board, that director would receive a cash payment equal to the value of his or her deferred stock account. |

| Under our Non-Employee Director Stock Program, upon joining our Board, each non-employee director is eligible to receive a grant of up to 1,000 shares of common stock. In order to qualify, each director must first have purchased an equivalent number of shares in the open market during the 60 days following the first date of his or her service on the Board. |

18

| The following table sets forth certain information concerning the compensation of directors for 2013: |

Director Compensation

| Name | Fees Earned or Paid in ($) |

Stock Awards (2)(3) ($) |

Option Awards |

Non-Equity Incentive Plan Compensation ($) |

All

Other Compensation (4) ($) |

Total ($) |

||||||||||||||||

| Dan O. Dinges |

100,000 | 100,000 | 0 | 0 | 0 | 200,000 | ||||||||||||||||

| John G. Drosdick |

107,500 | 107,500 | 0 | 0 | 10,000 | 225,000 | ||||||||||||||||

| John J. Engel |

107,500 | 110,000 | 0 | 0 | 0 | 217,500 | ||||||||||||||||

| Richard A. Gephardt |

107,500 | 110,000 | 0 | 0 | 0 | 217,500 | ||||||||||||||||

| Murry S. Gerber |

100,000 | 100,000 | 0 | 0 | 10,000 | 210,000 | ||||||||||||||||

| Thomas W. LaSorda (1) |

66,667 | 83,847 | 0 | 0 | 0 | 150,514 | ||||||||||||||||

| Charles R. Lee |

100,000 | 97,500 | 0 | 0 | 10,000 | 207,500 | ||||||||||||||||

| Frank J. Lucchino (1) |

33,333 | 30,833 | 0 | 0 | 0 | 64,166 | ||||||||||||||||

| Robert A. McDonald (1) |

0 | 0 | 0 | 0 | 0 | 0 | ||||||||||||||||

| Glenda G. McNeal |

100,000 | 100,000 | 0 | 0 | 0 | 200,000 | ||||||||||||||||

| Seth E. Schofield |

108,750 | 108,750 | 0 | 0 | 0 | 217,500 | ||||||||||||||||

| David S. Sutherland |

0 | 200,000 | 0 | 0 | 0 | 200,000 | ||||||||||||||||

| Patricia A. Tracey |

100,000 | 100,000 | 0 | 0 | 0 | 200,000 | ||||||||||||||||

| (1) | Mr. Lucchino retired from the Board of Directors effective as of April 30, 2013. Mr. LaSorda joined the Board of Directors on April 30, 2013. Mr. McDonald joined the Board of Directors on January 1, 2014. |

| (2) | The amount shown represents the aggregate grant date fair value, computed in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718 (“ASC 718”), as described in the Corporation’s financial statements for the year ended December 31, 2013 included in the Corporation’s annual report on Form 10-K for 2013. All of the 2013 stock awards represent Common Stock Units under the Deferred Compensation Program for Non-Employee Directors, except in the case of Mr. LaSorda where $66,667 of the amount shown represents Common Stock Units under the Deferred Compensation Program for Non-Employee Directors and $17,180 represents shares awarded under the Non-Employee Director Stock Program. |

| (3) | The aggregate stock awards outstanding at the end of 2013 for each director listed in the table are as follows and represent Common Stock Units under the Deferred Compensation Program for Non-Employee Directors: |

| Number of Common Stock Units * |

||||

| Dan O. Dinges |

11,035 | |||

| John G. Drosdick |

24,147 | |||

| John J. Engel |

10,066 | |||

| Richard A. Gephardt |

18,997 | |||

| Murry S. Gerber |

6,297 | |||

| Thomas W. LaSorda |

3,669 | |||

| Charles R. Lee |

33,399 | |||

| Frank J. Lucchino |

0 | |||

| Robert A. McDonald |

0 | |||

| Glenda G. McNeal |

15,192 | |||

| Seth E. Schofield |

27,737 | |||

| David S. Sutherland |

28,305 | |||

| Patricia A. Tracey |

15,192 | |||

| * | Fractional units are not included. The amounts shown also include Common Stock Units that are convertible only into cash in the following amounts: 858 for each of Messrs. Drosdick, Lee and Schofield and 680 for Mr. Gephardt. Upon his resignation from the Board of Directors, all remaining Common Stock Units in Mr. Lucchino’s account were converted into actual shares of the Corporation’s common stock and distributed to him. |

| (4) | The amounts shown represent contributions made under the U. S. Steel Matching Gift Program. Under this Program, United States Steel Foundation, Inc. matches charitable contributions made by directors and employees to eligible educational institutions, subject to certain limitations and conditions set forth in the Program. |

19

Communications from Security Holders and Interested Parties

Security holders and interested parties may send communications through the Secretary of the Corporation to (1) the Board, (2) the Committee chairmen, (3) the Chairman of the Board or the Lead Director, or (4) the outside directors as a group. The Secretary will collect, organize and forward to the directors all communications that, in his or her judgment, are appropriate for consideration by the directors. Examples of communications that would not be considered appropriate for consideration by the directors include solicitations for products or services, employment matters, and matters not relevant to the shareholders, to the functioning of the Board, or to the affairs of the Corporation.

Policy With Respect To Related Person Transactions

The Board of Directors of the Corporation has adopted a written policy that requires certain transactions with related persons to be approved or ratified by its Corporate Governance & Public Policy Committee. For purposes of this policy, related persons include (i) any person who is, or at any time since the beginning of the Corporation’s last fiscal year was, a director or executive officer of the Corporation or a nominee to become a director of the Corporation, (ii) any person who is the beneficial owner of more than 5 percent of any class of the Corporation’s voting securities; and (iii) any immediate family member of any person described in (i) or (ii). The types of transactions that are subject to this policy are transactions, arrangements or relationships (or any series of similar transactions, arrangements or relationships) in which the Corporation, or any of its subsidiaries, was, is or will be a participant and in which any related person had, has or will have a direct or indirect material interest and the aggregate amount involved will or may be expected to exceed $120,000. The standards applied by the Corporate Governance & Public Policy Committee when reviewing transactions with related persons include (a) the benefits to the Corporation of the transaction; (b) the terms and conditions of the transaction and whether such terms and conditions are comparable to the terms available to an unrelated third party or to employees generally; and (c) the potential for the transaction to affect the independence or judgment of a director or executive officer of the Corporation. Under the policy, certain transactions are deemed to be automatically pre-approved and do not need to be brought to the Corporate Governance & Public Policy Committee for individual approval. The transactions which are automatically pre-approved include (i) transactions involving compensation to directors and executive officers of the type that is required to be reported in the Corporation’s proxy statement; (ii) indebtedness for ordinary business travel and expense payments; (iii) transactions with another company at which a related person’s only relationship is as an employee (other than an executive officer), a director or beneficial owner of less than 10 percent of any class of equity securities of that company, provided that the amount involved does not exceed the greater of $1,000,000 or 2 percent of that company’s consolidated gross annual revenues; (iv) transactions where the interest of the related person arises solely from the ownership of a class of equity securities of the Corporation, and all holders of that class of equity securities receive the same benefit on a pro rata basis; (v) transactions where the rates or charges involved are determined by competitive bid; (vi) transactions involving the rendering of services as a common or contract carrier or public utility at rates or charges fixed in conformity with law or governmental regulation; and (vii) transactions involving services as a bank depositary of funds, transfer agent, registrar, trustee under a trust indenture or similar services.

There were no transactions that required approval of the Corporate Governance & Public Policy Committee under this policy during 2013.

20

The Board will present the following proposals at the meeting:

| Election of Directors |

U. S. Steel’s Certificate of Incorporation provides for a classified Board of Directors that divides the directors into three classes: Class I, Class II and Class III. Each class must consist, as nearly as possible, of one-third of the directors. Once elected, directors serve for a term of three years and until their successors are duly elected and qualified. At each annual meeting, directors who are elected to succeed directors whose terms have expired are identified as being of the same class as those they succeed. A director elected to fill a vacancy is elected to the same class as the director he or she succeeds, and a director elected to fill a newly created directorship holds office until the next election of the class to which he or she is elected.

In Proposal 5, the Board has recommended that the shareholders approve an amendment to the Corporation’s Restated Certificate of Incorporation that will eliminate the classified Board of Directors. If that Proposal is approved by the affirmative vote of a majority of the outstanding shares of the Corporation, the elimination of our classified Board structure will be phased in over a three-year period, beginning with the 2015 Annual Meeting of Stockholders.

Except in the case of contested elections, each director is elected if a majority of the votes are cast for that director’s election. The term “a majority of the votes cast” means that the number of votes cast “for” a director’s election exceeds the number of votes cast “against” the director’s election, with abstentions and broker non-votes not counted as votes cast either “for” or “against” the director’s election. A “contested election” is one in which the number of nominees exceeds the number of directors to be elected at the meeting.

If a nominee who is currently serving as a director is not re-elected, Delaware law provides that the director would continue to serve on the Board until the director’s successor is duly elected and qualified or until the director’s earlier resignation or removal. Under our By-laws, in order for any incumbent director to become a nominee for election by the stockholders as a director, that director must tender an irrevocable offer to resign from the Board of Directors, contingent upon acceptance of such offer of resignation by the Board of Directors, if the director fails to receive a majority of the votes cast in an election that is not a contested election. If an incumbent director fails to receive a majority of the votes cast in an election that is not a contested election, the Corporate Governance & Public Policy Committee, or such other independent committee designated by the Board of Directors, must make a recommendation to the Board of Directors as to whether to accept or reject the offer of resignation of the incumbent director, or to take other action. The Board of Directors must act on the offer of resignation, taking into account the committee’s recommendation, within 90 days following certification of the election results. The committee, in making its recommendation, and the Board of Directors, in making its decision, each may consider such factors and other information as it may consider appropriate and relevant in the circumstances.

The four current Class I directors are nominees for election this year. The Board is recommending all four nominees be elected for a three-year term that will expire at the 2017 annual meeting.

A brief statement about the background and qualifications of each nominee and each continuing director is given on the following pages. No director has a family relationship to any other director, nominee for director or executive officer.

If any nominee for whom you have voted becomes unable to serve, your proxy may be voted for another person designated by the Board.

The Board recommends a vote FOR the election of each nominee.

21

Nominees for Class I Directors

Terms Expire 2017

|

Richard A. Gephardt | Director since 2005 | Age 73 | |||

| President and Chief Executive Officer, Gephardt Group (consulting) | ||||||

|

Congressman Gephardt received a Bachelor of Science degree from Northwestern University and a Juris Doctor degree from the University of Michigan Law School. After serving as a Democratic committeeman and alderman in his native St. Louis, he was elected to the United States House of Representatives in 1976, representing Missouri’s Third District. He was re-elected 13 times. While in the House, Congressman Gephardt served on the Budget Committee and on the Ways and Means Committee. He was elected Chairman of the House Democratic Caucus in 1984; and he served as majority leader from 1989 to 1994. In 1994 he was elected House Democratic Leader, the top Democratic leadership position in the House. He served as minority leader from 1995 to 2003. After deciding not to seek re-election, Congressman Gephardt retired from the House on January 3, 2005. Congressman Gephardt has served as President and Chief Executive Officer of Gephardt Group, a multi-disciplined consulting firm, since 2005. He is a director of Spirit Aerosystems Holdings, Inc., Centene Corporation, CenturyLink, Inc. and Ford Motor Company. He previously served as a director of Embarq Corporation and Dana Holding Corporation.

Congressman Gephardt has valuable experience in public policy and governmental affairs as a result of his service in the United States House of Representatives. He was recommended as a candidate for election to the Board of Directors pursuant to an agreement with the United Steelworkers that permits it to suggest two individuals for consideration for Board membership. | ||||||

|

Murry S. Gerber | Director since 2012 | Age 61 | |||

| Retired Chairman and Chief Executive Officer EQT Corporation (natural gas exploration, production and transportation) | ||||||

|

Mr. Gerber received a Bachelors degree in Geology from Augustana College and a Masters Degree in Geology from the University of Illinois. From 1979 to 1998, Mr. Gerber served in a series of technical and management positions with Shell Oil Company, including Chief Executive Officer of Coral Energy, L.P. (now Shell Trading North America) from 1995 to 1998. Mr. Gerber served as Chief Executive Officer and President of EQT Corporation from June 1998 through February 2007; Chairman and Chief Executive Officer from May 2000 through April 2010; and Executive Chairman from April 2010 until May 2011. Mr. Gerber is also a member of the Boards of Directors of BlackRock, Inc. and Halliburton Company.

Mr. Gerber has valuable experience in managing the issues that face a publicly held company as a result of his service as Chairman and Chief Executive Officer of EQT Corporation. Mr. Gerber also provides the Board with knowledge and insight regarding the energy industry, an important supplier to, and customer of, the Corporation. | ||||||

22

|

Glenda G. McNeal | Director since 2007 | Age 53 | |||

| Executive Vice President and General Manager – Global Client Group, Global Merchant Services American Express Company (global payments, network, credit card and travel services) | ||||||

|

Ms. McNeal received a Bachelor of Arts degree in Accounting from Dillard University and an MBA in Finance from the Wharton School of the University of Pennsylvania. Ms. McNeal began her career with Arthur Andersen, LLP in 1982, and was employed by Salomon Brothers, Inc. from 1987 to 1989. In 1989, Ms. McNeal joined American Express Company and since that time has served in a series of increasingly responsible positions for that company. She assumed her current position in 2011. Ms. McNeal is a director of RLJ Lodging Trust, Vente-Privee USA and the UNCF.

Ms. McNeal has valuable experience in business development, customer relationship management, and financial and accounting matters as a result of her current position as a senior executive at American Express Company, along with her prior positions with Arthur Andersen, LLP and Salomon Brothers, Inc. In addition, she provides the Board with knowledge and insight regarding the financial services industry and financial markets. | ||||||

|

Patricia A. Tracey | Director since 2007 | Age 63 | |||

| Vice President, Homeland Security and Defense Services Hewlett Packard Enterprise Services (technology services) | ||||||

|

Vice Admiral Tracey received a Bachelor of Arts degree in Mathematics from the College of New Rochelle and a Masters Degree in Operations Research from the Naval Postgraduate School. From 1970 to 2004, Vice Admiral Tracey served in a series of increasingly responsible positions with the United States Navy, including Chief of Naval Education and Training from 1996 to 1998; Deputy Assistant Secretary of Defense (Military Manpower and Personnel Policy) from 1998 to 2001; and Director, Navy Staff from 2001 to 2004. Vice Admiral Tracey served as a consultant to the United States Navy from 2004 to 2005 and to the Department of Defense from 2005 to 2006. In 2006, Vice Admiral Tracey served as a Senior Fellow at the Center for Naval Analysis, prior to taking a position as Client Industry Executive with Electronic Data Systems Corporation. Hewlett Packard Co. acquired Electronic Data Systems Corporation in August of 2008. Vice Admiral Tracey assumed her current position as Vice President, Homeland Security and Defense Services with Hewlett Packard Enterprise Services in September 2012.

As a result of her service with the United States Navy, Vice Admiral Tracey has valuable experience in governmental affairs, environmental laws and regulations, OSHA standards, human resources, and education and training matters. She also provides the Board with knowledge and insight regarding the information technology industry. | ||||||

23

Continuing Class III Directors

Terms Expire 2016

|

Dan O. Dinges | Director since 2010 | Age 60 | |||

| Chairman, President and Chief Executive Officer, Cabot Oil & Gas Corporation (exploration and development of oil and gas properties) | ||||||

|

Mr. Dinges graduated from the University of Texas with a BBA degree in Petroleum Land Management. Mr. Dinges began his career with Mobil Oil Corporation in 1978. From 1981 to 2001, Mr. Dinges worked in a variety of management positions with Samedan Oil Corporation, a subsidiary of Noble Affiliates, Inc. (now Noble Energy Inc.). In September 2001, Mr. Dinges joined Cabot Oil & Gas Corporation as its President and Chief Operating Officer, and assumed his current position in May 2002. Mr. Dinges serves on the Board of Directors of Spitzer Industries, Inc., the American Natural Gas Alliance, the American Exploration & Production Council and the Foundation for Energy Education. Mr. Dinges previously served on the Board of Directors of Lone Star Technologies, Inc.

Mr. Dinges has valuable experience in managing the issues that face a publicly held company as a result of his service as Chairman and Chief Executive Officer of Cabot Oil & Gas Corporation. Mr. Dinges also possesses knowledge of and insight into the steel industry through his prior service as a director of Lone Star Technologies, Inc. In addition, he provides the Board with knowledge and insight regarding the energy industry, an important supplier to, and customer of, the Corporation. | ||||||

|

John G. Drosdick | Director since 2003 | Age 70 | |||

| Retired Chairman, Chief Executive Officer and President, Sunoco, Inc. (petroleum and petrochemical products) | ||||||

|

Mr. Drosdick graduated from Villanova University with a BS degree in chemical engineering and received a master’s degree in chemical engineering from the University of Massachusetts. From 1968 to 1983, Mr. Drosdick worked in a wide variety of management positions with Exxon Corporation. He was named President of Tosco Corporation in 1987 and President of Ultramar Corporation in 1992. In 1996, Mr. Drosdick became President and Chief Operating Officer of Sunoco and was elected Chairman and Chief Executive Officer in May 2000. He retired from his positions as Chief Executive Officer and President of Sunoco effective as of August 8, 2008 and as Chairman of Sunoco effective as of December 31, 2008. Mr. Drosdick is Chairman of the Board of Trustees of the PNC Funds and PNC Advantage Funds and a director of Triumph Group, Inc. Mr. Drosdick previously served on the Board of Directors of H.J. Heinz Co., Lincoln National Corporation and Sunoco Logistic, Inc.

As a result of his service as Chairman and Chief Executive Officer of Sunoco, Inc., Mr. Drosdick has valuable experience in managing the issues that face a publicly held company. In addition, he provides the Board with knowledge and insight regarding the energy industry, an important supplier to, and customer of, the Corporation. He also has experience in the chemicals and coke industries. | ||||||

24

|

John J. Engel | Director since 2011 | Age 52 | |||

| Chairman, President and Chief Executive Officer, WESCO International, Inc. (distribution of electrical and industrial products and supply chain services) | ||||||

|

Mr. Engel graduated from Villanova University in 1984 with a BS degree in Mechanical Engineering. He received his MBA from the University of Rochester in 1991. Mr. Engel began his career with General Electric Company where he held various engineering, manufacturing and general management positions from 1985 to 1994. From 1994 to 1999, Mr. Engel served as Vice President and General Manager of Allied Signal, Inc.; from 1999 to 2002, as Executive Vice President and Senior Vice President of Perkin Elmer, Inc.; and from 2003 to 2004, as Senior Vice President and General Manager of Gateway, Inc. Mr. Engel joined WESCO International, Inc. in 2004 and served as Senior Vice President and Chief Operating Officer from 2004 to 2009. He became a Director in October 2008 and served as President, Chief Executive Officer and Director from 2009 until 2011. He assumed his current position of Chairman, President and Chief Executive Officer in May 2011.

As a result of his service as Chairman, President and Chief Executive Officer of WESCO International, Inc. and working in a diverse range of industries, Mr. Engel has valuable experience managing the issues that face a publicly held company. | ||||||

|

Charles R. Lee | Director since 2001 | Age 74 | |||

| Retired Chairman and Co-Chief Executive Officer, Verizon Communications (telecommunications) | ||||||

|

Mr. Lee received a Bachelor’s degree in metallurgical engineering from Cornell University and an MBA with distinction from the Harvard Graduate School of Business. He served in various financial and management positions before becoming Senior Vice President-Finance for Penn Central Corporation and then Columbia Pictures Industries Inc. In 1983, he joined GTE Corporation (which merged with Bell Atlantic Corporation to form Verizon Communications in 2000) as Senior Vice President of Finance and in 1986 was named Senior Vice President of Finance and Planning. He was elected President, Chief Operating Officer and director in December 1988 and was elected Chairman of the Board and Chief Executive Officer of GTE in May 1992. Mr. Lee served as Chairman and Co-Chief Executive Officer of Verizon from June 2000 to March 2002 and as Non-Executive Chairman until December 31, 2003. Mr. Lee is a director of Marathon Petroleum Corporation and DirecTV Group. He previously served on the Board of Directors of Marathon Oil Corporation , The Procter & Gamble Company and United Technologies Corporation. Mr. Lee is also a member of the Board of Overseers of the Weill Medical College of Cornell University and Trustee Emeritus of Cornell University.

As a result of his service as Chairman and Chief Executive Officer of Verizon Communications, Mr. Lee has valuable experience in managing the issues that face a publicly held company with significant international operations. His long service on our Board allows him to offer historical insights into our company and industry. In addition, he has extensive financial and accounting expertise, as reflected in his designation as a financial expert on our Audit Committee. | ||||||

25

Continuing Class II Directors

Terms Expire 2015

|

Thomas W. LaSorda | Director since 2013 | Age 59 | |||

| President, LaSorda Group LLC (management advisory and consulting services) | ||||||

|

Mr. LaSorda graduated from University of Windsor in 1977 with a Bachelor of Arts and Commerce. He received his MBA from the University of Windsor in 1980. Mr. LaSorda began his career with General Motors Corporation where he held various manufacturing and management positions from 1977 to 2000, including Vice President, Quality, Reliability & Competitive Operations Implementation for GM North America, from 1998 to 2000. In 2000, Mr. LaSorda joined Chrysler Group where he served as Senior Vice President from 2000 to 2004, Chief Operating Officer from 2004 to 2005, a member of the Board of Management of Daimler AG from 2004 to 2007, President and Chief Executive Officer of Chrysler Group from 2005 to 2007 and Vice Chairman, President and a member of the Board of Managers of Chrysler LLC from 2007 to 2009. Mr. LaSorda joined Fisker Automotive as its Vice Chairman commencing in December 2011, and assumed the additional position of Chief Executive Officer in 2012. He left Fisker Automotive in August of 2012. Mr. LaSorda previously served as a director of Electrovaya, Inc., AGCO Corporation, and Husky Injection Molding Systems Ltd. He is also the founder of IncWell LP, a private venture capital fund.

Mr. LaSorda provides the Board with substantial manufacturing and quality control experience, especially regarding the challenges faced by large, multi-national public companies. He also provides the Board with insight regarding the automotive industry, an important market for the Corporation. | ||||||

|

Mario Longhi | Director since 2013 | Age 59 | |||

| President and Chief Executive Officer, United States Steel Corporation | ||||||

|

Mr. Longhi received a bachelor’s degree in metallurgical engineering from the Institute Mauá de Tecnologica in São Paulo, Brazil in 1977. He joined Alcoa, Inc. in 1982 where he served until 2005 in a variety of senior management positions. He was President of Gerdau Ameristeel Corporation from 2005 to 2006 and President and Chief Executive Officer from 2006 to 2011. Mr. Longhi was elected Executive Vice President and Chief Operating Officer of United States Steel Corporation in July 2012; President and Chief Operating Officer in June 2013; and President & Chief Executive Officer and a Director in September 2013. Mr. Longhi is also a director of RTI International Metals, Inc.

As the President and Chief Executive Officer of U. S. Steel, Mr. Longhi is responsible for all of the business and corporate affairs of U. S. Steel. His knowledge of the steel industry in general, and the Corporation’s business in particular, provides crucial insight to the Board on the Corporation’s strategic planning and operations. His knowledge and handling of the day-to-day issues affecting U. S. Steel’s business provide the Board with invaluable information necessary to direct the business and affairs of the Corporation. | ||||||

26

|

Robert A. McDonald | Director since 2014 | Age 60 | |||

| Retired Chairman of the Board, President & Chief Executive Officer, The Procter & Gamble Company (consumer goods) | ||||||

|

Mr. McDonald received a Bachelor of Science in Engineering from the United States Military Academy and an MBA from the University of Utah. He served for five years as an Airborne Ranger Infantry Officer, primarily in the 82nd Airborne Division of the U.S. Army. Mr. McDonald joined Procter & Gamble in 1980 and served in a series of increasingly responsible positions for that company. He was named Vice Chairman, Global Operations in 2004; Chief Operating Officer in 2007; President and Chief Executive Officer in 2009; and Chairman of the Board in 2010. Mr. McDonald is a member of the Board of Directors of Xerox Corporation.

As a result of his service as Chairman of the Board, President and Chief Executive Officer of Procter & Gamble, Mr. McDonald has valuable experience in managing the issues that face a large publicly held company, including international experience, executive leadership expertise and extensive knowledge of financial and operational matters. | ||||||

|

Seth E. Schofield | Director since 2001 | Age 74 | |||

| Retired Chairman and Chief Executive Officer, USAir Group (air carrier) | ||||||

|

Mr. Schofield graduated from the Harvard Business School Program for Management Development in 1975. He served in various corporate staff positions after joining USAir in 1957 and became Executive Vice President-Operations in 1981. Mr. Schofield served as President and Chief Operating Officer from 1990 until 1991. He was elected President and Chief Executive Officer in 1991 and became Chairman of the boards of USAir Group and USAir, Inc. in 1992. He retired in January 1996. Mr. Schofield is a director of Marathon Petroleum Corporation and Chairman of the Board of Directors of Calgon Carbon Corporation. He previously served on the Board of Directors of Marathon Oil Corporation.

As a result of his service as Chairman and Chief Executive Officer of USAir Group and Chairman of the Board of Calgon Carbon Corporation, Mr. Schofield has valuable experience in managing the issues that face a publicly held company. In addition, his long service on our Board allows him to offer historical insights into our company and industry. | ||||||

27

|

David S. Sutherland | Director since 2008 | Age 64 | |||

| Chairman of the Board, United States Steel Corporation Retired President and Chief Executive Officer, IPSCO, Inc. (steel producer) | ||||||

|

Mr. Sutherland earned a Bachelor of Commerce degree from the University of Saskatchewan and a master’s degree in business administration from the University of Pittsburgh’s Katz Graduate School of Business. Mr. Sutherland retired as President and Chief Executive Officer of the former IPSCO, Inc., a leading North American steel producer, in July 2007 after spending thirty years with the company and more than five as President and Chief Executive Officer. Mr. Sutherland became the non-executive Chairman of the Board of U. S. Steel on January 1, 2014. Mr. Sutherland is a director of GATX Corporation and Imperial Oil, Ltd. Mr. Sutherland is a former chairman of the American Iron and Steel Institute and served as a member of the board of directors of IPSCO, Inc., ZCL Composites Inc., the Steel Manufacturers Association, the International Iron and Steel Institute, the Canadian Steel Producers Association and the National Association of Manufacturers.

Mr. Sutherland has valuable experience in managing the issues that face a publicly held steel company as a result of his service as President and Chief Executive Officer of IPSCO, Inc. He has extensive knowledge of the Canadian business climate in general, and the Canadian steel industry in particular, all of which is helpful in the context of the Corporation’s Canadian presence. | ||||||

28

| Ratification of Appointment of Independent Registered Public Accounting Firm |

Pursuant to the authority provided by its Charter, the Audit Committee has appointed PricewaterhouseCoopers LLP (PwC) as the independent registered public accounting firm for U. S. Steel for the current fiscal year. Although action by the stockholders in this matter is not required by law or the Corporation’s By-Laws, the Audit Committee believes that it is appropriate to seek stockholder ratification of this appointment in light of the important role played by the independent registered public accounting firm in maintaining the integrity of the Corporation’s financial controls and reporting. If the appointment of PwC is not ratified by the stockholders, the Audit Committee will reconsider its appointment and review its future selection of an independent registered public accounting firm in light of that result. However, the Audit Committee may decide to maintain its appointment of PwC. Even if the appointment is ratified, the Audit Committee may, in its discretion, direct the appointment of a different independent registered public accounting firm at any time during the year if it determines that such change would be in the Corporation’s best interests and in the best interests of our stockholders.

PwC has served as the independent auditor (now referred to as the independent registered public accounting firm) of U. S. Steel for many years. We believe that PwC’s knowledge of U. S. Steel’s business and its organization gained through this period of service is quite valuable. Partners and employees of PwC assigned to the U. S. Steel engagement are periodically rotated, thus giving U. S. Steel the benefit of new thinking and approaches in the audit area. We expect representatives of PwC to be present at the annual meeting with an opportunity to make a statement if they desire to do so and to be available to respond to appropriate questions.

For the year 2013, PwC performed professional services for U. S. Steel in connection with audits of the financial statements of U. S. Steel, and of U. S. Steel’s internal control over financial reporting as of December 31, 2013, and audits of certain subsidiaries and certain pension and other employee benefit plans. PwC has also reviewed quarterly reports and other filings with the Securities and Exchange Commission and other agencies.

The Board recommends a vote FOR the ratification of the appointment of PwC as our independent registered public accounting firm.

| Advisory Vote on Executive Compensation |

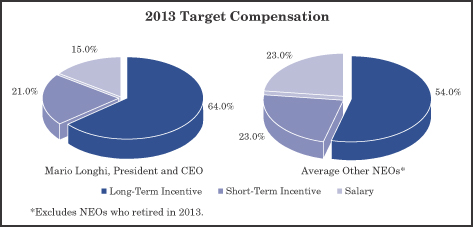

As further described below in the Compensation Discussion & Analysis, our executive compensation programs are designed to attract, retain, motivate and reward executives who make a significant contribution to the achievement of our corporate goals. Our guiding principles include fair and competitive pay, pay for performance, and the alignment of executive and shareholder interests. In general, executive pay is targeted at the 50th percentile of our peer group with over 75% of the compensation (approximately 85% for the CEO) tied to the achievement of performance goals or the performance of our stock. Accordingly, the Compensation & Organization Committee believes that our compensation programs effectively align the interests of our executive officers with those of our shareholders.

We are committed to communicating with shareholders about our executive compensation programs and, as outlined below, in 2013 we held several discussions with major shareholders to explain recent changes to our programs and to seek additional feedback. This shareholder feedback was considered by the Compensation & Organization Committee in revising our executive compensation programs for 2014. The 2014 revisions support the broad business transformation efforts that are being implemented under the leadership of our new President and CEO Mario Longhi, who assumed the role September 1, 2013.

29

In May of 2013, after considering the results of the 2013 Advisory Vote on Executive Compensation, discussions with our largest shareholders, and a lower stock price on the date of grant in comparison to prior years, the Compensation & Organization Committee of the Board of Directors revised our executive compensation program to further align compensation with corporate performance and shareholder interests by making the following changes:

| Ÿ | Traditional stock options were replaced with “premium priced stock options” with an exercise price set at $25.00, which was a 34% premium over the grant date stock price of $18.64. The premium priced stock options add an additional performance based feature to our traditional stock options and allow our shareholders to benefit from the first 34% increase in our stock price before executives realize any value. |

| Ÿ | A $25.00 stock price (instead of the fair market value of $18.64 on the date of grant) was used to determine the number of shares granted for all equity awards except new-hire grants, which resulted in fewer shares being granted in comparison to prior years. |

| Ÿ | With respect to performance awards, the standards (which are based on relative TSR) required to earn a payout were increased from the 25th percentile at the threshold level, 50th percentile at the target level, and 75th percentile at the maximum level to the 30th, 60th, and 90th percentiles respectively. |

In the fall of 2013, management and the Chairman of the Compensation & Organization Committee contacted our largest shareholders to discuss the above changes. Specific feedback obtained from shareholders in these discussions is outlined on page 50 of the Compensation Discussion & Analysis.

To address the views expressed by our shareholders in those discussions, and in support of the business transformation efforts implemented by our new CEO, the Committee revised our incentive plans for 2014. The Annual Incentive Compensation Program was revised to focus on fundamental improvements in cash flow and income from operations, while rewarding individual performance and emphasizing a safe work environment. The Long-Term Incentive Plan (which consists of performance awards, stock options and restricted stock units) was revised to (1) increase the performance awards from 40% to 60% of the total awards (the remaining awards will continue to be divided equally between stock options and restricted stock units), and (2) add a second performance measure, Return on Capital Employed, to the existing relative TSR measure; both are further explained in the Executive Summary section of the Compensation Discussion & Analysis.

We are asking our stockholders to approve, on an advisory basis, the compensation of the Corporation’s Named Executive Officers as disclosed in this proxy statement by voting FOR the following resolution:

RESOLVED, that the stockholders of United States Steel Corporation (the “Corporation”) approve, on an advisory basis, the compensation of the Named Executive Officers as disclosed pursuant to the compensation disclosure rules of the Securities and Exchange Commission in the Corporation’s proxy statement for the 2014 Annual Meeting of Stockholders, including the Compensation Discussion & Analysis, compensation tables and narrative discussions.

Although this is an advisory vote which will not be binding on the Compensation & Organization Committee or the Board, we will carefully review the results of the vote. The Board has adopted a policy providing for an annual advisory vote on executive compensation. Unless the Board modifies this policy, the next advisory vote on executive compensation will be held at our 2015 Annual Meeting of Stockholders.

| Amendment and Restatement of the 2005 Stock Incentive Plan |

The United States Steel Corporation 2005 Stock Incentive Plan (the “Stock Plan”) was originally adopted by the Board of Directors and stockholders on April 26, 2005 and

30

was subsequently amended and restated by the Board of Directors and approved by stockholders on April 27, 2010.

Upon recommendation of the Compensation & Organization Committee, our Board of Directors adopted, subject to your approval, an amended and restated Stock Plan effective April 29, 2014. The principal amendment to the prior Stock Plan is an increase of 5,800,000 in the total number of shares of our common stock reserved for issuance as awards under the Stock Plan. The affirmative vote of a majority of the shares present in person at the meeting or represented by proxy and entitled to vote is required for approval of an amendment and restatement of the Stock Plan.

In determining the number of shares of common stock to be authorized under the amended and restated Stock Plan, the Compensation & Organization Committee considered the needs of U. S. Steel for the shares and the potential dilution that awarding the requested shares may have on the existing stockholders. An independent compensation advisor assisted U. S. Steel in determining the appropriate number of shares to be requested. The advisor examined a number of factors, including U. S. Steel’s burn rate and an overhang analysis. The Compensation & Organization Committee expects the number of shares available under the amended and restated Stock Plan to be sufficient for up to approximately three years of awards based upon the historic rates of awards.

The burn rate is the total equity awards granted by U. S. Steel in a fiscal year divided by the total common stock outstanding at the beginning of the year. In fiscal 2011, 2012 and 2013, U. S. Steel made equity awards representing a total of 1,214,180 shares, 2,742,671 shares and 3,125,850 shares, respectively. Using the ISS Proxy Advisory Services methodology for calculating burn rate, which applies a multiplier of 2 to any full value awards (awards for which the participant does not pay for the shares), U. S. Steel’s three-year average (ISS adjusted) burn rate for equity grants made in fiscal 2011, 2012 and 2013 was 2.34%.

An additional metric used to measure the cumulative dilutive impact of the equity program is overhang. The calculation of overhang can be described as (A+B) / (A+B+C) where:

| Ÿ | A is the number of outstanding stock options and outstanding full value awards; |

| Ÿ | B is the number of shares available for future grant under the proposed Stock Plan; and |

| Ÿ | C is the total outstanding shares of common stock |

As of December 31, 2013, U. S. Steel had 5,207,288 outstanding stock options, 1,992,234 outstanding full value awards, and 2,609,897 shares available for future grant under the Stock Plan. As of that date, U. S. Steel had 144,578,000 outstanding shares of Common Stock. This results in an overhang of 6.4%.