2011

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended December 31, 2011

Commission file number 1-16811

(Exact name of registrant as specified in its charter)

| Delaware | 25-1897152 | |

| (State of Incorporation) | (I.R.S. Employer Identification No.) |

600 Grant Street, Pittsburgh, PA 15219-2800

(Address of principal executive offices)

Tel. No. (412) 433-1121

Securities registered pursuant to Section 12 (b) of the Act:

| Title of Each Class | Name of Exchange on which Registered | |

| United States Steel Corporation |

New York Stock Exchange, Chicago Stock Exchange |

Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ü No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes No ü

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months and (2) has been subject to such filing requirements for at least the past 90 days. Yes ü No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ü No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ü

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ü | Accelerated filer | |

| Non-accelerated filer (Do not check if a smaller reporting company) |

Smaller reporting company |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes No ü

Aggregate market value of Common Stock held by non-affiliates as of June 30, 2011 (the last business day of the registrant’s most recently completed second fiscal quarter): $6.6 billion. The amount shown is based on the closing price of the registrant’s Common Stock on the New York Stock Exchange composite tape on that date. Shares of Common Stock held by executive officers and directors of the registrant are not included in the computation. However, the registrant has made no determination that such individuals are “affiliates” within the meaning of Rule 405 under the Securities Act of 1933.

There were 150,925,911 shares of United States Steel Corporation Common Stock outstanding as of February 16, 2012.

Documents Incorporated By Reference:

Portions of the Proxy Statement for the 2012 Annual Meeting of Stockholders are incorporated into Part III.

| 3 | ||||||||

| PART I |

||||||||

| Item 1. |

4 | |||||||

| Item 1A. |

31 | |||||||

| Item 1B. |

40 | |||||||

| Item 2. |

41 | |||||||

| Item 3. |

42 | |||||||

| Item 4. |

51 | |||||||

| PART II |

||||||||

| Item 5. |

53 | |||||||

| Item 6. |

54 | |||||||

| Item 7. |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

55 | ||||||

| Item 7A. |

83 | |||||||

| Item 8. |

F-1 | |||||||

| Item 9. |

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE |

86 | ||||||

| Item 9A. |

86 | |||||||

| Item 9B. |

86 | |||||||

| PART III |

||||||||

| Item 10. |

87 | |||||||

| Item 11. |

87 | |||||||

| Item 12. |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS |

88 | ||||||

| Item 13. |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE |

88 | ||||||

| Item 14. |

88 | |||||||

| PART IV |

||||||||

| Item 15. |

89 | |||||||

| 96 | ||||||||

| 97 | ||||||||

| SUPPLEMENTARY DATA |

98 | |||||||

| TOTAL NUMBER OF PAGES |

100 | |||||||

2

Certain sections of the Annual Report of United States Steel Corporation (U. S. Steel) on Form 10-K, particularly Item 1. Business, Item 1A. Risk Factors, Item 3. Legal Proceedings, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations and Item 7A. Quantitative and Qualitative Disclosures About Market Risk, include forward-looking statements concerning trends or events potentially affecting U. S. Steel. These statements typically contain words such as “anticipates,” “believes,” “estimates,” “expects” or similar words indicating that future outcomes are uncertain. In accordance with “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, these statements are accompanied by cautionary language identifying important factors, though not necessarily all such factors, that could cause future outcomes to differ materially from those set forth in forward-looking statements. For additional factors affecting the businesses of U. S. Steel, see “Item 1A. Risk Factors” and “Supplementary Data – Disclosures About Forward-Looking Statements.” References in this Annual Report on Form 10-K to “U. S. Steel,” “the Company,” “we,” “us” and “our” refer to U. S. Steel and its consolidated subsidiaries, unless otherwise indicated by the context.

3

PART I

U. S. Steel is an integrated steel producer of flat-rolled and tubular products with major production operations in North America and Europe. An integrated producer uses iron ore and coke as primary raw materials for steel production. U. S. Steel has annual raw steel production capability of 31.7 million net tons (tons) (24.3 million tons in North America and 7.4 million tons in Europe). As further described below, on January 31, 2012, we sold U. S. Steel Serbia d.o.o. (USSS). According to World Steel Association’s latest published statistics, we were the eighth largest steel producer in the world in 2010. U. S. Steel is also engaged in other business activities consisting primarily of transportation services (railroad and barge operations) and real estate operations.

The global economic recession that began in 2008 greatly affected U. S. Steel and many of the markets we serve. The United States and Canada have experienced improvement in the overall North American economy as a modest, but uneven recovery continues. Our results continue to be affected by difficult economic conditions in several of the key business sectors we serve in North America and Europe. Some North American markets, such as automotive, have had significant improvement from the depths of the recession, although not yet reaching pre-recession levels, while other markets, such as construction, have shown very little improvement. Our Tubular operations have benefitted from demand for energy related products resulting mainly from the continued strength of drilling in North American shale formations as well as a return to exploration and development in the Gulf of Mexico. The ongoing European Union (EU) sovereign debt and other economic challenges have negatively impacted our European operations. For further discussion, see “Business Strategy,” “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Overview,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Liquidity” and “Supplementary Data – Disclosures About Forward-Looking Statements.”

On

January 31, 2012, U. S. Steel sold USSS to the Republic of Serbia for a purchase price of one dollar. In addition,

U. S. Steel Košice received a $40 million payment for certain intercompany balances owed by U. S. Steel Serbia for raw

materials and support services. U. S. Steel expects to record a total non-cash charge of approximately $400 million in the first quarter of 2012, which includes the loss on the sale and a charge of approximately $50 million to recognize the

cumulative currency translation adjustment related to USSS.

4

5

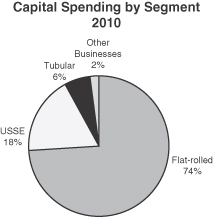

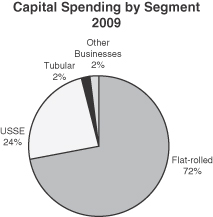

Segments

U. S. Steel has three reportable operating segments: Flat-rolled Products (Flat-rolled), U. S. Steel Europe (USSE) and Tubular Products (Tubular). The results of several operating segments that do not constitute reportable segments are combined and disclosed in the Other Businesses category.

The Flat-rolled segment includes the operating results of U. S. Steel’s North American integrated steel mills and equity investees involved in the production of slabs, rounds, strip mill plates, sheets and tin mill products, as well as all iron ore and coke production facilities in the United States and Canada. These operations primarily serve North American customers in the service center, conversion, transportation (including automotive), construction, container, and appliance and electrical markets. Flat-rolled supplies steel rounds and hot-rolled bands to Tubular.

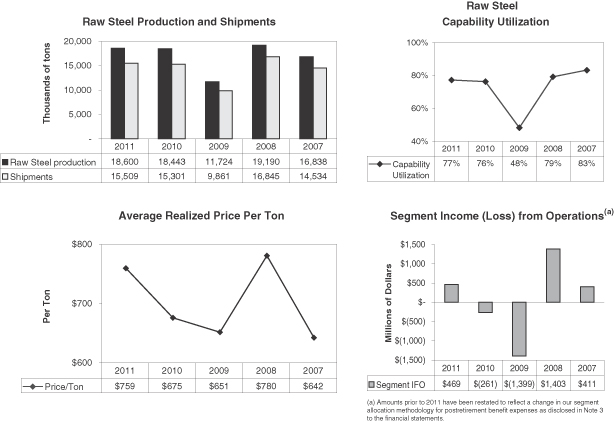

Flat-rolled has annual raw steel production capability of 24.3 million tons. Raw steel production was 18.6 million tons in 2011, 18.4 million tons in 2010 and 11.7 million tons in 2009. Raw steel production averaged 77 percent of capability in 2011, 76 percent of capability in 2010 and 48 percent of capability in 2009.

The USSE segment included the operating results of U. S. Steel Košice (USSK), U. S. Steel’s integrated steel mill and coke production facilities in Slovakia; U. S. Steel Serbia (USSS), U. S. Steel’s integrated steel mill and other facilities in Serbia; and an equity investee. USSS was sold on January 31, 2012. USSE primarily serves customers in the European construction, service center, conversion, container, transportation (including automotive), appliance and electrical, and oil, gas and petrochemical markets. USSE produces and sells slabs, sheet, strip mill plate, tin mill products and spiral welded pipe, as well as heating radiators and refractory ceramic materials.

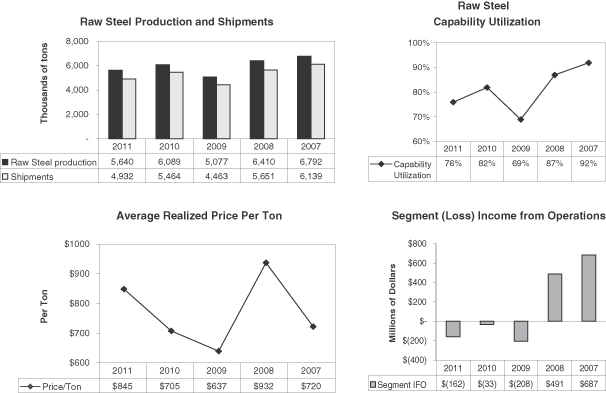

USSE had annual raw steel production capability of 7.4 million tons, which consists of 5.0 million and 2.4 million tons from USSK and USSS, respectively. On January 31, 2012, USSS was sold, reducing USSE’s annual steel capacity to 5.0 million tons. USSE’s raw steel production was 5.6 million tons in 2011, 6.1 million tons in 2010 and 5.1 million tons in 2009. USSE’s raw steel production averaged 76 percent of capability in 2011, 82 percent of capability in 2010 and 69 percent of capability in 2009.

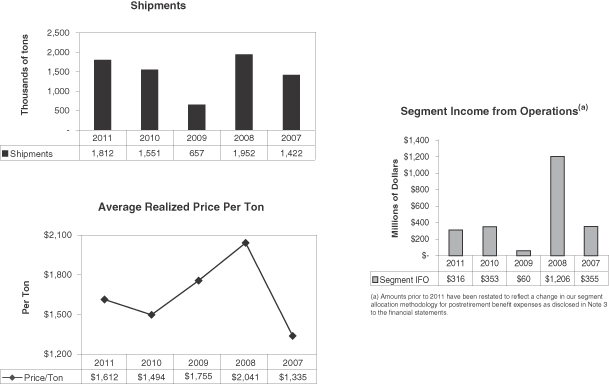

The Tubular segment includes the operating results of U. S. Steel’s tubular production facilities, primarily in the United States, and equity investees in the United States and Brazil. These operations produce and sell seamless and electric resistance welded (ERW) steel casing and tubing (commonly known as oil country tubular goods or OCTG), standard and line pipe and mechanical tubing and primarily serve customers in the oil, gas and petrochemical markets. Tubular’s annual production capability is 2.8 million tons.

All other U. S. Steel businesses not included in reportable segments are reflected in Other Businesses. These businesses include transportation services (railroad and barge operations) and real estate operations.

For further information, see Note 3 to the Financial Statements.

6

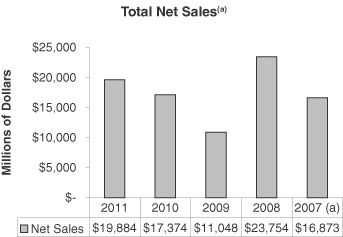

Financial and Operational Highlights

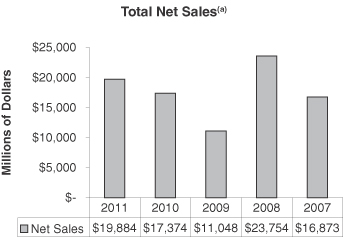

Net Sales

| (a) | Includes the former Lone Star facilities from the date of acquisition on June 14, 2007 and USSC from the date of acquisition on October 31, 2007. |

Net Sales by Segment

| (Dollars in millions, excluding intersegment sales) | 2011 | 2010 | 2009 | |||||||||||||

| Flat-rolled |

$ | 12,367 | $ | 10,848 | $ | 6,814 | ||||||||||

| USSE |

4,306 | 3,989 | 2,944 | |||||||||||||

| Tubular |

3,034 | 2,403 | 1,216 | |||||||||||||

|

|

|

|

|

|

|

|||||||||||

| Total sales from reportable segments |

19,707 | 17,240 | 10,974 | |||||||||||||

| Other Businesses |

177 | 134 | 74 | |||||||||||||

|

|

|

|

|

|

|

|||||||||||

| Net sales |

$ | 19,884 | $ | 17,374 | $ | 11,048 | ||||||||||

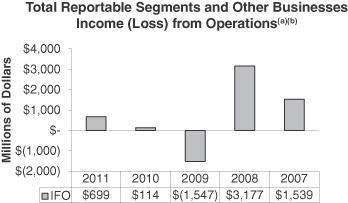

Income (Loss) from Operations by Segment(a)

| Year Ended December 31, | ||||||||||||||||

| (Dollars in Millions) | 2011 | 2010 | 2009 | |||||||||||||

|

Flat-rolled(b) |

$ | 469 | $ | (261 | ) | $ | (1,399 | ) | ||||||||

| USSE |

(162 | ) | (33 | ) | (208 | ) | ||||||||||

|

Tubular(b) |

316 | 353 | 60 | |||||||||||||

|

|

|

|

|

|

|

|||||||||||

| Total income (loss) from reportable segments(b) |

623 | 59 | (1,547 | ) | ||||||||||||

| Other Businesses(b) |

46 | 55 | – | |||||||||||||

|

|

|

|

|

|

|

|||||||||||

| Reportable segments and Other Businesses income (loss) from operations(b) |

669 | 114 | (1,547 | ) | ||||||||||||

| Postretirement benefit expenses(b) |

(386 | ) | (231 | ) | (178 | ) | ||||||||||

| Other items not allocated to segments: |

||||||||||||||||

| Federal excise tax refund |

– | – | 34 | |||||||||||||

| Litigation reserve |

– | – | 45 | |||||||||||||

| Net gain on the sale of assets |

– | 6 | 97 | |||||||||||||

| Environmental remediation charge |

(18 | ) | – | (49 | ) | |||||||||||

| Workforce reduction charges |

– | – | (86 | ) | ||||||||||||

|

|

|

|

|

|

|

|||||||||||

| Total income (loss) from operations |

$ | 265 | $ | (111 | ) | $ | (1,684 | ) | ||||||||

| (a) | See Note 3 to the Financial Statements for reconciliations and other disclosures required by Accounting Standards codification Topic 280. |

| (b) | Amounts prior to 2011 have been restated to reflect a change in our segment allocation methodology for postretirement benefit expenses as disclosed in Note 3 to the Financial Statements. |

7

Reportable Segments and Other Businesses – Income (Loss) from Operations (IFO)

| (a) | Includes the former Lone Star facilities from the date of acquisition on June 14, 2007 and USSC from the date of acquisition on October 31, 2007. |

| (b) | Amounts prior to 2011 have been restated to reflect a change in our segment allocation methodology for postretirement benefit expenses as disclosed in Note 3 to the Financial Statements. |

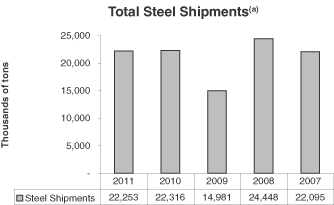

Steel Shipments

| (a) | Includes the former Lone Star facilities from the date of acquisition on June 14, 2007 and USSC from the date of acquisition on October 31, 2007. |

8

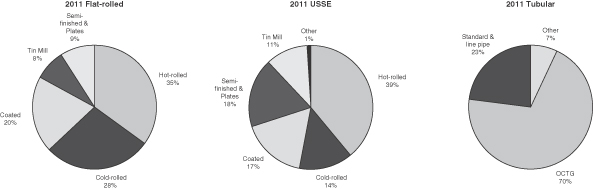

Steel Shipments by Product and Segment

The following table does not include shipments to end customers by joint ventures and other equity investees of U. S. Steel, but instead reflects the shipments of substrate materials, primarily hot-rolled and cold-rolled sheets, to those entities.

(Thousands of Tons)

| Flat-rolled | USSE | Tubular | Total | |||||||||||||||||||

| Product – 2011 |

||||||||||||||||||||||

| Hot-rolled Sheets |

5,421 | 1,940 | – | 7,361 | ||||||||||||||||||

| Cold-rolled Sheets |

4,311 | 707 | – | 5,018 | ||||||||||||||||||

| Coated Sheets |

3,136 | 816 | – | 3,952 | ||||||||||||||||||

| Tin Mill Products |

1,177 | 528 | – | 1,705 | ||||||||||||||||||

| Oil country tubular goods (OCTG) |

– | – | 1,276 | 1,276 | ||||||||||||||||||

| Standard and line pipe |

– | 8 | 408 | 416 | ||||||||||||||||||

| Semi-finished and Plates |

1,464 | 865 | – | 2,329 | ||||||||||||||||||

| Other |

– | 68 | 128 | 196 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||

| TOTAL |

15,509 | 4,932 | 1,812 | 22,253 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Memo: Intersegment Shipments from |

||||||||||||||||||||||

| Flat-rolled to Tubular |

||||||||||||||||||||||

| Hot-rolled sheets |

1,554 | |||||||||||||||||||||

| Rounds |

686 | |||||||||||||||||||||

| Product – 2010 |

||||||||||||||||||||||

| Hot-rolled Sheets |

4,963 | 2,191 | – | 7,154 | ||||||||||||||||||

| Cold-rolled Sheets |

4,340 | 752 | – | 5,092 | ||||||||||||||||||

| Coated Sheets |

2,893 | 878 | – | 3,771 | ||||||||||||||||||

| Tin Mill Products |

1,340 | 583 | – | 1,923 | ||||||||||||||||||

| Oil country tubular goods (OCTG) |

– | – | 1,103 | 1,103 | ||||||||||||||||||

| Standard and line pipe |

– | 9 | 360 | 369 | ||||||||||||||||||

| Semi-finished, Bars and Plates |

1,765 | 982 | – | 2,747 | ||||||||||||||||||

| Other |

– | 69 | 88 | 157 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||

| TOTAL |

15,301 | 5,464 | 1,551 | 22,316 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Memo: Intersegment Shipments from |

||||||||||||||||||||||

| Flat-rolled to Tubular |

||||||||||||||||||||||

| Hot-rolled sheets |

895 | |||||||||||||||||||||

| Rounds |

706 | |||||||||||||||||||||

| Product – 2009 |

||||||||||||||||||||||

| Hot-rolled Sheets |

3,173 | 1,896 | – | 5,069 | ||||||||||||||||||

| Cold-rolled Sheets |

3,152 | 655 | – | 3,807 | ||||||||||||||||||

| Coated Sheets |

1,882 | 793 | – | 2,675 | ||||||||||||||||||

| Tin Mill Products |

1,253 | 534 | – | 1,787 | ||||||||||||||||||

| Oil country tubular goods (OCTG) |

– | – | 420 | 420 | ||||||||||||||||||

| Standard and line pipe |

– | 5 | 155 | 160 | ||||||||||||||||||

| Semi-finished, Bars and Plates |

401 | 498 | – | 899 | ||||||||||||||||||

| Other |

– | 82 | 82 | 164 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||

| TOTAL |

9,861 | 4,463 | 657 | 14,981 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Memo: Intersegment Shipments from |

||||||||||||||||||||||

| Flat-rolled to Tubular |

||||||||||||||||||||||

| Hot-rolled sheets |

117 | |||||||||||||||||||||

| Rounds |

376 | |||||||||||||||||||||

9

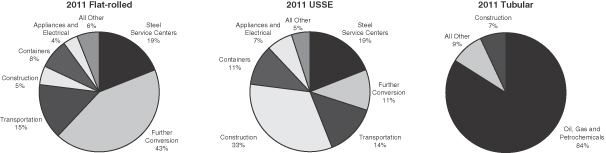

Steel Shipments by Market and Segment

The following table does not include shipments to end customers by joint ventures and other equity investees of U. S. Steel. Shipments of materials to these entities are included in the “Further Conversion – Joint Ventures” market classification. No single customer accounted for more than 10 percent of gross annual revenues.

(Thousands of Tons)

| Flat-rolled | USSE | Tubular | Total | |||||||||||||

| Major Market – 2011 |

||||||||||||||||

| Steel Service Centers |

2,988 | 943 | – | 3,931 | ||||||||||||

| Further Conversion – Trade Customers |

4,805 | 539 | (6 | ) | 5,338 | |||||||||||

| – Joint Ventures |

1,803 | – | – | 1,803 | ||||||||||||

| Transportation (Including Automotive) |

2,268 | 707 | – | 2,975 | ||||||||||||

| Construction and Construction Products |

870 | 1,622 | 128 | 2,620 | ||||||||||||

| Containers |

1,221 | 525 | – | 1,746 | ||||||||||||

| Appliances and Electrical Equipment |

650 | 328 | – | 978 | ||||||||||||

| Oil, Gas and Petrochemicals |

– | 14 | 1,526 | 1,540 | ||||||||||||

| Exports from the United States |

572 | – | 164 | 736 | ||||||||||||

| All Other |

332 | 254 | – | 586 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| TOTAL |

15,509 | 4,932 | 1,812 | 22,253 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Major Market – 2010 |

||||||||||||||||

| Steel Service Centers |

3,214 | 1,106 | – | 4,320 | ||||||||||||

| Further Conversion – Trade Customers |

4,243 | 676 | 13 | 4,932 | ||||||||||||

| – Joint Ventures |

1,835 | – | – | 1,835 | ||||||||||||

| Transportation (Including Automotive) |

2,136 | 629 | 3 | 2,768 | ||||||||||||

| Construction and Construction Products |

821 | 1,764 | 38 | 2,623 | ||||||||||||

| Containers |

1,398 | 586 | – | 1,984 | ||||||||||||

| Appliances and Electrical Equipment |

703 | 319 | – | 1,022 | ||||||||||||

| Oil, Gas and Petrochemicals |

– | 11 | 1,438 | 1,449 | ||||||||||||

| Exports from the United States |

687 | – | 59 | 746 | ||||||||||||

| All Other |

264 | 373 | – | 637 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| TOTAL |

15,301 | 5,464 | 1,551 | 22,316 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Major Market – 2009 |

||||||||||||||||

| Steel Service Centers |

1,998 | 882 | 1 | 2,881 | ||||||||||||

| Further Conversion – Trade Customers |

2,203 | 461 | 11 | 2,675 | ||||||||||||

| – Joint Ventures |

1,283 | – | – | 1,283 | ||||||||||||

| Transportation (Including Automotive) |

1,258 | 387 | 4 | 1,649 | ||||||||||||

| Construction and Construction Products |

653 | 1,615 | 22 | 2,290 | ||||||||||||

| Containers |

1,296 | 517 | – | 1,813 | ||||||||||||

| Appliances and Electrical Equipment |

755 | 248 | – | 1,003 | ||||||||||||

| Oil, Gas and Petrochemicals |

– | 17 | 551 | 568 | ||||||||||||

| Exports from the United States |

322 | – | 68 | 390 | ||||||||||||

| All Other |

93 | 336 | – | 429 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| TOTAL |

9,861 | 4,463 | 657 | 14,981 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

10

Business Strategy

Over the long term, our strategy is to be forward-looking, grow responsibly, generate a competitive return on capital and meet our financial and stakeholder obligations. We remain committed to being a world leader in safety and environmental stewardship; improving our quality, cost competitiveness and customer service; and attracting, developing and retaining a diverse workforce with the talent and skills needed for our long-term success.

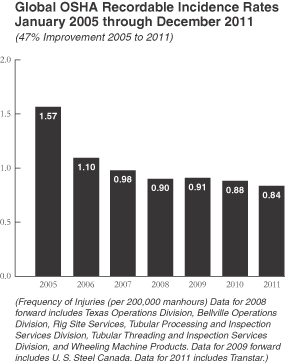

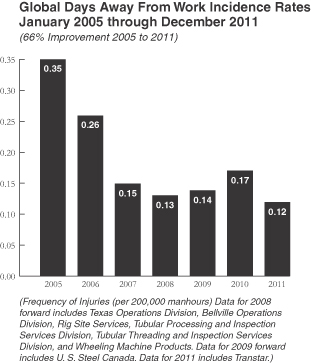

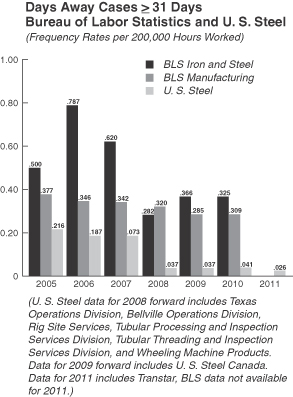

Through 2011, the six-year trends for our key safety measurements: global rate of recordable injuries, global days away from work rate and global severity rate showed improvement of 47 percent, 66 percent and 88 percent respectively, as shown in the following graphs.

|

|

11

Our commercial strategy is focused on providing value-added steel products, including advanced high strength steel and coated sheets for the automotive and appliance industries, electrical steel sheets for the manufacture of motors and electrical equipment, galvanized and Galvalume® sheets for construction, tin mill products for the container industry and oil country tubular goods for the oil and gas industry, including providing high quality steel to the developing North American shale oil and gas market. In addition, our European operations concentrate on being a dependable source of high-quality steel to meet the needs of the developing central European markets.

We are committed to meeting our customers requirements by developing new steel products and uses for steel. In connection with this commitment we have research centers in Pittsburgh, Pennsylvania, and Košice, Slovakia. We also have an automotive center in Troy, Michigan and in 2011 we completed construction of an innovation and technology center for Tubular products in Houston, Texas. The focus of these centers is to develop new products and to work with our customers to serve their needs. Examples of our customer focused product innovation include the development of advanced high strength steels, including Dual-Ten® and TRIP steels, that provide high strength to meet safety requirements while significantly reducing weight to meet fuel efficiency requirements and our PATRIOT TC® tubular connections to meet our customers needs in horizontal drilling and deep well applications such as Marcellus Shale.

Our decisions concerning what facilities to operate and at what levels are made based upon our customers’ orders for products as well as the capabilities and cost performance of our locations. In depressed markets such as those experienced in the recent recession, we concentrated production operations at several plant locations and did not operate others in response to customer demand. Similarly we are not currently operating the steelmaking facilities at Hamilton Works, but recently restarted operation of the third blast furnace at USSK reflecting current market demand. The USSS facility was sold to the Republic of Serbia on January 31, 2012.

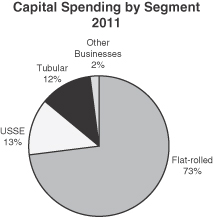

With regard to capital investments, we remain focused on a number of key projects of strategic importance in each of our three business segments. We have made significant progress to improve our self-sufficiency and reduce our reliance on coke for the steel making process through the application of advanced technologies, upgrades to our existing coke facilities and increased use of natural gas and pulverized coal in our operations. This may enable us to minimize additional capital investments in coke and carbon alloy projects in the future. Engineering and

12

construction of a technologically and environmentally advanced battery at the Mon Valley Works’ Clairton Plant with a projected capacity of 960,000 tons per year is underway with completion expected near year-end 2012. We are constructing a carbon alloy facility at Gary Works which utilizes an environmentally compliant, energy efficient and flexible production technology to produce a coke substitute with a projected capacity of 500,000 tons per year with completion expected in the second half of 2012. We expect both of these projects to reach full production capability in 2013. We completed construction of our blast furnace coal injection facilities in Europe. The facilities became operational in 2011 and provide our European blast furnaces access to pulverized coal, traditionally a lower cost source of carbon than coke. We continue to pursue the use of natural gas in our operations, primarily in North America, given the significant cost and environmental advantages of this fuel. These projects tend to be smaller projects with limited capital cost. In order to more efficiently serve our tubular product customers’ increased focus on North American shale resources, the construction of an additional quench and temper line was completed during the third quarter of 2011 along with the installation of a hydrotester, threading and coupling and inspection stations at our Lorain Tubular Operations in Ohio. We are currently developing additional projects that will further enhance our ability to support our North American Tubular customers’ evolving needs. In an effort to increase our participation in the automotive market as vehicle emission and safety requirements become more stringent, PRO-TEC Coating Company, our joint venture in Ohio with Kobe Steel, Ltd., has a new automotive continuous annealing line under construction that is being financed at the joint-venture level and is expected to reach full production by the end of 2013. We are also continuing our efforts to implement an enterprise resource planning (ERP) system to replace outdated systems and to help us operate more efficiently. The completion of the ERP project is expected to provide further opportunities to streamline, standardize and centralize business processes in order to maximize cost effectiveness, efficiency and control across our global operations. Over the longer term, we are considering business strategies to leverage our significant iron ore position in the United States, and to exploit opportunities related to the availability of reasonably priced natural gas as an alternative to coke in the iron reduction process to improve our cost competitiveness, while reducing our dependence on coal and coke. We are considering an expansion of our iron ore pellet operations at Keewatin, MN (Keetac) facility, which would increase our production capability by approximately 3.6 million tons thereby increasing our iron ore self-sufficiency. Final permitting for the expansion was completed in December 2011. The total cost of this project as currently conceived is broadly estimated to be approximately $800 million. We also are examining alternative iron and steelmaking technologies such as gas-based, direct-reduced iron and electric arc furnace (EAF) steelmaking. Our capital investments in the future may reflect such strategies, although we expect that iron and steel-making through the blast furnace and basic oxygen furnace manufacturing processes will remain our primary processing technology for the long term.

We are committed to reducing emissions as well as our carbon footprint. We have an established program to investigate, share and create innovative, best practice solutions throughout U. S. Steel to manage and reduce energy intensity and CO2 emissions. We are also committed to investing in technology to move the steelmaking process in an even more environmentally responsible direction by investing in low emission technologies. In addition to the environmentally compliant projects noted above, we entered into a 15 year coke supply agreement with Gateway Energy & Coke Company, LLC in connection with its heat recovery coke plant located at Granite City Works which began operations in the fourth quarter of 2009.

In 2011, we achieved air opacity performance improvements at our domestic coke plants. Continuous process improvements have allowed us to make environmental progress through the utilization of enhanced refractory repair programs and strategic, focused maintenance on the structural integrity of our coke batteries as well as use of data analysis to track our coke oven performance allowing us to pro-actively prioritize repairs.

All of our major production facilities are ISO 14001 certified and we continue to focus on implementing energy reduction strategies, implementation of efficient energy sources, waste reduction management as well as the utilization of by-product fuels to reduce our reliance on natural gas.

We are currently seeking application approval for an innovative approach to environmental permitting for Minntac Air and Water compliance for PM, Mercury, SO2 and Sulfate. Once the approval process has been granted, this will be the first Multi-Media compliance solution of its type for iron-ore operations in the United States.

Our environmental stewardship is also focused on education and active involvement with local sponsorship of academic programs designed to produce an inter-active learning experience for the participants on the importance of environmental responsibility and awareness.

13

During 2011, we were re-certified from the Wildlife Habitat Council (WHC) for our Wildlife at Work program at our South Taylor Environmental Park (STEP) near Pittsburgh, Pennsylvania, which incorporates interaction with elementary school programs in Western Pennsylvania. In addition, we renewed our WHC certification under the Corporate Lands for Learning Program at STEP, Clairton and Gary Works.

We continue to assess North American and international expansion and divestment opportunities and carefully weigh them in light of changing global steel and financial market conditions and long-term value considerations. We may consider 100 percent acquisition opportunities, joint ventures and other arrangements.

The foregoing statements regarding expected capital expenditures, capital projects, emissions reductions and expected benefits from the implementation of the ERP project and environmental projects are forward-looking statements. Factors that may affect our capital spending and the projects include: (i) levels of cash flow from operations; (ii) changes in tax laws; (iii) general economic conditions; (iv) steel industry conditions; (v) cost and availability of capital; (vi) receipt of necessary permits; and (vii) unforeseen hazards such as contractor performance, material shortages, weather conditions, explosions or fires. There is also a risk that the completed projects will not produce at the expected levels and within the costs currently projected. Predictions regarding benefits resulting from the implementation of the ERP project are subject to uncertainties. Actual results could differ materially from those expressed in these forward-looking statements.

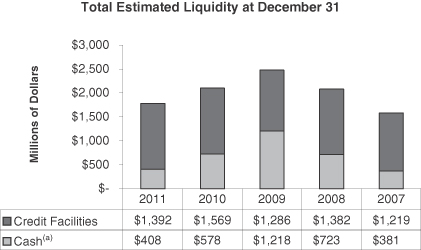

Our financial goals are to maintain or enhance our liquidity, maintain a solid capital structure, focus capital investments on key projects of long-term strategic importance and position ourselves for success in the longer term. During 2011, we amended and restated our $750 million Credit Agreement to increase the facillity to $875 million while extending its maturity until 2016. We also amended our Receivables Purchase Agreement (RPA) to increase the maximum amount of receivables eligible for sale from $525 million to $625 million while extending its maturity until 2014. In total, these actions increased our available liquidity by $225 million. We voluntarily contributed $140 million to our main defined benefit pension plan in 2011. We refinanced $196 million of Environmental Revenue Bonds (ERBs) and have fully satisfied our obligation to Marathon Oil Corporation (Marathon) concerning the ERB obligations we assumed in connection with the separation from Marathon Oil on December 31, 2001. We maintained our strong liquidity position and ended the year with total liquidity of $1.8 billion.

Steel Industry Background and Competition

The global steel industry is cyclical, highly competitive and has historically been characterized by overcapacity.

According to the World Steel Association’s latest published statistics, we were the eighth largest steel producer in the world in 2010. We believe we are currently the largest integrated steel producer headquartered in North America, one of the largest integrated flat-rolled producers in Central Europe and the largest tubular producer in North America. U. S. Steel competes with many North American and international steel producers. Competitors include integrated producers which, like U. S. Steel, use iron ore and coke as primary raw materials for steel production, and EAF producers, which primarily use steel scrap and other iron-bearing feedstocks as raw materials. In addition, other products, such as plastics and composites, compete with steel in some applications.

EAF producers typically require lower capital expenditures for construction of facilities and may have lower total employment costs; however, these competitive advantages may be minimized or eliminated by the cost of scrap when scrap prices are high. Some mini-mills utilize thin slab casting technology to produce flat-rolled products and are increasingly able to compete directly with integrated producers in a number of flat-rolled products previously produced only by integrated steelmaking. U. S. Steel provides defined benefit pension and other postretirement benefits to approximately 115,000 retirees and their beneficiaries. EAF producers and most of our other competitors do not have comparable retiree obligations.

International competitors may have lower labor costs than U.S. producers and some are owned, controlled or subsidized by their governments, allowing their production and pricing decisions to be influenced by political, social and economic policy considerations, as well as prevailing market conditions.

14

Through our wholly owned operations and our share of joint ventures, we have adequate iron ore pellet production to cover a significant portion of our North American needs and have secured the remaining iron ore pellets for our North American operations through contracts. With our own coke production facilities and a long-term coke supply agreement with Gateway Energy & Coke Company, LLC (Gateway), we have the capability to be nearly self sufficient for coke in North America at normal operating levels. We also have multi-year contracts for some of our North American coking coal requirements. Our relatively balanced raw materials position in North America and limited dependence on purchased steel scrap have helped mitigate the volatility of our production costs.

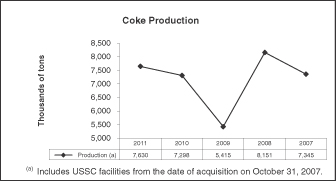

Our coke production in North America has declined over the last several years mainly due to the closure of one coke battery at Gary Works in 2005 and three coke batteries at the Clairton Plant in 2009. Additionally, some of our existing coke batteries are reaching the end of their useful lives. Improving our coke self sufficiency and expanding our use of natural gas as a coke substitute are important strategic objectives. During 2011, we continued construction of a technologically and environmentally advanced coke battery at the Clairton Plant of Mon Valley Works with an expected completion near year-end 2012, and a coke substitute carbon alloy facility at Gary Works, with an expected completion in the second half of 2012. We expect both of these projects to reach full production capability in 2013.

Demand for flat-rolled products is influenced by a wide variety of factors, including but not limited to macro-economic drivers, the supply-demand balance, inventories, imports and exports, currency fluctuations, and the demand from flat-rolled consuming markets. The largest drivers of North American consumption have historically been the automotive and construction markets which make up more than 50 percent of total sheet consumption. Other sheet consuming industries include appliance, converter, container, tin, energy, electrical equipment, agricultural, domestic and commercial equipment and industrial machinery.

USSE conducts business primarily in Europe. Like our domestic operations, USSE is affected by the cyclical nature of demand for steel products and the sensitivity of that demand to worldwide general economic conditions. The sovereign debt issues and the resulting economic uncertainties adversely affected markets in the EU. We are subject to market conditions in those areas which are influenced by many of the same factors that affect U.S. markets, as well as matters specific to international markets such as quotas, tariffs and other protectionist measures. As discussed above, we sold our Serbian operations on January 31, 2012.

Demand for oil country tubular goods depends on several factors, most notably the number of oil and natural gas wells being drilled, completed and re-worked, the depth and drilling conditions of these wells and the drilling techniques utilized. The level of these activities depends primarily on the demand for natural gas and oil and the expectation of future prices of these commodities. Demand for our tubular products is also affected by the continuing development of shale oil and gas resources, the level of inventories maintained by manufacturers, distributors, and end users and by the level of imports in the markets we serve.

Steel imports to the United States accounted for an estimated 13 percent of the U.S. steel market in 2011 and 2010 and 15 percent in 2009. Increases in future levels of imported steel could reduce future market prices and demand levels for steel produced in our North American facilities.

Imports of flat-rolled steel to Canada accounted for an estimated 36 percent of the Canadian market for flat-rolled steel products in 2011, 40 percent in 2010 and 39 percent in 2009.

Energy related tubular products imported into the United States accounted for an estimated 46 percent in 2011 and 2010 and 58 percent in 2009.

Many of these imports have violated U.S. or Canadian trade laws. Under these laws, duties can be imposed against dumped products, which are products sold at a price that is below that producer’s sales price in its home market or at a price that is lower than its cost of production. Countervailing duties can be imposed against products that benefited from foreign government financial assistance for the benefit of the production, manufacture, or exportation of the product. For many years, U. S. Steel, other producers, customers and the United Steelworkers (USW) have sought the imposition of duties and in many cases have been successful. Such duties are generally subject to review every five years and we actively participate in such review proceedings. As in the past, U. S. Steel continues to monitor unfairly traded imports and is prepared to seek appropriate remedies against such imports.

15

In May 2011, the U.S. International Trade Commission (ITC) concluded its five-year (sunset) reviews of antidumping orders against hot-rolled carbon steel flat products from Brazil and Japan, a countervailing duty order against hot-rolled carbon steel flat products from Brazil, and a suspended antidumping investigation concerning hot-rolled carbon steel flat products from Russia. It determined that terminating the existing suspended antidumping duty investigation on imports of product from Russia would be likely to lead to the continuation or recurrence of material injury within a reasonably foreseeable time, and that revoking the orders against product from Brazil and Japan would not be likely to lead to the continuation or recurrence of material injury within a reasonably foreseeable time. As a result, the orders against product from Brazil and Japan have been terminated, while the suspended investigation against product from Russia will remain suspended. U. S. Steel has appealed the ITC’s negative determinations with respect to Brazil and Japan to the U.S. Court of International Trade.

The U.S. Department of Commerce (DOC) and the ITC concluded their five-year (sunset) reviews of antidumping orders against seamless standard, line, and pressure pipe from Japan (large-diameter and small-diameter) and Romania (small-diameter) in August 2011 and September 2011, respectively. The DOC determined that revoking these orders would likely lead to the continuation or recurrence of dumping, and the ITC determined that revoking the orders would be likely to lead to the continuation or recurrence of material injury within a reasonably foreseeable time. As a result, the orders remain in place.

On December 19, 2011, in the case of GPX International Tire Corp. v. United States, the U. S. Court of Appeals for the Federal Circuit held that the countervailing duty statute cannot be applied to imports from non market economies including China. There are a number of countervailing duty orders involving Chinese steel.

The DOC and the ITC are currently conducting five-year (sunset) reviews of the following international trade orders of interest to U. S. Steel: (i) antidumping orders against cut-to-length steel plate from India, Indonesia, Italy, Japan and Korea and countervailing duty orders against cut-to-length steel plate from India, Indonesia, Italy and Korea; (ii) an antidumping order against tin- and chromium-coated steel sheet from Japan; and (iii) eight antidumping orders and one countervailing duty order against circular welded pipe up to 16” in diameter from Brazil, India, Korea, Mexico, Taiwan, Thailand, and Turkey.

On December 1, 2010, the Canadian International Trade Tribunal (CITT) initiated an expiry review of the Canadian antidumping orders against hot-rolled carbon and alloy steel sheet and strip from Brazil, China, Taiwan, India, South Africa and Ukraine and a subsidy order against India. On March 31, 2011, the Canada Border Services Agency (CBSA) found a likelihood of continued or resumed dumping with respect to respondent countries China, Brazil, Taiwan, India and Ukraine (and the likelihood of continued or resumed subsidization in the case of India) if the orders were to be rescinded, but it found that dumping from South Africa would not be likely to continue or resume. In August 2011, a majority of the CITT found that the expiry of the orders concerning hot-rolled carbon and alloy steel sheet and strip from Brazil, China, Taiwan, India and Ukraine would likely cause injury to the domestic industry. The CBSA will therefore continue to impose anti-dumping and/or countervailing duties on those goods. However, following the CBSA’s determination that the expiry of the order on hot-rolled carbon and alloy steel sheet and strip from South Africa was unlikely to result in the continuation or resumption of dumping, the order was rescinded and the CBSA will not continue to impose anti-dumping duties on merchandise from South Africa.

Total imports of flat-rolled carbon steel products (excluding quarto plates and wide flats) to the the 27 countries currently comprising the EU were 17 percent of the EU market in 2011, 14 percent in 2010 and 15 percent in 2009. Increases in future levels of imported steel could reduce market prices and demand levels for steel produced in our European facilities.

We expect to continue to experience competition from imports and will continue to closely monitor imports of products in which we have an interest. Additional complaints may be filed if unfairly traded imports adversely impact, or threaten to adversely impact, financial results.

U. S. Steel’s businesses are subject to numerous federal, state and local laws and regulations relating to the storage, handling, emission and discharge of environmentally sensitive materials. U. S. Steel believes that our major North American and many European integrated steel competitors are confronted by substantially similar environmental conditions and thus does not believe that our relative position with regard to such competitors is materially affected by the impact of environmental laws and regulations. However, the costs and operating

16

restrictions necessary for compliance with environmental laws and regulations may have an adverse effect on U. S. Steel’s competitive position with regard to domestic mini-mills, some foreign steel producers (particularly in developing economies such as China) and producers of materials which compete with steel, all of which may not be required to undertake equivalent costs in their operations. In addition, the specific impact on each competitor varies depending on a number of factors, including the age and location of its operating facilities and its production methods. U. S. Steel is also responsible for remediation costs related to our prior disposal of environmentally sensitive materials. Many of our competitors have fewer historical liabilities. For further information, see “Item 3. Legal Proceedings – Environmental Proceedings” and “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations – Environmental Matters, Litigation and Contingencies.”

Many nations have adopted or are considering regulation of carbon dioxide (CO2) emissions. The integrated steel process involves a series of chemical reactions involving carbon that create CO2 emissions. This distinguishes integrated steel producers from mini-mills and many other industries where CO2 generation is generally linked to energy usage. In the United States, the Environmental Protection Agency (EPA) has published rules for regulating greenhouse gas emissions for certain facilities and has implemented various reporting requirements. In the last Congress, legislation was passed in the House of Representatives and introduced in the Senate. We do not know what action, if any, may be taken in the future by the current or a new session of Congress. The EU has established greenhouse gas regulations and Canada has published details of a regulatory framework for greenhouse gas emissions. Such regulations may entail substantial costs for emission allowances, restriction of production, and higher prices for coking coal, natural gas and electricity generated by carbon-based systems. Some foreign nations such as China and India are not aggressively pursuing regulation of CO2 and integrated steel producers in such countries may achieve a competitive advantage over U. S. Steel. For further information, see “Item 3. Legal Proceedings – Environmental Proceedings” and “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations – Environmental Matters, Litigation and Contingencies.”

U. S. Steel is subject to foreign currency exchange risks as a result of its European and Canadian operations. USSE’s revenues are primarily in Euros and its costs are primarily in U.S. dollars and Euros. U. S. Steel Canada’s (USSC’s) revenues and costs are denominated in both Canadian and U.S. dollars. In addition, international cash requirements have been and in the future may be funded by intercompany loans, creating intercompany monetary assets and liabilities in currencies other than the functional currencies of the entities involved, which can impact income when they are remeasured at the end of each period. A $1.6 billion U.S. dollar-denominated intercompany loan from a U.S. subsidiary to a European subsidiary was the primary exposure at December 31, 2011.

Facilities and Locations

Flat-rolled

Except for the Fairfield pipe mill, the operating results of all the facilities within U. S. Steel’s integrated steel mills in North America are included in Flat-rolled. These facilities include Gary Works, Great Lakes Works, Mon Valley Works, Granite City Works, Lake Erie Works, Fairfield Works and Hamilton Works. The operating results of U. S. Steel’s coke and iron ore pellet operations and many equity investees in North America are also included in Flat-rolled.

Gary Works, located in Gary, Indiana, has annual raw steel production capability of 7.5 million tons. Gary Works has three coke batteries, four blast furnaces, six steelmaking vessels, a vacuum degassing unit and four continuous slab casters. Gary Works generally consumes all the coke it produces and sells coke by-products. Finishing facilities include a hot strip mill, two pickling lines, two cold reduction mills, three temper mills, a double cold reduction line, four annealing facilities and two tin coating lines. Principal products include hot-rolled, cold-rolled and coated sheets and tin mill products. Gary Works also produces strip mill plate in coil. We are constructing a carbon alloy facility at Gary Works which utilizes an environmentally compliant, energy efficient and flexible production technology to produce a coke substitue product. The facility has a projected capacity of 500,000 tons per year with completion expected in the second half of 2012 with full production capability in 2013. The Midwest Plant and East Chicago Tin are operated as part of Gary Works.

The Midwest Plant, located in Portage, Indiana, processes hot-rolled and cold rolled bands and produces tin mill products and hot dip galvanized, cold-rolled and electrical lamination sheets. Midwest facilities include a pickling line, two cold reduction mills, two temper mills, a double cold reduction mill, two annealing facilities, two hot dip galvanizing lines, a tin coating line and a tin-free steel line.

17

East Chicago Tin is located in East Chicago, Indiana and produces tin mill products. Facilities include a pickling line, a cold reduction mill, two annealing facilities, a temper mill, a tin coating line and a tin-free steel line.

Great Lakes Works, located in Ecorse and River Rouge, Michigan, has annual raw steel production capability of 3.8 million tons. Great Lakes facilities include three blast furnaces, two steelmaking vessels, a vacuum degassing unit, two slab casters, a hot strip mill, a pickling line, a tandem cold reduction mill, three annealing facilities, a temper mill, a recoil and inspection line, an electrolytic galvanizing line and a hot dip galvanizing line. Principal products include hot-rolled, cold-rolled and coated sheets.

Mon Valley Works consists of the Edgar Thomson Plant, located in Braddock, Pennsylvania; the Irvin Plant, located in West Mifflin, Pennsylvania; the Fairless Plant, located in Fairless Hills, Pennsylvania; and the Clairton Plant, located in Clairton, Pennsylvania. Mon Valley Works has annual raw steel production capability of 2.9 million tons. Facilities at the Edgar Thomson Plant include two blast furnaces, two steelmaking vessels, a vacuum degassing unit and a slab caster. Irvin Plant facilities include a hot strip mill, two pickling lines, a cold reduction mill, three annealing facilities, a temper mill and two hot dip galvanizing lines. The Fairless Plant operates a hot dip galvanizing line. Principal products from Mon Valley Works include hot-rolled, cold-rolled and coated sheets, as well as coke and coke by-products produced at the Clairton Plant.

The Clairton Plant is comprised of nine coke batteries. Almost all of the coke produced is consumed by U. S. Steel facilities or swapped with other domestic steel producers. Coke by-products are sold to the chemicals and raw materials industries. Engineering and construction of a technologically and environmentally advanced coke battery at the Clairton Plant is underway with completion expected near year-end 2012 with full production capability in 2013.

Granite City Works, located in Granite City, Illinois, has annual raw steel production capability of 2.8 million tons. Granite City’s facilities include two coke batteries, two blast furnaces, two steelmaking vessels, two slab casters, a hot strip mill, a pickling line, a tandem cold reduction mill, a hot dip galvanizing line and a hot dip galvanizing/Galvalume® line. Granite City Works generally consumes all the coke it produces and sells coke by-products. Principal products include hot-rolled and coated sheets. Gateway constructed a coke plant which began operating in October 2009 to supply Granite City Works. U. S. Steel owns and operates a cogeneration facility that utilizes by-products from the Gateway coke plant to generate heat and power.

Lake Erie Works, located in Nanticoke, Ontario, has annual raw steel production capability of 2.6 million tons. Lake Erie Works facilities include a coke battery, a blast furnace, two steelmaking vessels, a slab caster, a hot strip mill and three pickling lines. Principal products include slabs and hot-rolled sheets.

Fairfield Works, located in Fairfield, Alabama, has annual raw steel production capability of 2.4 million tons. Fairfield Works facilities included in Flat-rolled are a blast furnace, three steelmaking vessels, a vacuum degassing unit, a slab caster, a rounds caster, a hot strip mill, a pickling line, a cold reduction mill, two temper/skin pass mills, a hot dip galvanizing line and a hot dip galvanizing/Galvalume® line. Principal products include hot-rolled, cold-rolled and coated sheets, and steel rounds for Tubular.

Hamilton Works, located in Hamilton, Ontario, has annual raw steel production capability of 2.3 million tons. Hamilton Works facilities include a coke battery, a blast furnace, three steelmaking vessels, a slab caster, a combination slab/bloom caster, a pickling line, a cold reduction mill and two hot dip galvanizing lines and a galvanizing/galvannealing line. Principal products include slabs and cold-rolled and coated sheets.

U. S. Steel owns a Research and Technology Center located in Munhall, Pennsylvania where we carry out a wide range of applied research, development and technical support functions.

U. S. Steel also owns an automotive technical center in Troy, Michigan. This facility brings automotive sales, service, distribution and logistics services, product technology and applications research into one location. Much of U. S. Steel’s work in developing new grades of steel to meet the demands of automakers for high-strength, light-weight and formable materials is carried out at this location.

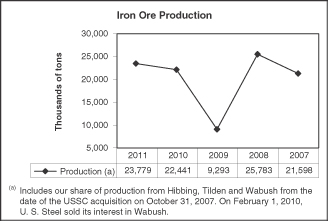

U. S. Steel has iron ore pellet operations located at Mt. Iron (Minntac) and Keewatin (Keetac), Minnesota with annual iron ore pellet production capability of 22.4 million tons. During 2011, 2010 and 2009, these operations produced 21.1 million, 20.0 million and 8.5 million net tons of iron ore pellets, respectively.

18

U. S. Steel has a 14.7 percent ownership interest in Hibbing Taconite Company (Hibbing), which is based in Hibbing, Minnesota. Hibbing’s rated annual production capability is 9.1 million tons of iron ore pellets, of which our share is about 1.3 million tons, reflecting our ownership interest. Our share of 2011, 2010 and 2009 production was 1.2 million, 1.0 million and 0.3 million tons, respectively.

U. S. Steel has a 15 percent ownership interest in Tilden Mining Company (Tilden), which is based in Ishpeming, Michigan. Tilden’s rated annual production capability is 8.7 million tons of iron ore pellets, of which our share is about 1.3 million tons, reflecting our ownership interest. Our share of 2009 production was a minimal amount and our share of 2011 and 2010 production was 1.4 million tons in both years.

U. S. Steel participates in a number of additional joint ventures that are included in Flat-rolled, most of which are conducted through subsidiaries or other separate legal entities. All of these joint ventures are accounted for under the equity method. The significant joint ventures and other investments are described below. For information regarding joint ventures and other investments, see Note 11 to the Financial Statements.

U. S. Steel and POSCO of South Korea participate in a 50-50 joint venture, USS-POSCO Industries (USS-POSCO), located in Pittsburg, California. The joint venture markets sheet and tin mill products, principally in the western United States. USS-POSCO produces cold-rolled sheets, galvanized sheets, tin plate and tin-free steel from hot bands principally provided by U. S. Steel and POSCO, which each provide about 50 percent of its requirements. USS-POSCO’s annual production capability is approximately 1.5 million tons.

U. S. Steel and Kobe Steel, Ltd. of Japan participate in a 50-50 joint venture, PRO-TEC Coating Company (PRO-TEC). PRO-TEC owns and operates two hot dip galvanizing lines in Leipsic, Ohio, which primarily serve the automotive industry. PRO-TEC’s annual production capability is approximately 1.2 million tons. U. S. Steel supplies PRO-TEC with all of its requirements of cold-rolled sheets and markets all of its products. PRO-TEC is constructing a $400 million automotive continuous annealing line (CAL) at the facility, with a projected operating capability of 500,000 tons. This facility is expected to reach full capacity by the end of 2013. The CAL will produce high strength, light weight steels that are an integral component in automotive manufacturing as vehicle emission and safety requirements become increasingly stringent.

U. S. Steel and Severstal North America, Inc. participate in Double Eagle Steel Coating Company (DESCO), a 50-50 joint venture which operates an electrogalvanizing facility located in Dearborn, Michigan. The facility coats sheet steel with free zinc or zinc alloy coatings, primarily for use in the automotive industry. DESCO processes steel supplied by each partner and each partner markets the steel it has processed by DESCO. DESCO’s annual production capability is approximately 870,000 tons.

U. S. Steel and ArcelorMittal participate in the Double G Coatings Company, L.P. 50-50 joint venture (Double G), a hot dip galvanizing and Galvalume® facility located near Jackson, Mississippi, which primarily serves the construction industry. Double G processes steel supplied by each partner and each partner markets the steel it has processed by Double G. Double G’s annual production capability is approximately 315,000 tons.

U. S. Steel and Worthington Industries, Inc. participate in Worthington Specialty Processing (Worthington), a joint venture with locations in Jackson, Canton and Taylor, Michigan in which U. S. Steel has a 49 percent interest. Worthington slits, cuts to length and presses blanks from steel coils to desired specifications. Worthington’s annual production capability is approximately 890,000 tons.

U. S. Steel and ArcelorMittal Dofasco, Inc. participate in Baycoat Limited Partnership (Baycoat), a 50-50 joint venture located in Hamilton, Ontario. Baycoat applies a variety of paint finishes to flat-rolled steel coils. Baycoat’s annual production capability is approximately 280,000 tons.

D.C. Chrome Limited, a 50-50 joint venture between U. S. Steel and The Court Group of Companies Limited, operates a plant in Stony Creek, Ontario which textures and chromium plates work rolls for Hamilton Works and for other customers, and grinds and chromes steel shafts used in manlifts.

Chrome Deposit Corporation (CDC), a 50-50 joint venture between U. S. Steel and Court Holdings, reconditions finishing work rolls, which require grinding, chrome plating and/or texturing. The rolls are used on rolling mills to provide superior finishes on steel sheets. CDC has seven locations across the United States, with all locations near major steel mills.

19

Feralloy Processing Company (FPC), a joint venture between U. S. Steel and Feralloy Corporation, converts coiled hot strip mill plate into sheared and flattened plates for shipment to customers. U. S. Steel has a 49 percent interest. The plant, located in Portage, Indiana, has annual production capability of approximately 275,000 tons.

U. S. Steel, along with Feralloy Mexico, S.R.L. de C.V. and Mitsui & Co. (USA), Inc., participates in a joint venture, Acero Prime, S.R.L. de CV (Acero Prime). U. S. Steel has a 40 percent interest. Acero Prime has facilities in San Luis Potosi and Ramos Arizpe, Mexico. Acero Prime provides slitting, warehousing and logistical services. Acero Prime’s annual slitting capability is approximately 385,000 tons.

USSE

USSE consisted of USSK and its subsidiaries, USSS and an equity investee.

On January 31, 2012, USSS was sold.

USSK operates an integrated facility in Košice, Slovakia, which has annual raw steel production capability of 5.0 million tons. This facility has two coke batteries, three blast furnaces, four steelmaking vessels, a vacuum degassing unit, two dual strand casters, a hot strip mill, two pickling lines, two cold reduction mills, three annealing facilities, a temper mill, a temper/double cold reduction mill, three hot dip galvanizing lines, two tin coating lines, three dynamo lines, a color coating line and two spiral welded pipe mills. Principal products include hot-rolled, cold-rolled and coated sheets, tin mill products and spiral welded pipe. USSK also has facilities for manufacturing heating radiators and refractory ceramic materials.

In addition, USSK has a research laboratory which, in conjunction with our Research and Technology Center, supports efforts in cokemaking, electrical steels, design and instrumentation, and ecology.

USSS consisted of an integrated plant in Smederevo, Serbia which had annual raw steel production capability of 2.4 million tons. Facilities at this plant included two blast furnaces, three steelmaking vessels, two slab casters, a hot strip mill, two pickling lines, a cold reduction mill, two annealing facilities, a temper mill and a temper/double cold reduction mill. Other facilities included a tin mill in Šabac with one tin coating line, a limestone mine in Kučevo and a river port in Smederevo, all located in Serbia. Principal products included hot-rolled and cold-rolled sheets and tin mill products.

Tubular

Tubular manufactures seamless and welded oil country tubular goods (OCTG), standard and line pipe and mechanical tubing.

Seamless products are produced on a mill located at Fairfield Works in Fairfield, Alabama, and on two mills located in Lorain, Ohio. The Fairfield mill has annual production capability of 750,000 tons and is supplied with steel rounds from Flat-rolled’s Fairfield Works. The Fairfield mill has the capability to produce outer diameter (O.D.) sizes from 4.5 to 9.875 inches and has quench and temper, hydrotester, threading and coupling and inspection capabilities. The Lorain mills have combined annual production capability of 780,000 tons and has used steel rounds supplied by Fairfield Works and external sources. Lorain #3 Mill has the capability to produce O.D. sizes from 10.125 to 26 inches and has quench and temper, hydrotester, cutoff and inspection capabilities. Lorain #4 Mill has the capability to produce O.D. sizes from 1.9 to 4.5 inches and has quench and temper, hydrotester, threading and coupling and inspection capabilities for OCTG casing and uses Tubular Processing Services in Houston for oil field production tubing finishing. In August of 2011, Lorain Tubular Operations commissioned its new #6 Mill quench and temper line, which is able to heat treat O.D. sizes from 2.375 to 7.625 inches, and also installed hydrotester, threading and coupling, and inspection stations, bringing its annual production capabilities to 120,000 tons of OCTG finishing capacity.

Texas Operations, located in Lone Star, Texas, manufactures welded OCTG, standard and line pipe and mechanical tubing products. Texas Operations #1 Mill has the capability to produce O.D. sizes from 7 to 16 inches. Texas Operations #2 Mill has the capability to produce O.D. sizes from 1.088 to 7.15 inches. Both mills have quench and temper, hydrotester, threading and coupling and inspection capabilities. Bellville Operations, in

20

Bellville, Texas, manufactures welded tubular products primarily for OCTG. Bellville Operations has the capability to produce O.D. sizes from 2.375 to 4.5 inches and has limited hydrotester and cutoff capabilities and uses Tubular Processing Services in Houston for oil field production tubing finishing. Texas Operations and Bellville Operations have combined annual production capability of 1.0 million tons and are supplied with hot rolled bands from Flat-rolled’s facilities.

Welded products are also produced at a mill located in McKeesport, Pennsylvania, which, prior to May 1, 2011, was operated by a third party operator. The McKeesport mill has annual production capability of 315,000 tons and processes hot-rolled bands from several Flat-rolled locations. This mill has the capability to produce, hydrotest, cut to length and inspect O.D. sizes from 8.625 to 20 inches.

Wheeling Machine Products supplies couplings used to connect individual sections of oilfield casing and tubing. It produces sizes ranging from 2.375 to 20 inches at two locations: Pine Bluff, Arkansas, and Hughes Springs, Texas.

Tubular Processing Services, located in Houston, Texas, provides quench and temper and end-finishing services for oilfield production tubing. Tubular Threading and Inspection Services, also located in Houston, Texas, provides threading, inspection and storage services to the OCTG market.

U. S. Steel also has a 50 percent ownership interest in Apolo Tubulars S.A. (Apolo), a Brazilian supplier of welded casing, tubing, line pipe and other tubular products. Apolo’s annual production capability is approximately 150,000 tons.

U. S. Steel, POSCO and SeAH Steel Corporation, a Korean manufacturer of tubular products, participate in United Spiral Pipe LLC which owns and operates a manufacturing facility in Pittsburg, California with annual production capability of 300,000 tons of spiral welded tubular products. U. S. Steel and POSCO each hold a 35-percent ownership interest in the joint venture, with the remaining 30-percent ownership interest being held by SeAH.

We completed construction of an innovation and technology center for Tubular products in Houston, Texas in 2011.

Other Businesses

U. S. Steel’s Other Businesses include transportation services (railroad and barge operations) and real estate operations.

U. S. Steel owns the Gary Railway Company in Indiana, Lake Terminal Railroad Company and Lorain Northern Company in Ohio; Union Railroad Company and McKeesport Connecting Railroad Company in Pennsylvania, Fairfield Southern Company, Inc. and Warrior and Gulf Navigation Company, all located in Alabama; Delray Connecting Railroad Company in Michigan and Texas & Northern Railroad Company in Texas; all of which comprise U. S. Steel’s transportation business. On December 21, 2010, U. S. Steel sold all of the operating assets of Mobile River Terminal Company Inc., and certain assets of Warrior and Gulf Navigation Company for approximately $35 million. For further information, see Note 6 to the Financial Statements.

On December 1, 2011, U. S. Steel and Birmingham Terminal Railway, L.L.C, (BTR) a subsidiary of Watco Companies, L.L.C. entered into an agreement under which BTR would acquire the majority of the operating assets of Birmingham Southern Railroad Company as well as the Port Birmingham Terminal. The transaction was completed on February 1, 2012. See Note 6 to the Financial Statements for further information.

U. S. Steel owns, develops and manages various real estate assets, which include approximately 200,000 acres of surface rights primarily in Alabama, Illinois, Maryland, Michigan, Minnesota and Pennsylvania. In addition, U. S. Steel participates in joint ventures that are developing real estate projects in Alabama, Maryland and Illinois. U. S. Steel also owns approximately 4,000 acres of land in Ontario, Canada, which could potentially be sold or developed.

Raw Materials and Energy

As an integrated producer, U. S. Steel’s primary raw materials are iron units in the form of iron ore pellets and sinter ore, carbon units in the form of coal and coke (which is produced from coking coal) and steel scrap. U. S. Steel’s raw materials supply strategy consists of acquiring and expanding captive sources of these primary raw materials and entering into flexible multi-year supply contracts for certain raw materials.

21

The amounts of such raw materials needed to produce a ton of steel will fluctuate based upon the specifications of the final steel products, the quality of raw materials and, to a lesser extent, differences among steel producing equipment. In broad terms, U. S. Steel estimates that it consumes about 1.4 tons of coal to produce one ton of coke and that it consumes approximately 0.4 tons of coke, 0.2 tons of steel scrap (40 percent of which is internally generated) and 1.3 tons of iron ore pellets to produce one ton of raw steel. At normal operating levels, we also consume approximately 6 mmbtu’s of natural gas per ton produced. While we believe that these estimates are useful for planning purposes, substantial variations occur. They are presented in order to give a general sense of raw material and energy consumption related to steel production.

Iron Ore

The iron ore facilities at Minntac and Keetac contain an estimated 712 million short tons of recoverable reserves and our share of recoverable reserves at the Hibbing and Tilden joint ventures is 59 million short tons. Recoverable reserves are defined as the tons of product that can be used internally or delivered to a customer after considering mining and beneficiation or preparation losses. Minntac and Keetac’s annual capability and our share of annual capability for the Hibbing and Tilden joint ventures total 25 million tons. Through our wholly owned operations and our share of joint ventures, we have adequate iron ore pellet production to cover a significant portion of our North American needs and have secured the remaining iron ore pellets through contracts. We are considering an expansion of our iron ore pellet operations at our Keetac facility, which would increase our production capability by approximately 3.6 million tons thereby increasing our iron ore self-sufficiency. Final permitting for the expansion was completed in December 2011. The total cost of this project as currently conceived is broadly estimated to be approximately $800 million.

Lower than anticipated operating levels in 2011 and contractual obligations to purchase iron ore pellets resulted in excess inventory levels. A portion of the excess iron ore pellets were sold on the global market. Depending on our production requirements, we may sell additional pellets in the future.

USSE purchases substantially all of its iron ore requirements from outside sources, but has also received iron ore from U. S. Steel’s iron ore facilities in North America. We believe that supplies of iron ore adequate to meet USSE’s needs are available at competitive market prices. The main sources of iron ore for USSE are mining companies in Russia and Ukraine.

Coking Coal

All of U. S. Steel’s coal requirements for our cokemaking facilities are purchased from outside sources.

U. S. Steel has entered into multi-year contracts for a portion of Flat-rolled’s coking coal requirements. Prices for these North American contracts for 2012 are set at what we believe are competitive market prices. Prices in subsequent years will be negotiated in accordance with contractual provisions on an annual basis at prevailing market prices.

Prices for European contracts are negotiated at defined intervals (no less than quarterly) with regional suppliers.

We believe that supplies of coking coal adequate to meet our needs are available from outside sources at competitive market prices. The main sources of coking coal for Flat-rolled are the United States and Canada; and for USSE include Poland, the Czech Republic, the United States, Canada, Russia and Ukraine.

22

Coke

In North America, the Flat-rolled segment operates cokemaking facilities at the Clairton Plant of Mon Valley Works, Gary Works, Granite City Works, Hamilton Works and Lake Erie Works. In Europe, the USSE segment operates cokemaking facilities at USSK. Blast furnace injection of coal, natural gas and self-generated coke oven gas is also used to reduce coke usage. The increase in coke production in 2008 was mainly due to the inclusion of production at Lake Erie Works and Hamilton Works for the entire year following the USSC acquisition in 2007. The decrease in coke production in 2009 resulted from the temporary idling of cokemaking facilities at the Clairton Plant, Granite City Works, Hamilton Works and Lake Erie Works for part of the year as well as the permanent shut down of three coke batteries at the Clairton Plant. In 2010, we restarted the facilities that were idled in 2009, resulting in an increase in coke production. We have taken a number of steps to ensure long-term access to high quality coke for our blast furnaces. We are in the process of constructing a technologically and environmentally advanced battery at the Clairton Plant, with production capability of approximately 960,000 tons with completion expected near year-end 2012 with full production capability expected in 2013. We entered into a 15 year coke supply agreement with Gateway Energy & Coke Company, LLC (Gateway) in connection with its 650,000 ton per year heat recovery coke plant and is located at Granite City Works. Also, we are in the process of constructing a carbon alloy facility at Gary Works which will utilize state-of-the-art technology to produce a carbon alloy material that will be used as a coke substitute. The carbon alloy facility is expected to have production capability of approximately 500,000 tons per year and is anticipated to start production in the second half of 2012 with full production capability expected in 2013.

With Flat-rolled’s cokemaking facilities and the Gateway long-term supply agreement, it has the capability to be nearly self-sufficient with respect to its annual coke requirements at normal operating levels. To the extent that it is necessary or appropriate, considering existing needs and/or applicable transportation costs, coke is purchased from, sold or swapped with suppliers and other end-users.

With the sale of USSS, USSE has the capability to be nearly self-sufficient for coke at normal operating levels. The remainder of USSE’s needs is purchased from outside sources.

Steel Scrap and Other Materials

We believe that supplies of steel scrap and other alloying and coating materials required to fulfill the requirements for Flat-rolled and USSE are available from outside sources at competitive market prices. Generally, approximately 40 percent of our steel scrap requirements are internally generated through normal operations.

Limestone

All of Flat-rolled’s limestone requirements are purchased from outside sources. We believe that supplies of limestone adequate to meet Flat-rolled’s needs are readily available from outside sources at competitive market prices.

Subsequent to the sale of USSS, all of USSE’s limestone requirements are purchased from outside sources. We believe that supplies of limestone adequate to meet USSE’s needs are available from outside sources at competitive market prices.

Zinc and Tin

We believe that supplies of zinc and tin required to fulfill the requirements for Flat-rolled and USSE are available from outside sources at competitive market prices. We routinely execute fixed-price forward physical purchase

23

contracts for a portion of our expected business needs in order to partially manage our exposure to the volatility of the zinc and tin markets.

Natural Gas

All of U. S. Steel’s natural gas requirements are purchased from outside sources.