Strategic Acquisition of Lone Star Technologies, Inc. March 29, 2007 © United States Steel Corporation 2007 Exhibit 99.1 |

Strategic Acquisition of Lone Star Technologies, Inc. March 29, 2007 © United States Steel Corporation 2007 Exhibit 99.1 |

2 Forward — Looking Statements Risks and Uncertainties Regarding United States Steel Corporation and Lone Star

Technologies, Inc. Some factors, among others, that could affect market conditions, costs, shipments and prices for the domestic and foreign operations of U. S. Steel and Lone Star include global product demand, prices and mix; global and company steel production levels; global and domestic demand for tubular products; global and domestic energy markets; plant operating performance, including, the start up of several blast furnaces; the timing and completion of facility projects; natural gas prices, usage and supply disruptions; raw materials availability and prices; changes in environmental, tax and other laws; employee strikes; power outages; and U.S. and global economic performance and political developments. Domestic steel shipments and prices could be affected by import levels and actions taken by the U.S. Government. Economic conditions and political facts in Europe that may affect U. S. Steel’s foreign operations results include, but are not limited to, taxation, environmental permitting, nationalization, inflation, currency fluctuations, increased regulation, export quotas, tariffs, and other protectionist measures. Factors that may affect the amount of net periodic benefit costs include, among others, changes to laws affecting benefits, pension fund investment performance, liability changes and interest rates. Please refer to the Form 10-K of U.S. Steel for the year ended December 31, 2006 and the Form 10-K of Lone Star Technologies, Inc. for the year ended December 31, 2006 for additional factors that could cause actual results to differ materially from any forward-looking statements. Risks and Uncertainties Regarding the Transaction Forward-looking statements regarding United States Steel Corporation’s acquisition and integration of Lone Star Technologies, Inc. include statements relating to or concerning expected synergies, cost savings, accretive effect, industry size, and market sector. Risks and uncertainties regarding the transaction include the possibility that the expected synergies may not be realized in the time period anticipated or at all, that the market fails to perform as anticipated, and that the closing does not occur, either due to the failure of closing conditions, including the approval of the shareholders of Lone Star, or the failure to obtain required regulatory approvals, or other reasons. Even if the transaction closes as anticipated, integration may not proceed as expected, and the impact of changes in the industry, markets or the economy in general may result in unexpected costs or the failure to realize anticipated benefits of the transaction. Forward-looking statements included in this news release are made only as of the date hereof, and the companies undertake no obligation to update these forward-looking statements to reflect future events or circumstances except as may be required by law. |

3 U. S. Steel acquires Lone Star for $2.1 billion or $67.50 per share All cash transaction •Financed with cash on hand and committed credit facilities Potential annual synergies in excess of $100 million by end of 2008 Acquisition expected to be accretive in 2007 before synergies •Excluding accounting effects of the sale of acquired inventory and other

customary purchase accounting adjustments Closing expected in second or third quarter 2007 U. S. Steel to Acquire Lone Star Technologies Transaction Overview Lone Star a leading North American producer of welded tubular products |

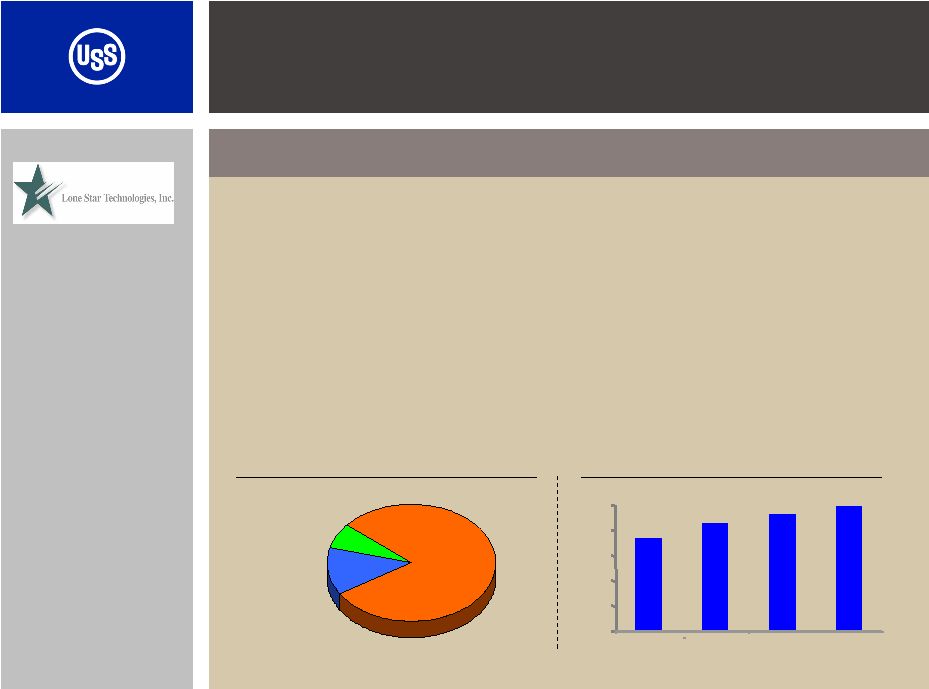

4 Leading North American producer of welded OCTG Major producer and marketer of line pipe Major supplier to oil patch of threading,heat treating and finishing Annual production capacity of 1mm tons*. 2006 revenues of $1.4 billion and EBITDA $203* million Lone Star Steel Technologies, Inc. (LSS) Business Overview Product Mix by Revenue Oilfield Products 80% Specialty 13% Other 7% 2006 Revenue = $1,378mm Shipment History (000 tons) 734 882 926 996 0 200 400 600 800 1,000 2003 2004 2005 2006 Other Businesses: Producer of specialty tubing Marketer of OCTG and Line Pipe for others Producer/supplier of hot rolled steel * EBITDA is not a GAAP measure. Please refer to the forms 10-K for the year ended

December 31, 2006 filed by U. S. Steel and Lone Star, respectively, for

GAAP financial information. |

5 Complementary Assets & Attributes Expanded and Complementary Product Portfolio Strong Tubular Product Mix Creates largest North American fully integrated seamless and welded tubular producer Annual synergies estimated to be in excess of $100 million: Sourcing semi-finished product SG&A, Procurement and Best Practices Lone Star Steel Technologies, Inc. Business Case for Acquisition The premier North American supplier to the attractive and growing OCTG market sector |

6 U.S. Steel and Lone Star - Complementary Assets & Attributes Significant North American seamless supplier Full seamless size range 1.9” through 26” Limited welded pipe supplier World class manufacturing facilities with heat treating capacity Strong distributor relationships Leading North American welded pipe supplier Full size welded range utilizing the Alliance mills 1” through 60” Additional heat treating Coupling supply Tubing finishing & threading Primarily direct to end customer U. S. Steel Lone Star Technologies |

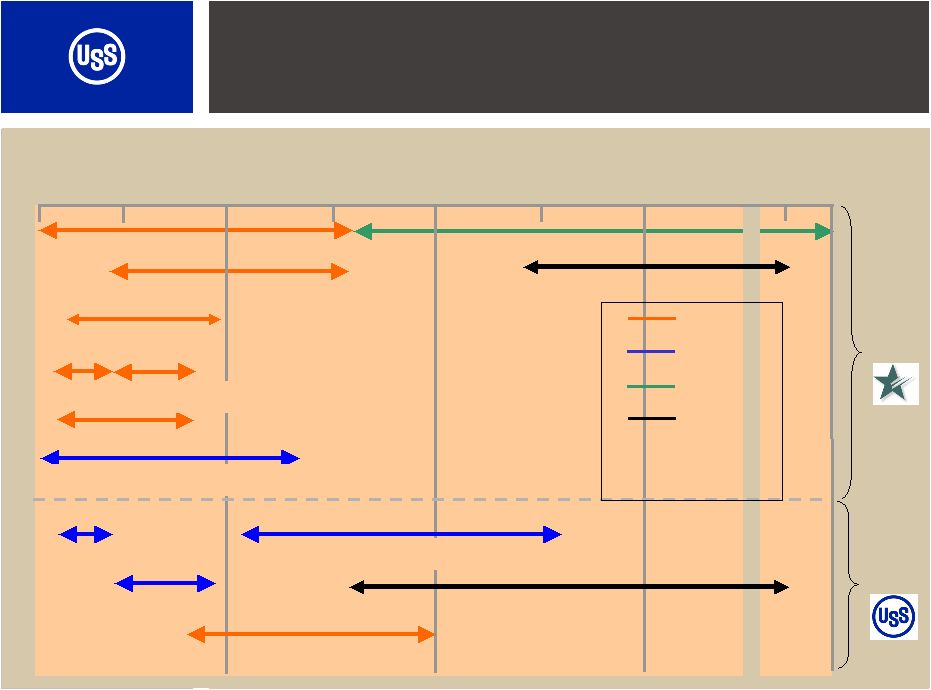

7 1 5 10 15 20 25 30 60 Inches Lone Star Steel Welspun * Northwest Pipe * Bellville Texas Tubular * Tex-Tube * Lorain #4 Lorain #3 Fairfield Camp Hill Hunan Valin – Potential JV Expanded and Complementary Product Portfolio USSK 50 Welspun JV ERW Seamless DSAW Spiral Welded * Identifies LSS alliances Apolo JV LSS USS |

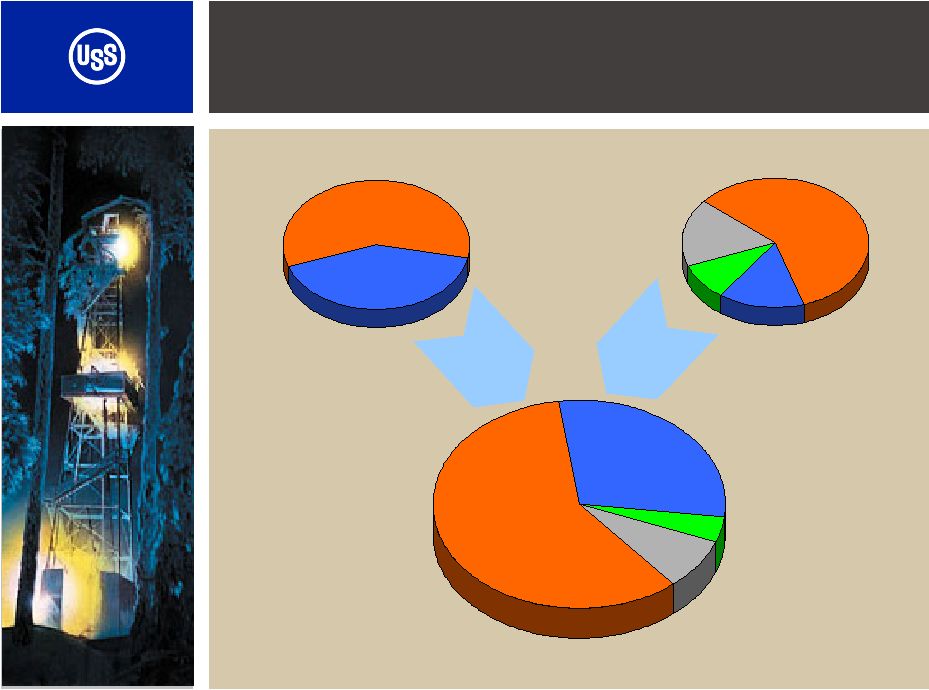

8 U. S. Steel and Lone Star - Strong Tubular Product Mix OCTG 59% 2006 Pro forma Shipments (2.2 mm tons) U. S. Steel (1.2 mm tons) S&L** 29% Lone Star (1.0 mm tons) OCTG 59% S&L** 41% OCTG 59% S&L** 15% Specialty * 9% LSS Flat Roll 17% Specialty 4% LSS Flat Roll 8% *Customer specified (custom) dimensions and grades **S&L = Standard and line pipe |

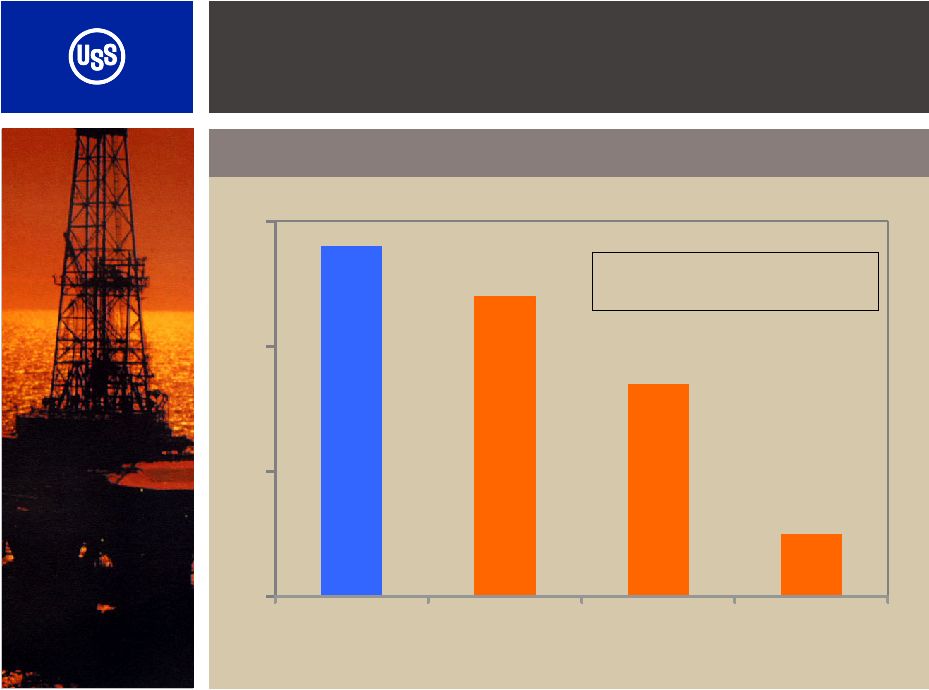

9 0 1 2 3 USS / LSS IPSCO / NS Group Tenaris / Maverick V&M Star Creates the Largest N.A. Seamless and Welded Tubular Producer Million Tons 2.8 * 2.4 1.7 0.5 Tubular Capacity Source: Company filings and equity research ** ** * 1.8 mm USS & 1.0 mm LSS * * 2006 Acquisitions |

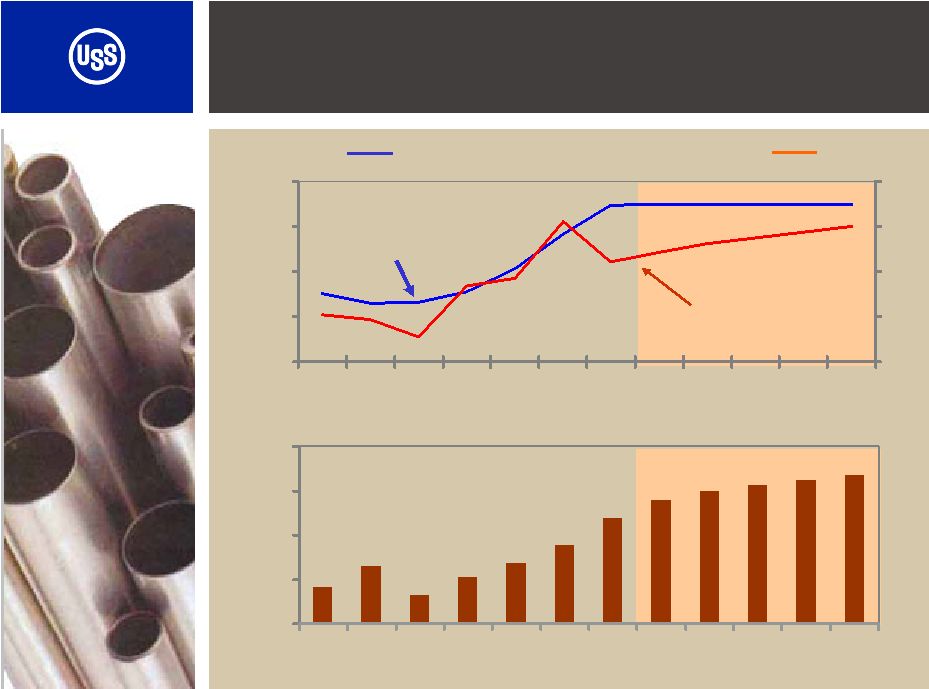

10 Strong Market Outlook Drives Demand Spot Price WTI Spot Price Source: Spears 500 1,000 1,500 2,000 2,500 '00 '01 '02 '03 '04 '05 '06 '07 '08 '09 '10 '11 Total N.A. Rig Count $ Barrel $ mmbtu Natural Gas Price 0 20 40 60 80 '00 '01 '02 '03 '04 '05 '06 '07 '08 '09 '10 '11 2 4 6 8 10 |

11 Financial Overview of Tubular Business Tons Shipped U.S. Steel Tubular Lone Star Revenue EBITDA** % margin Operating Income % margin 1.2 million 1.0 million* $1,798 $1,378 $631 $173 $644 $203 35.1% 12.5% 35.8% 14.7% Source: Company filings * Excludes alliance mills & Apolo joint venture ** EBITDA is not a GAAP measure. Please refer to the forms 10-K for the year ended

December 31, 2006 filed by U. S. Steel and Lone Star, respectively, for

GAAP financial information. FY 2006 $ millions |

12 U. S. Steel and Lone Star Technologies Creates the leading North American supplier of OCTG products • Largest North American supplier of seamless and welded pipe to energy sector • Leverages U.S. Steel’s production platform to drive operating performance Financially attractive: • Potential annual synergies in excess of $100 million by 2008 • Accretive before synergies • Maintains financial flexibility

post-transaction Transaction Summary |

13 Additional Information In connection with the proposed merger, Lone Star Technologies, Inc. intends to file a proxy statement and related materials with the Securities and Exchange Commission (SEC). The documents will contain important information about the proposed merger, and the shareholders of Lone Star are urged to read the carefully when they become available. These documents, when filed with the SEC, will be available for free at the SEC’s website, http://www.sec.gov and at Lone Star’s website, http://www.lonestartech.com. |

Strategic Acquisition of Lone Star Technologies, Inc. March 29, 2007 © United States Steel Corporation 2007 |