Strategic Acquisition of Stelco August 27, 2007 © United States Steel Corporation 2007 Exhibit 99.2 |

Strategic Acquisition of Stelco August 27, 2007 © United States Steel Corporation 2007 Exhibit 99.2 |

Forward — Looking Statements 2 Risks and Uncertainties Regarding United States Steel Corporation and Stelco. Some factors, among others, that could affect market conditions, costs, shipments and prices for the domestic and foreign operations of U.S. Steel and Stelco include global product demand, prices and mix; global and company

steel production levels; global and domestic demand for steel products;

global and domestic energy markets; plant operating performance, including the start up of several blast furnaces; the timing and completion of facility projects; natural gas prices, usage and

supply disruptions; raw materials availability and prices; changes in

environmental, tax and other laws; employee strikes; power outages; and U.S. and global economic performance and political developments. Domestic steel shipments and prices could be affected by import

levels and actions taken by the U.S. Government. Economic conditions and

political factors in Europe and Canada that may affect U. S. Steel’s foreign operations results include, but are not limited to, taxation, environmental permitting, nationalization, inflation, currency fluctuations, increased regulation, export quotas, tariffs, and other protectionist measures. Factors that may affect the amount of net periodic benefit costs include, among others, changes to laws affecting benefits, pension fund investment performance, liability changes and interest

rates. Please refer to the Form 10-K of U.S. Steel for the year ended December 31, 2006 and subsequent filings and Stelco’s Annual Information Form dated March 30, 2007 for additional factors that could cause actual results to differ materially from any

forward-looking statements. Risks and Uncertainties Regarding the

Transaction Forward-looking statements regarding United States Steel

Corporation’s acquisition and integration of Stelco include statements relating to or concerning expected synergies, cost savings, accretive effect, industry size, and

market sector. Risks and uncertainties regarding the transaction include the

possibility that the expected synergies may not be realized in the time period anticipated or at all, that the market fails to perform as anticipated, and that the closing does not occur, either due to the failure of closing conditions, including the approval of the shareholders of Stelco, or the failure to obtain required regulatory approvals, or

other reasons. Even if the transaction closes as anticipated, integration

may not proceed as expected, and the impact of changes in the industry, markets or the economy in general may result in unexpected costs or the failure to realize anticipated benefits of the transaction. Forward-looking statements included in this presentation are made only as of the date hereof, and the companies undertake no

obligation to update these forward-looking statements to reflect future

events or circumstances except as may be required by law. |

3 Transaction Overview U. S. Steel to Acquire Stelco • U. S. Steel acquires Stelco for $1.1 billion (U.S.) or $38.50 (Canadian) per share in an all cash transaction • Majority of approximately $760 million net debt as of 6/30/07 will be retired • Voluntary pension funding of $31 million at closing • Financed with cash on hand and committed credit facilities • Potential run rate synergies in excess of $100 million by end of 2008 • Acquisition expected to be accretive in 2008 before synergies • Excluding accounting effects of the sale of acquired inventory

and other customary purchase accounting

adjustments • Closing expected in fourth quarter 2007 |

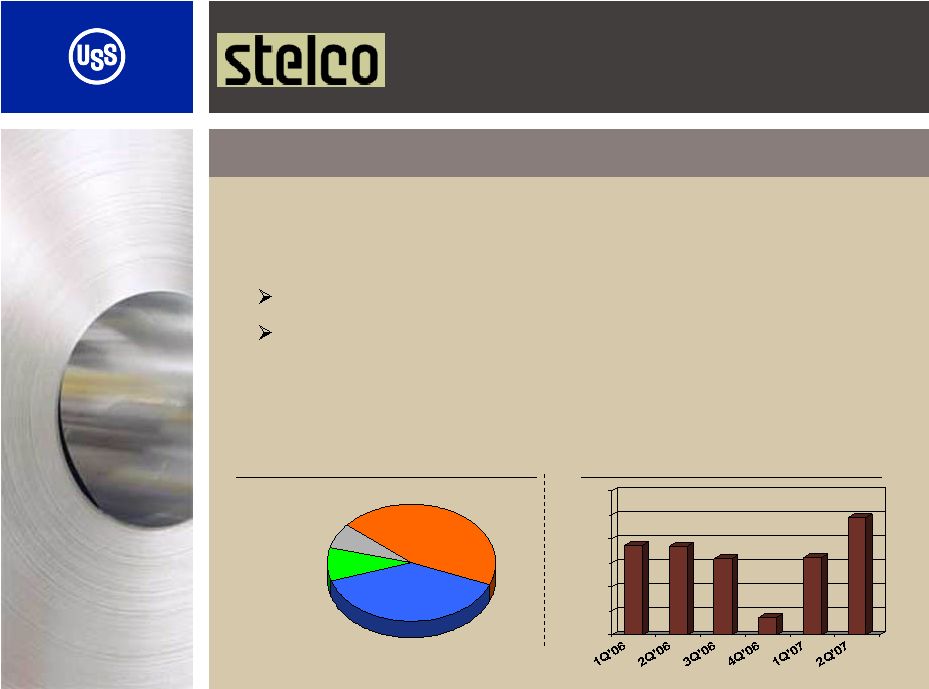

4 A leading Canadian sheet producer Major supplier of automotive and other value added products Strong raw material position 85% coke self sufficient 90% iron ore self sufficient* Annual raw steel capability of 5.5mm tons Long slab position – approximately 900,000 tons Business Overview Product Mix by Revenue Bars 9% Other 7% 2006 Sales = $2,365mm Quarterly Shipment History (000 tons) Hot Rolled 48% CR & Coated 37% 600 700 800 900 1,000 1,100 1,200 *Includes iron ore under long-term contract |

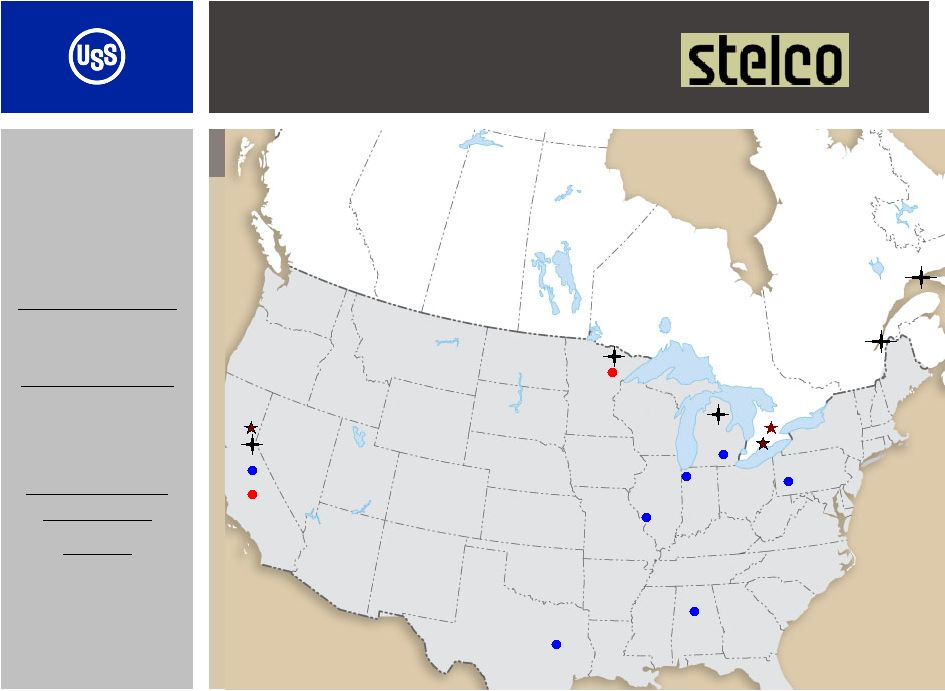

Stelco – Company Overview Hamilton Lake Erie British Columbia Alberta Manitoba Saskatchewan Ontario Quebec Mon Valley Fairfield Granite City Minntac/ Keetac Gary Great Lakes Tilden Hibbing Labrador 7/07 Employees 3,600 2006 Raw Steel (Million Net Tons) 4.2 Raw Materials Ownership Iron Ore Minority shares of: Hibbing Taconite Tilden Mining Wabush Mining Seignelay Reserve Raw Steel Capability Million Net Tons: Hamilton 2.6 Lake Erie 2.9 U. S. Steel Iron Ore Wabush Stelco Iron Ore Mining U. S. Steel Flat Rolled & Tubular Stelco Integrated Steel Mill East Texas |

6 Business Case for Acquisition Complementary assets & attributes: Stelco is long slabs, intend to ship approximately 900,000 tons to U.S. Steel facilities Improve U. S. Steel’s finishing facility utilization Strong product mix Creates 5th largest global steel company Annual synergies estimated to be in excess of $100 million: Sourcing semi-finished product Procurement, best practices and SG&A |

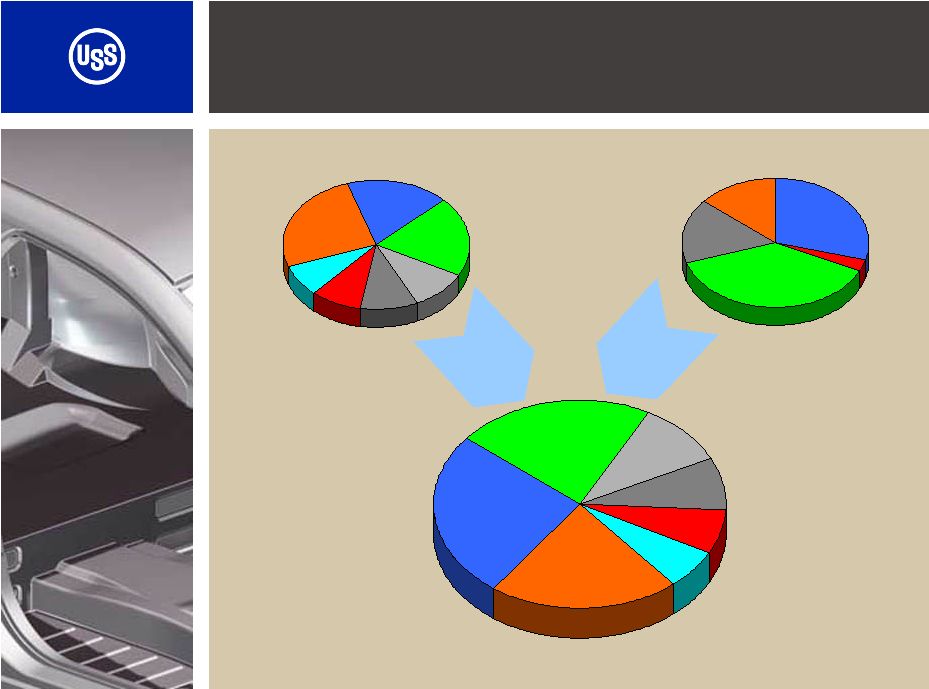

7 2006 Pro forma Shipments (17.7 mm tons) U. S. Steel* (14.2 mm tons) Stelco** (3.5 mm tons) U. S. Steel and Stelco Favorable Product Mix Service Center 23% Conversion 26% Automotive 18% Construction 9% Containers 9% All other 7% Appliance 8% Automotive 38% Service Center 14% Conversion 16% Construction 32% Automotive 22% Construction 13% Containers 8% Appliance 7% All other 6% Service Center 20% Conversion 24% * Flat-Rolled segment only Appliance 3% ** Includes bar product |

8 Financial Overview Tons Shipped U. S. Steel Stelco Sales EBITDA** Operating Income 3.5 million $15,715 $2,365* $1,785 ($126)* ($19)* Source: Company filings * Converted from Canadian dollars using .9443 ** EBITDA and Operating Income are not GAAP measures. See the following slide for a

reconciliation to Net Income (Loss), which is a GAAP measure. 2006 $ millions 21.6 million $2,226 2006 2Q’07 Stelco 1.1 million $677* $24* $50* |

8a - 41 - Discontinued operations 36 20 - Impairment charges & reorg. items 26 65 62 Net interest & other financial costs $50 ($19) $2,226 EBITDA 26 107 441 Depreciation, depletion & amortization 24 (126) 1,785 Operating Income (20) 46 25 Other * 21 7 324 Income tax provision ($39) ($305) $1,374 Net income (loss) 2Q’07 Stelco 2006 Stelco 2006 U. S. Steel $ millions * Includes workforce reduction costs, foreign exchange gains on long-term debt and

minority interests Reconciliation to GAAP |

9 Stelco’s Improvement plan Workforce reduction 29% from 1/1/06 • Facility utilization and productivity improvements • Reduced contractors and outside processing • Modified benefits and benefit administration • Reduced fixed costs: property tax, IT, legal, insurance • Closing obsolete facilities – Hamilton HSM, 5 stand, #2 pickle, #2 galv line • Logistics, material handling improvements • Divesting interest in Wabush mines |

10 Key changes since January 2005 U. S. Steel & Stelco Acquisition Stelco – Significant CAPEX Plan – Now Realized Lake Erie Hot Strip Mill Upgraded Hamilton Blast Furnace major work completed Stelco Labor Reductions attained – via Restructuring Divested mini-mill and other assets Negotiated work practice changes for steel facilities U. S. Steel Granite City Hot Strip Mill Upgraded Utilize Stelco slabs Pension Funding – Defined 10-year level funding agreement with Ontario |

U.

S. Steel and Stelco Strengthens our position as a leading North American

Flat-Rolled producer • Expands U. S. Steel’s supply chain across a larger geographic area • Leverages U. S. Steel’s production platform to drive operating performance Financially attractive: • Potential annual synergies in excess of $100 million by 2008 • Accretive before synergies and purchase accounting adjustments • Maintains financial flexibility

post-transaction 11 Transaction Summary |

Strategic Acquisition of Stelco August 27, 2007 © United States Steel Corporation 2007 |