1 EARNINGS CALL FIRST QUARTER 2023 David Burritt President and Chief Executive Officer Jessica Graziano SVP and Chief Financial Officer Rich Fruehauf SVP, Chief Strategy and Sustainability Officer Kevin Lewis VP, Finance

2 FORWARD-LOOKING STATEMENTS These slides are being provided to assist readers in understanding the results of operations, financial condition and cash flows of United States Steel Corporation as of and for the first quarter 2023. Financial results as of and for the periods ended March 31, 2023 provided herein are preliminary unaudited results based on current information available to management. They should be read in conjunction with the consolidated financial statements and Notes to the Consolidated Financial Statements contained in our Annual Report on Form 10-K and Quarterly Reports on Form 10-Q filed with the Securities and Exchange Commission. This presentation contains information that may constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. We intend the forward-looking statements to be covered by the safe harbor provisions for forward-looking statements in those sections. Generally, we have identified such forward-looking statements by using the words “believe,” “expect,” “intend,” “estimate,” “anticipate,” “project,” “target,” “forecast,” “aim,” “should,” “plan,” “goal,” “future,” “will,” “may,” and similar expressions or by using future dates in connection with any discussion of, among other things, the construction or operation of new or existing facilities or operating capabilities, the timing, size and form of share repurchase transactions, operating or financial performance, trends, events or developments that we expect or anticipate will occur in the future, statements relating to volume changes, share of sales and earnings per share changes, anticipated cost savings, potential capital and operational cash improvements, changes in the global economic environment, including supply and demand conditions, inflation, interest rates, supply chain disruptions and changes in prices for our products, international trade duties and other aspects of international trade policy, statements regarding our future strategies, products and innovations, statements regarding our greenhouse gas emissions reduction goals, statements regarding existing or new regulations and statements expressing general views about future operating results. However, the absence of these words or similar expressions does not mean that a statement is not forward-looking. Forward-looking statements are not historical facts, but instead represent only the Company’s beliefs regarding future events, many of which, by their nature, are inherently uncertain and outside of the Company’s control. It is possible that the Company’s actual results and financial condition may differ, possibly materially, from the anticipated results and financial condition indicated in these forward-looking statements. Management believes that these forward-looking statements are reasonable as of the time made. However, caution should be taken not to place undue reliance on any such forward-looking statements because such statements speak only as of the date when made. Our Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. In addition, forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from our Company's historical experience and our present expectations or projections. These risks and uncertainties include, but are not limited to, the risks and uncertainties described in “Item 1A. Risk Factors” in our Annual report on Form 10-K for the year ended December 31, 2022 and those described from time to time in our future reports filed with the Securities and Exchange Commission. References to "we," "us," "our," the "Company," and "U. S. Steel," refer to United States Steel Corporation and its consolidated subsidiaries, references to “Big River Steel” refer to Big River Steel Holdings LLC and its direct and indirect subsidiaries unless otherwise indicated by the context.

3 EXPLANATION OF USE OF NON-GAAP MEASURES We present adjusted net earnings, earnings before interest, income taxes, depreciation and amortization (EBITDA) and adjusted EBITDA, which are non-GAAP measures, as additional measurements to enhance the understanding of our operating performance. We believe that EBITDA, considered along with net earnings, is a relevant indicator of trends relating to our operating performance and provides management and investors with additional information for comparison of our operating results to the operating results of other companies. Adjusted net earnings is a non-GAAP measure that excludes the effects of items that include: debt extinguishment, asset impairment charges, restructuring and other charges, stock-based compensation expense, VEBA asset surplus adjustment, gains on assets sold and previously held investments, pension de-risking, United Steelworkers labor agreement signing bonus and related costs, tax impact of adjusted items and other charges, net (Adjustment Items). We present adjusted net earnings and adjusted EBITDA to enhance the understanding of our ongoing operating performance and established trends affecting our core operations by excluding the effects of events that can obscure underlying trends. U. S. Steel's management considers adjusted net earnings and adjusted EBITDA as alternative measures of operating performance and not alternative measures of the Company's liquidity. U. S. Steel’s management considers adjusted net earnings and adjusted EBITDA useful to investors by facilitating a comparison of our operating performance to the operating performance of our competitors. Additionally, the presentation of adjusted net earnings and adjusted EBITDA provides insight into management’s view and assessment of the Company’s ongoing operating performance because management does not consider the Adjustment Items when evaluating the Company’s financial performance. Adjusted net earnings and adjusted EBITDA should not be considered a substitute for net earnings or other financial measures as computed in accordance with U.S. GAAP and is not necessarily comparable to similarly titled measures used by other companies. We present free cash flow, a non-GAAP measure of cash generated from operations after any investing activity and investable free cash flow, a non-GAAP measure of cash generated from operations, after any investing activity adjusted for strategic capital expenditures. We believe that free and investable cash flow provides further insight into the Company's overall utilization of cash. We also present net debt, a non-GAAP measure calculated as total debt less cash and cash equivalents. We believe net debt is a useful measure in calculating enterprise value. A condensed consolidated statement of operations (unaudited), condensed consolidated cash flow statement (unaudited), condensed consolidated balance sheet (unaudited) and preliminary supplemental statistics (unaudited) for U. S. Steel are attached.

4 ADVANCING TOWARDS OUR BEST FOR ALL® FUTURE Current Landscape Confident in our ability to execute our Best for All strategy, SAFELY Bullish on U. S. Steel’s future Challenges Transitioning to a less cost- / capital- and carbon- intensive business model while becoming the best steel competitor Solution Expanding existing competitive advantages Balanced capital allocation framework Maintaining strong trade enforcement Path Forward Delivering on Best for All

5 TODAY’S DISCUSSION Progressing on our Best for All® strategy Healthy market backdrop Balanced and diverse order book Providing a strategic update Supporting strategy execution Serving end-market demand across industries

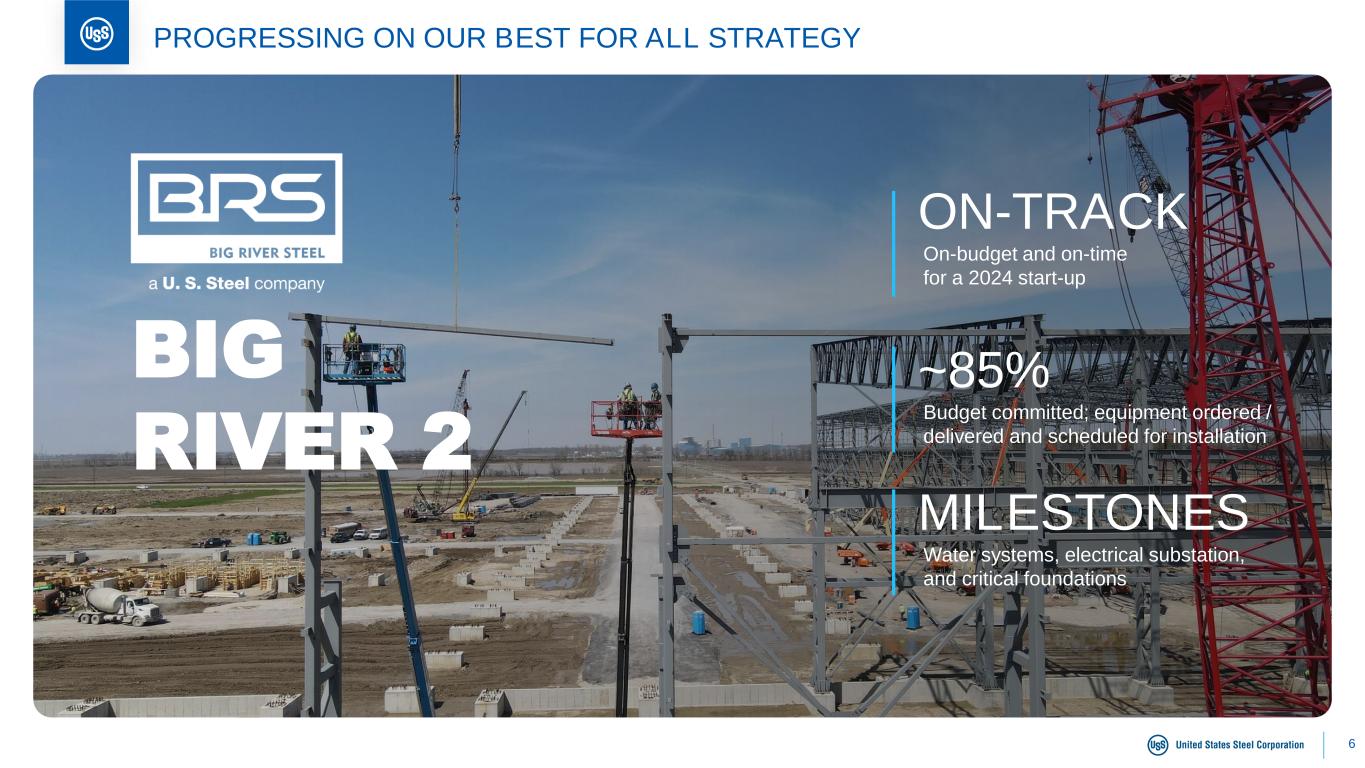

6 PROGRESSING ON OUR BEST FOR ALL STRATEGY ON-TRACK On-budget and on-time for a 2024 start-up ~85% Budget committed; equipment ordered / delivered and scheduled for installation MILESTONES Water systems, electrical substation, and critical foundations BIG RIVER 2

7 BIG RIVER 2 Water Systems BIG RIVER 2 Electrical Substation PROGRESSING ON OUR BEST FOR ALL STRATEGY

8 BIG RIVER 2 ECR1 Foundations PROGRESSING ON OUR BEST FOR ALL STRATEGY 1Endless casting and rolling

9 NGO ELECTRICAL STEEL ON-TRACK On-budget and on-time for a Q3 ’23 start-up IN DEMAND Significant customer interest in reserving time on the new line MILESTONES Cold commissioning critical components ahead of start-up PROGRESSING ON OUR BEST FOR ALL STRATEGY

10 NGO Hydraulic Systems NGO Cleaning Section PROGRESSING ON OUR BEST FOR ALL STRATEGY

11 PIG IRON CASTER COMPLETED Delivering EBITDA benefits in 2023; run-rate by 2024 INSOURCING Displacing 3rd party ore-based metallics with internally sourced metallics DE-RISKING De-risking the Mini Mill segment’s supply chain by displacing imported raw materials PROGRESSING ON OUR BEST FOR ALL STRATEGY

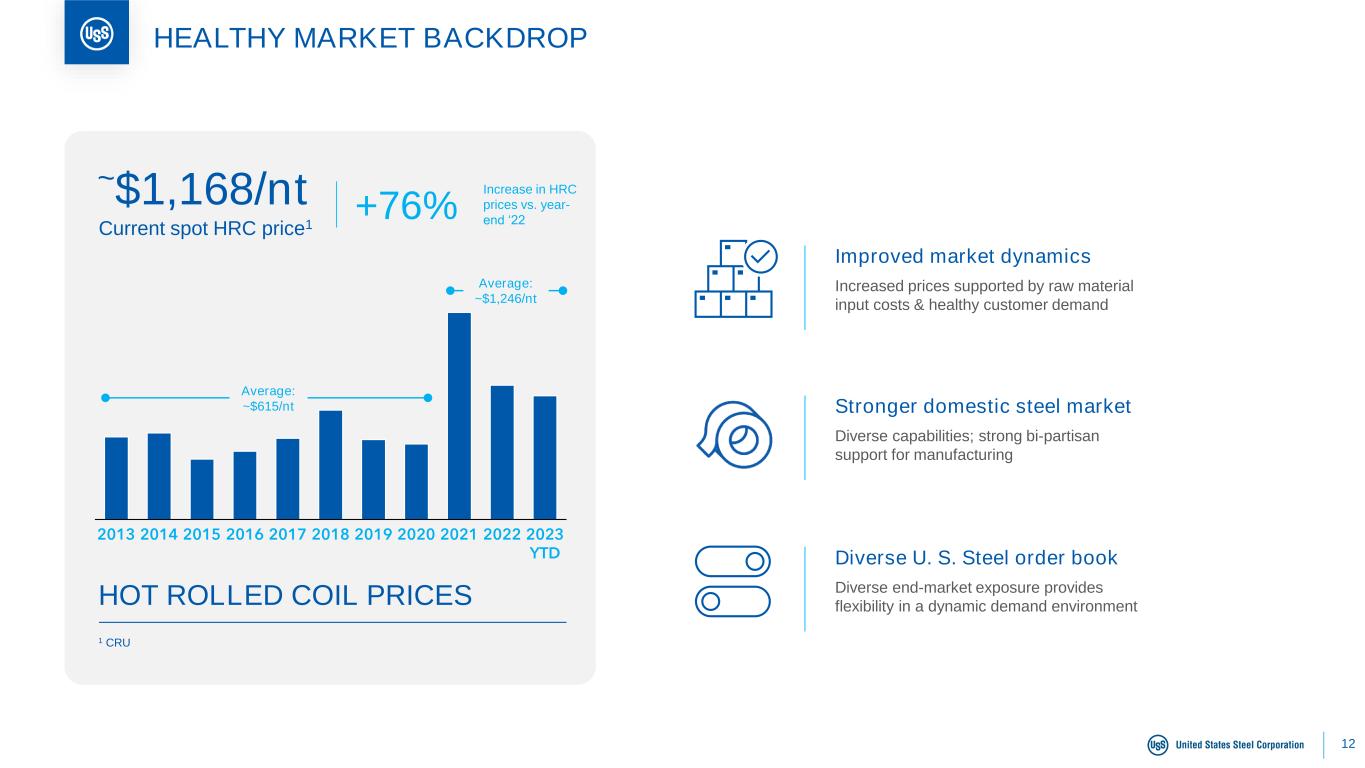

12 HEALTHY MARKET BACKDROP Improved market dynamics Increased prices supported by raw material input costs & healthy customer demand Stronger domestic steel market Diverse capabilities; strong bi-partisan support for manufacturing Diverse U. S. Steel order book Diverse end-market exposure provides flexibility in a dynamic demand environmentHOT ROLLED COIL PRICES ~$1,168/nt Increase in HRC prices vs. year- end ‘22 1 CRU 20182013 20202014 201920162015 2017 2021 2022 2023 YTD Average: ~$615/nt Average: ~$1,246/nt +76% Current spot HRC price1

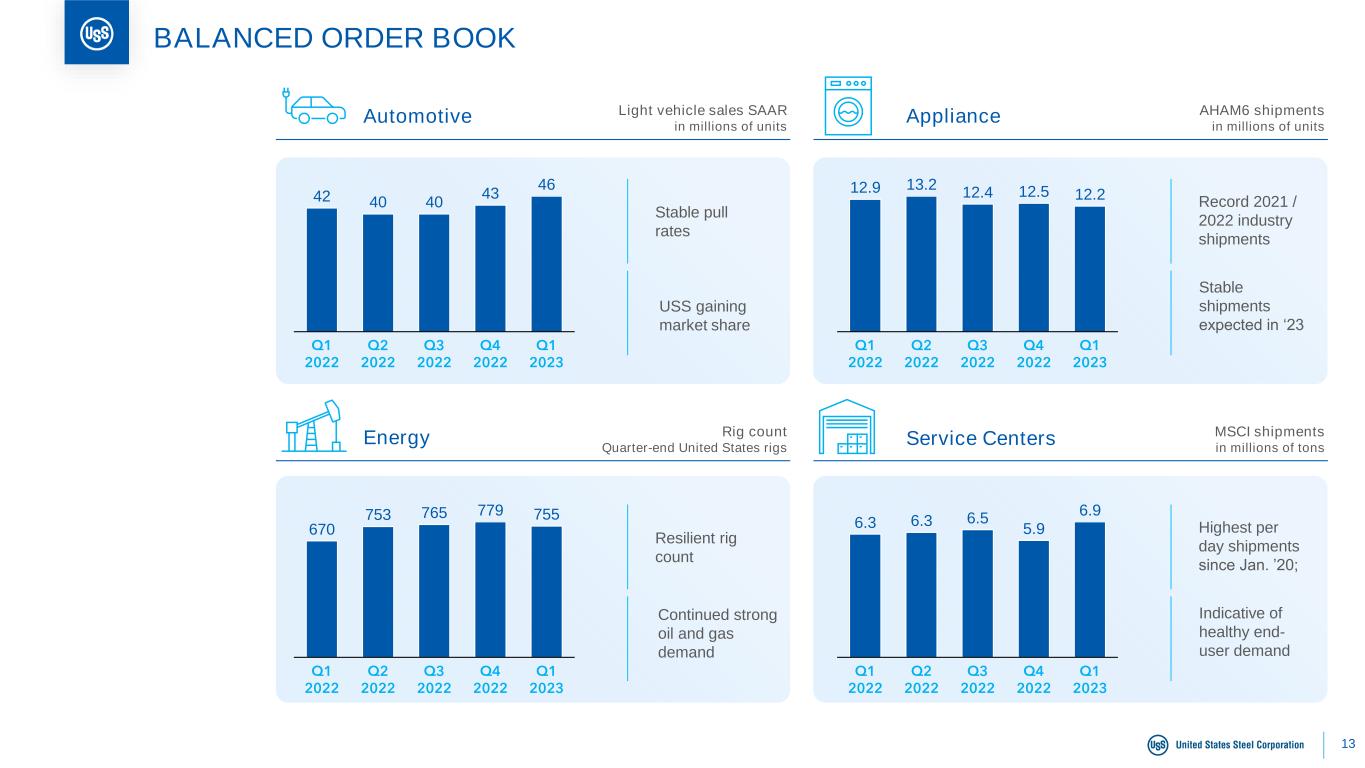

13 BALANCED ORDER BOOK Automotive Appliance Energy Service Centers Light vehicle sales SAAR in millions of units AHAM6 shipments in millions of units Rig count Quarter-end United States rigs MSCI shipments in millions of tons 42 40 40 43 46 Q4 2022 Q1 2022 Q3 2022 Q2 2022 Q1 2023 Stable pull rates USS gaining market share 12.9 13.2 12.4 12.5 12.2 Q1 2022 Q2 2022 Q1 2023 Q3 2022 Q4 2022 Record 2021 / 2022 industry shipments Stable shipments expected in ‘23 670 753 765 779 755 Q1 2023 Q1 2022 Q3 2022 Q2 2022 Q4 2022 Resilient rig count Continued strong oil and gas demand 6.3 6.3 6.5 5.9 6.9 Q1 2023 Q4 2022 Q2 2022 Q1 2022 Q3 2022 Highest per day shipments since Jan. ’20; Indicative of healthy end- user demand

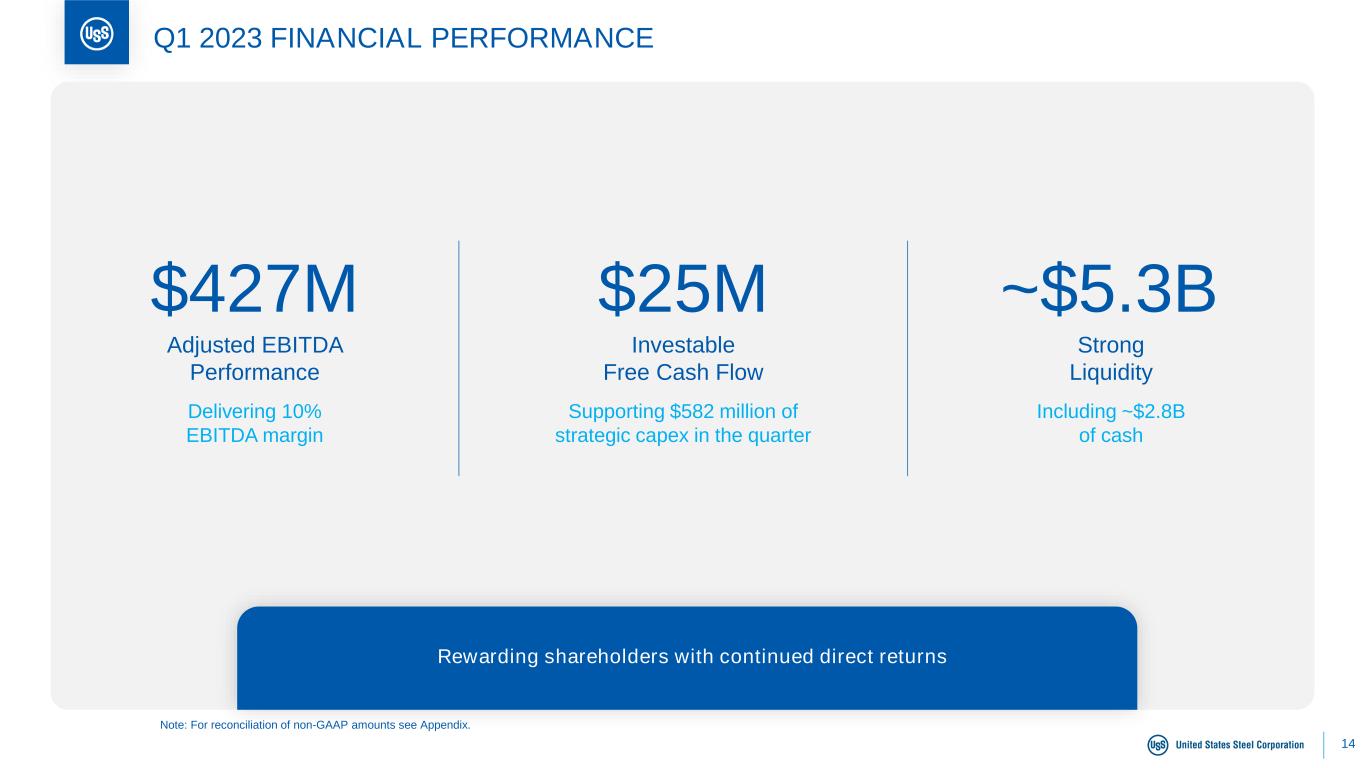

14 Q1 2023 FINANCIAL PERFORMANCE Rewarding shareholders with continued direct returns ~$5.3B Strong Liquidity Including ~$2.8B of cash $427M Adjusted EBITDA Performance Delivering 10% EBITDA margin $25M Investable Free Cash Flow Supporting $582 million of strategic capex in the quarter Note: For reconciliation of non-GAAP amounts see Appendix.

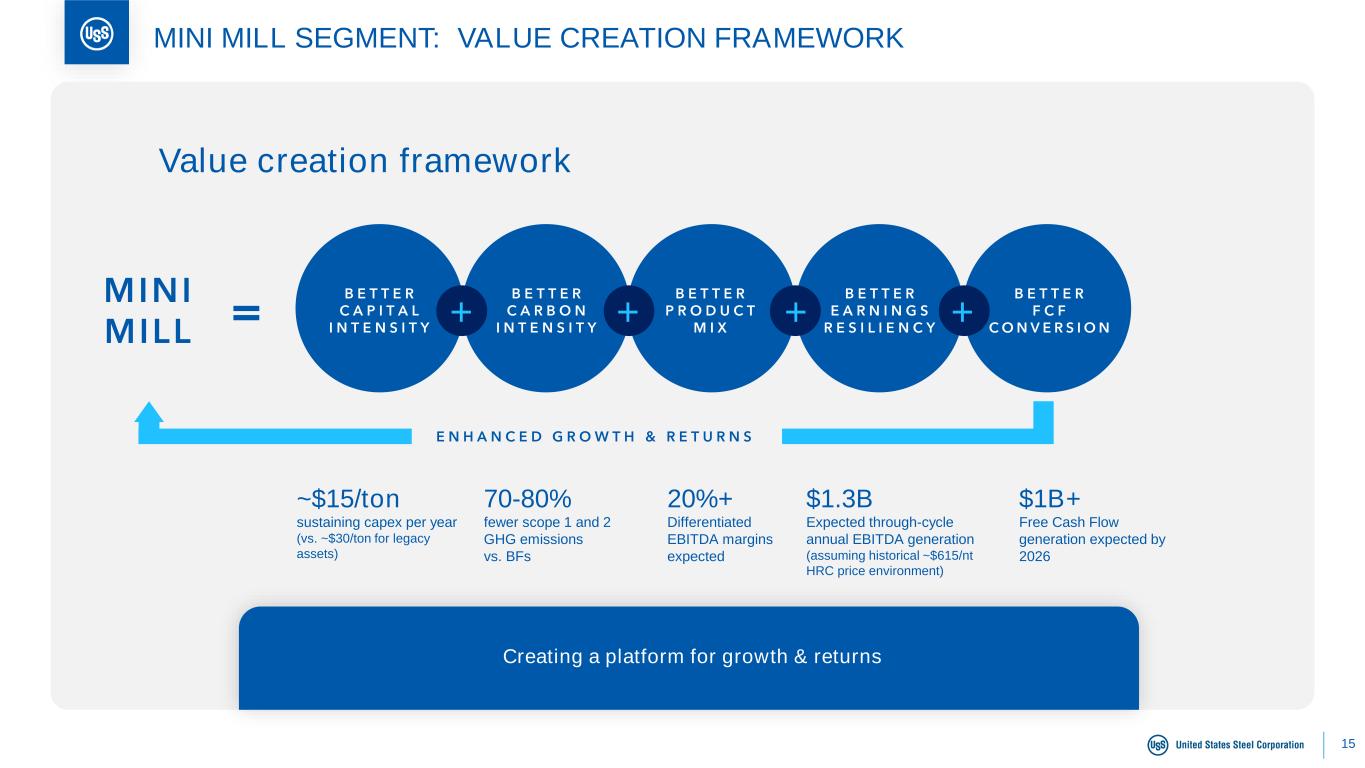

15 Value creation framework E N H A N C E D G R O W T H & R E T U R N S + + + + B E T T E R C A P I T A L I N T E N S I T Y B E T T E R C A R B O N I N T E N S I T Y B E T T E R E A R N I N G S R E S I L I E N C Y B E T T E R F C F C O N V E R S I O N B E T T E R P R O D U C T M I X ~$15/ton sustaining capex per year (vs. ~$30/ton for legacy assets) 70-80% fewer scope 1 and 2 GHG emissions vs. BFs $1.3B Expected through-cycle annual EBITDA generation (assuming historical ~$615/nt HRC price environment) $1B+ Free Cash Flow generation expected by 2026 20%+ Differentiated EBITDA margins expected Creating a platform for growth & returns MINI MILL = MINI MILL SEGMENT: VALUE CREATION FRAMEWORK

16 OPERATING SEGMENT OVERVIEW FLAT-ROLLED MINI MILL USSE TUBULAR

17 RECAP Progressing on our Best for All strategy Healthy market backdrop Balanced order book Best for All footprint is taking shape Further financial upside expected in Q2 2023 Supported by strategic end-market

18 CLOSING REMARKS

19 U. S. STEEL DELIVERS STRONG FIRST QUARTER 2023; BEST FOR ALL STRATEGY ON-TRACK 2023 F I R S T Q U A R T E R U P D A T E

20 IMPROVING ON RECORD SAFETY PERFORMANCE 0.07 0.06 0.05 0.02 2020 2021 2022 YTD 2023 OSHA Days Away from Work 2 SAFETY FIRST BLS - Iron & Steel: 0.90 Benchmark 1 : Multiple years of record-setting performance 1 Bureau of Labor Statistics – Iron & Steel 2021 data. 2 Occupational Safety and Health Administration (OSHA) Days Away from Work is defined as number of days away cases x 200,000 / hours worked. YTD as of April 27, 2023.

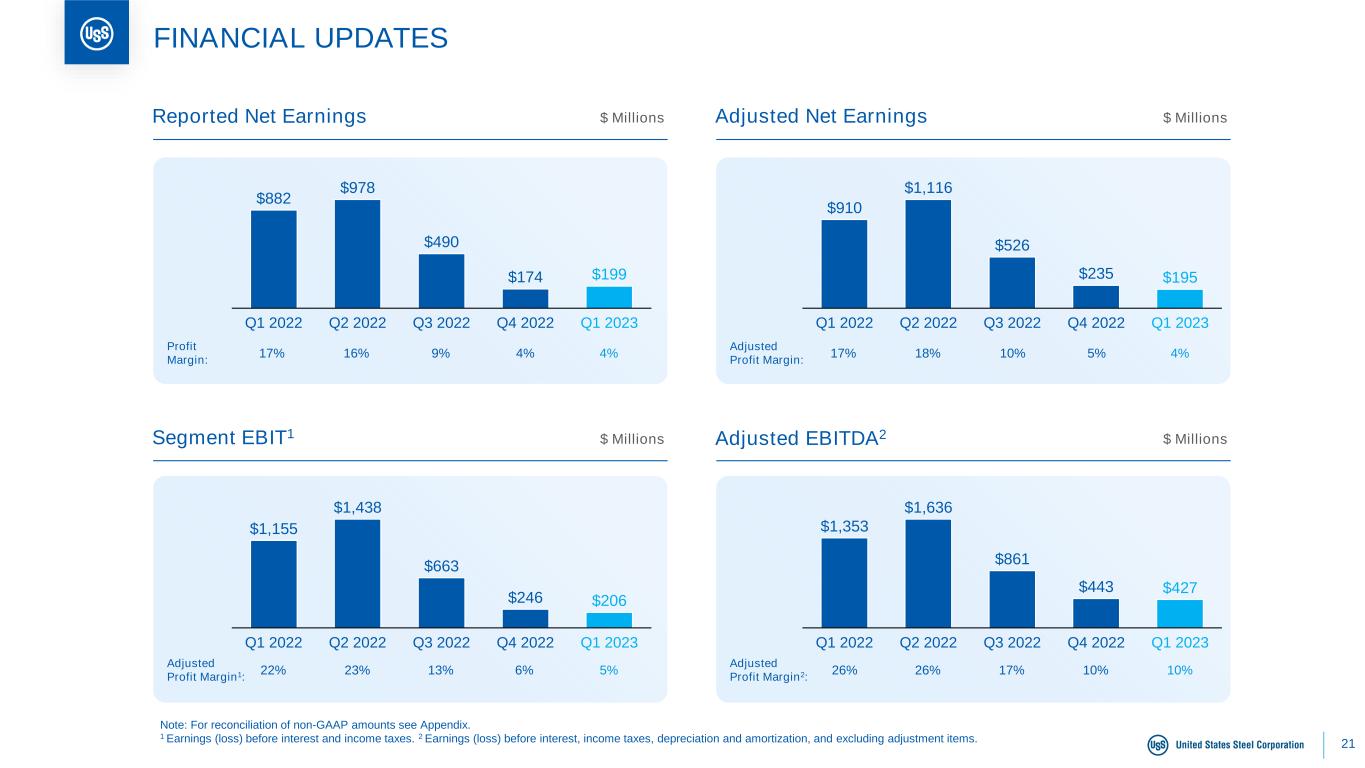

21 FINANCIAL UPDATES Reported Net Earnings Adjusted Net Earnings Segment EBIT1 Adjusted EBITDA2 Profit Margin: 17% 16% 9% 4% 4% $ Millions $ Millions $ Millions $ Millions 17% 18% 10% 5% 4% 22% 23% 13% 6% 5% Adjusted Profit Margin2: 26% 26% 17% 10% 10% Adjusted Profit Margin1: Note: For reconciliation of non-GAAP amounts see Appendix. 1 Earnings (loss) before interest and income taxes. 2 Earnings (loss) before interest, income taxes, depreciation and amortization, and excluding adjustment items. Adjusted Profit Margin: $882 $978 $490 $174 $199 Q1 2023Q3 2022 Q4 2022Q1 2022 Q2 2022 $910 $1,116 $526 $235 $195 Q1 2023Q2 2022Q1 2022 Q4 2022Q3 2022 $1,155 $1,438 $663 $246 $206 Q2 2022Q1 2022 Q3 2022 Q4 2022 Q1 2023 $1,353 $1,636 $861 $443 $427 Q1 2022 Q2 2022 Q1 2023Q3 2022 Q4 2022

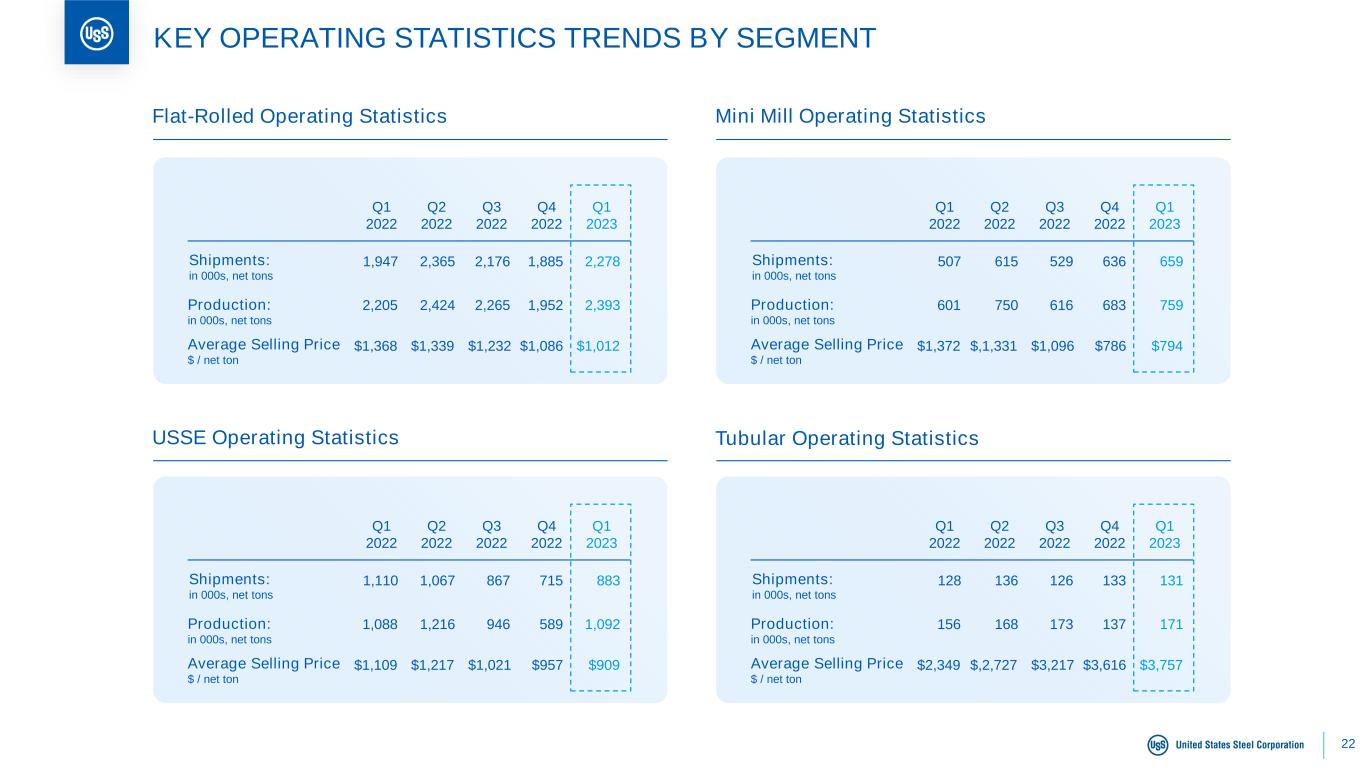

22 KEY OPERATING STATISTICS TRENDS BY SEGMENT Flat-Rolled Operating Statistics Mini Mill Operating Statistics USSE Operating Statistics Tubular Operating Statistics Shipments: in 000s, net tons Production: in 000s, net tons Average Selling Price $ / net ton Q1 2022 2,205 1,947 $1,368 Q2 2022 2,424 2,365 $1,339 Q3 2022 2,265 2,176 $1,232 Q4 2022 1,952 1,885 $1,086 Q1 2023 2,393 2,278 $1,012 Shipments: in 000s, net tons Production: in 000s, net tons Average Selling Price $ / net ton Q1 2022 601 507 $1,372 Q2 2022 750 615 $,1,331 Q3 2022 616 529 $1,096 Q4 2022 683 636 $786 Q1 2023 759 659 $794 Shipments: in 000s, net tons Production: in 000s, net tons Average Selling Price $ / net ton Q1 2022 1,088 1,110 $1,109 Q2 2022 1,216 1,067 $1,217 Q3 2022 946 867 $1,021 Q4 2022 589 715 $957 Q1 2023 1,092 883 $909 Shipments: in 000s, net tons Production: in 000s, net tons Average Selling Price $ / net ton Q1 2022 156 128 $2,349 Q2 2022 168 136 $,2,727 Q3 2022 173 126 $3,217 Q4 2022 137 133 $3,616 Q1 2023 171 131 $3,757

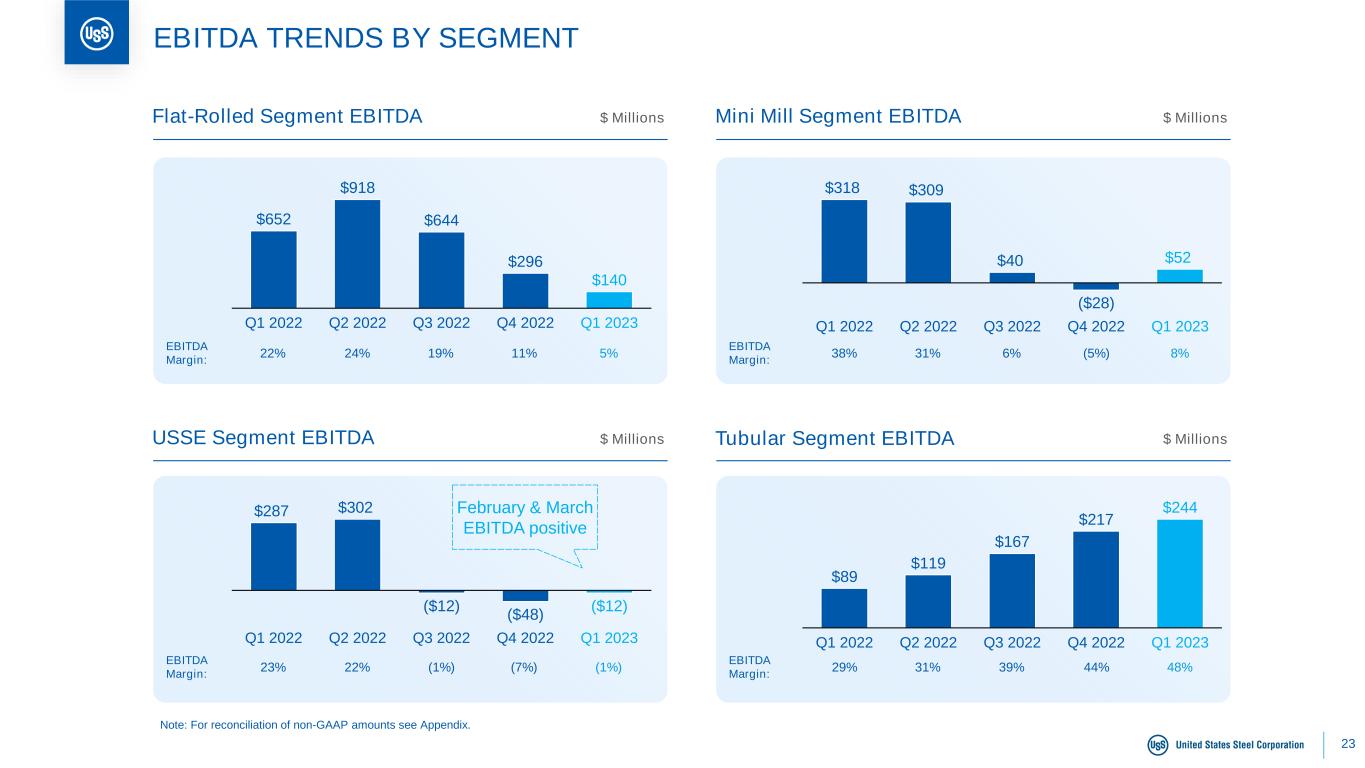

23 EBITDA TRENDS BY SEGMENT EBITDA Margin: 22% 24% 19% 11% 5% 38% 31% 6% (5%) 8% 23% 22% (1%) (7%) (1%) EBITDA Margin: 29% 31% 39% 44% 48% EBITDA Margin: Note: For reconciliation of non-GAAP amounts see Appendix. EBITDA Margin: $652 $918 $644 $296 $140 Q1 2022 Q4 2022Q2 2022 Q3 2022 Q1 2023 $318 $309 $40 ($28) $52 Q1 2022 Q2 2022 Q1 2023Q3 2022 Q4 2022 $287 $302 ($12) ($48) ($12) Q4 2022Q1 2022 Q2 2022 Q1 2023Q3 2022 $89 $119 $167 $217 $244 Q1 2022 Q1 2023Q3 2022Q2 2022 Q4 2022 Flat-Rolled Segment EBITDA Mini Mill Segment EBITDA$ Millions $ Millions USSE Segment EBITDA Tubular Segment EBITDA$ Millions $ Millions February & March EBITDA positive

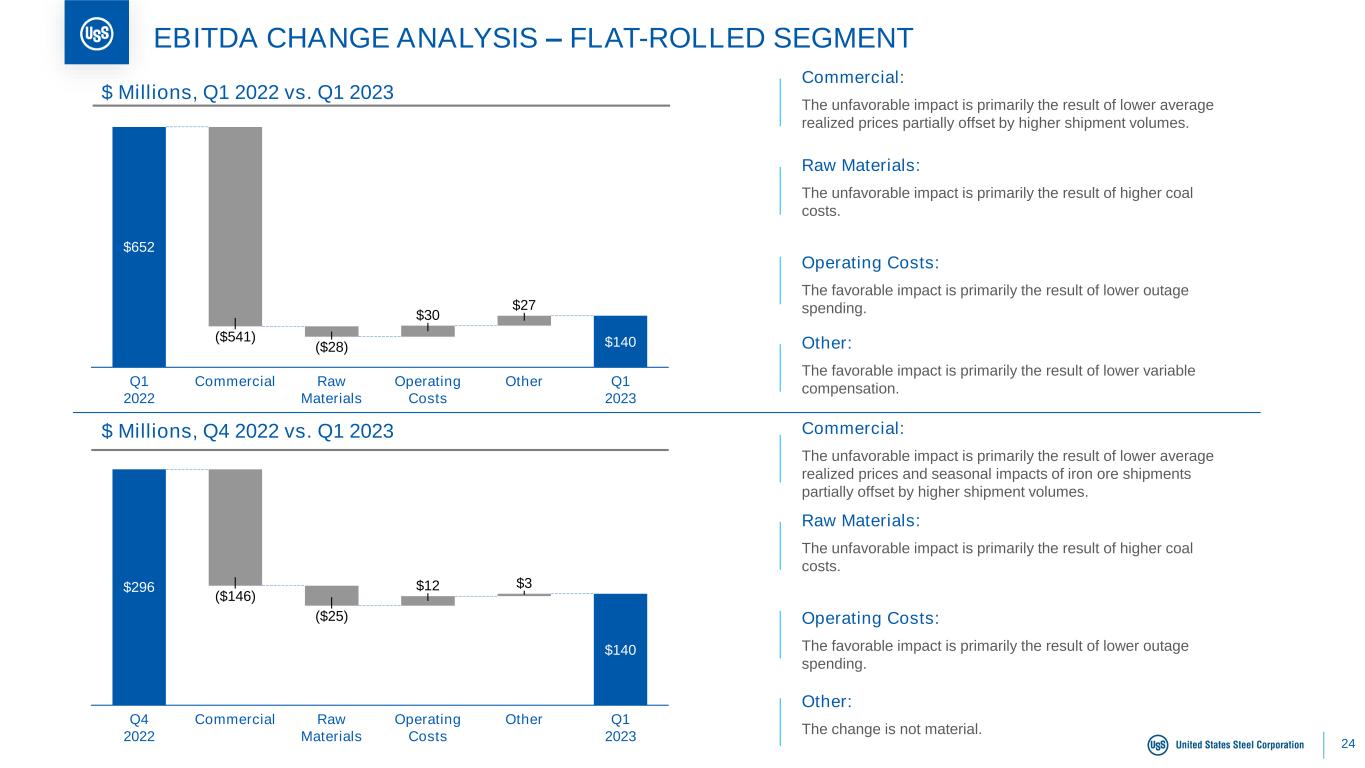

24 EBITDA CHANGE ANALYSIS – FLAT-ROLLED SEGMENT Commercial: The unfavorable impact is primarily the result of lower average realized prices partially offset by higher shipment volumes. Raw Materials: The unfavorable impact is primarily the result of higher coal costs. Operating Costs: The favorable impact is primarily the result of lower outage spending. $ Millions, Q1 2022 vs. Q1 2023 $652 $140 $30 $27 ($541) Q1 2022 Raw Materials Commercial ($28) Operating Costs Other Q1 2023 $ Millions, Q4 2022 vs. Q1 2023 $296 $140 $12 $3 Raw Materials Q4 2022 ($25) ($146) Commercial Operating Costs Other Q1 2023 Other: The favorable impact is primarily the result of lower variable compensation. Commercial: The unfavorable impact is primarily the result of lower average realized prices and seasonal impacts of iron ore shipments partially offset by higher shipment volumes. Raw Materials: The unfavorable impact is primarily the result of higher coal costs. Operating Costs: The favorable impact is primarily the result of lower outage spending. Other: The change is not material.

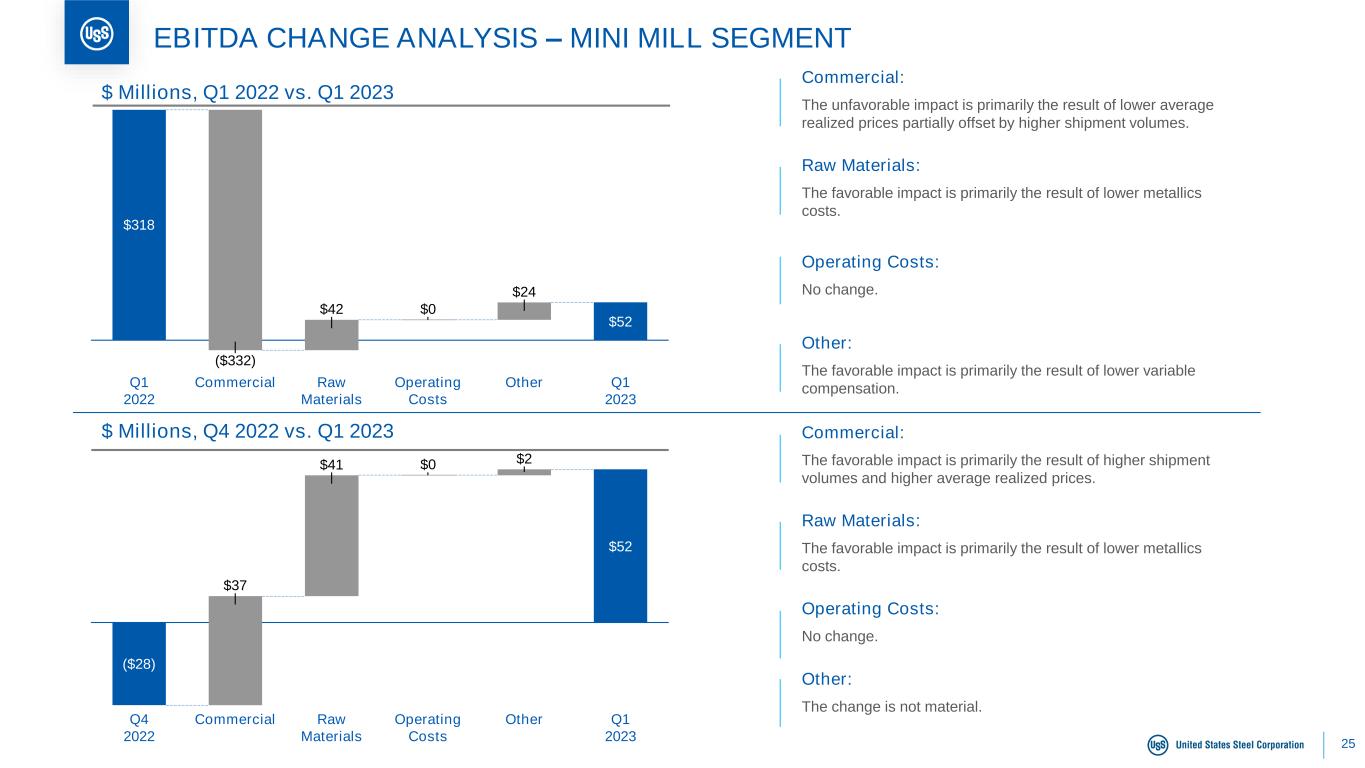

25 EBITDA CHANGE ANALYSIS – MINI MILL SEGMENT Commercial: The unfavorable impact is primarily the result of lower average realized prices partially offset by higher shipment volumes. Raw Materials: The favorable impact is primarily the result of lower metallics costs. Operating Costs: No change. $318 $52 $24 CommercialQ1 2022 ($332) $42 Raw Materials $0 Operating Costs Other Q1 2023 ($28) $52 $41 $2 CommercialQ4 2022 $37 Raw Materials $0 Operating Costs Other Q1 2023 Other: The favorable impact is primarily the result of lower variable compensation. Commercial: The favorable impact is primarily the result of higher shipment volumes and higher average realized prices. Raw Materials: The favorable impact is primarily the result of lower metallics costs. Operating Costs: No change. Other: The change is not material. $ Millions, Q1 2022 vs. Q1 2023 $ Millions, Q4 2022 vs. Q1 2023

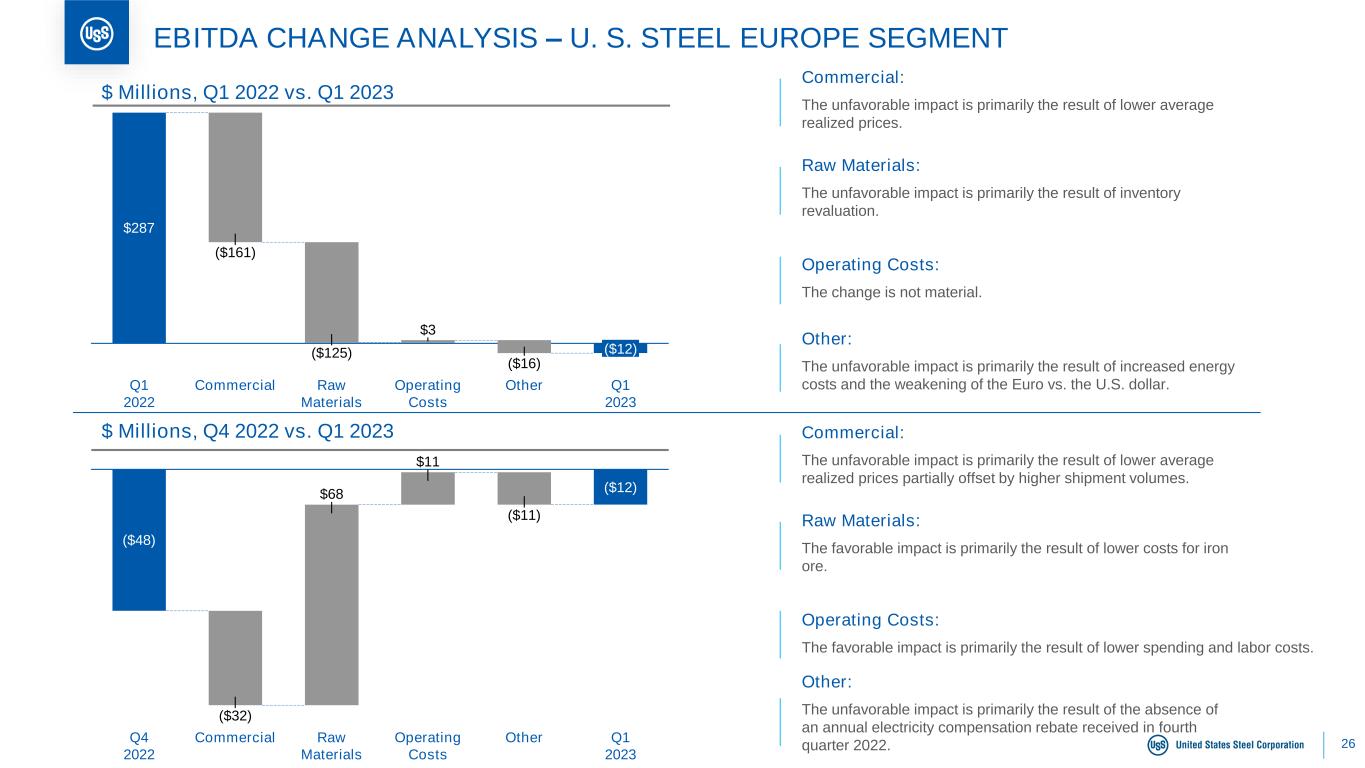

26 EBITDA CHANGE ANALYSIS – U. S. STEEL EUROPE SEGMENT Commercial: The unfavorable impact is primarily the result of lower average realized prices. Raw Materials: The unfavorable impact is primarily the result of inventory revaluation. Operating Costs: The change is not material. $287 $3 Q1 2023 Q1 2022 Raw Materials Commercial ($161) ($125) Operating Costs ($16) Other ($12) ($48) ($12) ($32) ($11) Q4 2022 $11 $68 Raw Materials Commercial Operating Costs Other Q1 2023 Other: The unfavorable impact is primarily the result of increased energy costs and the weakening of the Euro vs. the U.S. dollar. Commercial: The unfavorable impact is primarily the result of lower average realized prices partially offset by higher shipment volumes. Raw Materials: The favorable impact is primarily the result of lower costs for iron ore. Operating Costs: The favorable impact is primarily the result of lower spending and labor costs. Other: The unfavorable impact is primarily the result of the absence of an annual electricity compensation rebate received in fourth quarter 2022. $ Millions, Q1 2022 vs. Q1 2023 $ Millions, Q4 2022 vs. Q1 2023

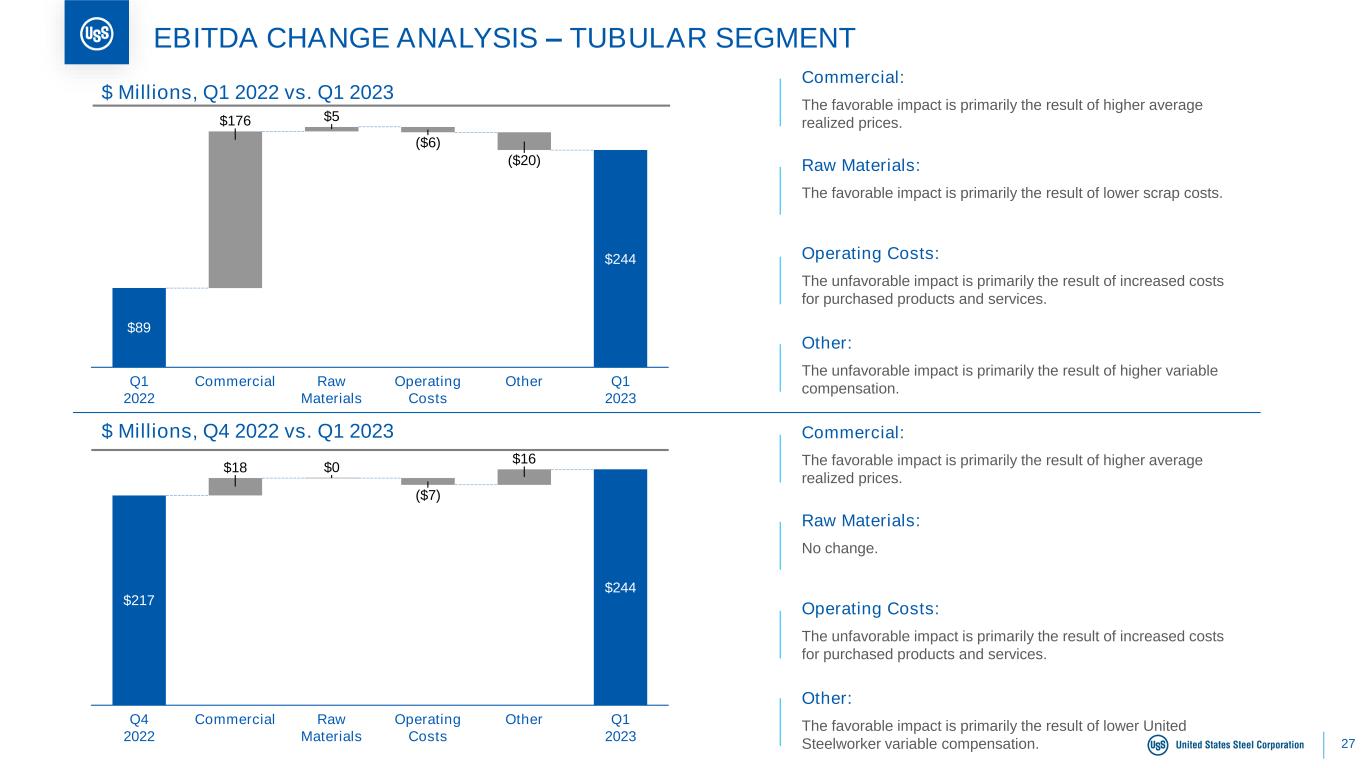

27 EBITDA CHANGE ANALYSIS – TUBULAR SEGMENT Commercial: The favorable impact is primarily the result of higher average realized prices. Raw Materials: The favorable impact is primarily the result of lower scrap costs. Operating Costs: The unfavorable impact is primarily the result of increased costs for purchased products and services. $89 $244 $176 $5 Q1 2022 Commercial Raw Materials ($6) Operating Costs ($20) Other Q1 2023 $217 $244 $18 $16 Q4 2022 ($7) OtherCommercial $0 Raw Materials Operating Costs Q1 2023 Other: The unfavorable impact is primarily the result of higher variable compensation. Commercial: The favorable impact is primarily the result of higher average realized prices. Raw Materials: No change. Operating Costs: The unfavorable impact is primarily the result of increased costs for purchased products and services. Other: The favorable impact is primarily the result of lower United Steelworker variable compensation. $ Millions, Q1 2022 vs. Q1 2023 $ Millions, Q4 2022 vs. Q1 2023

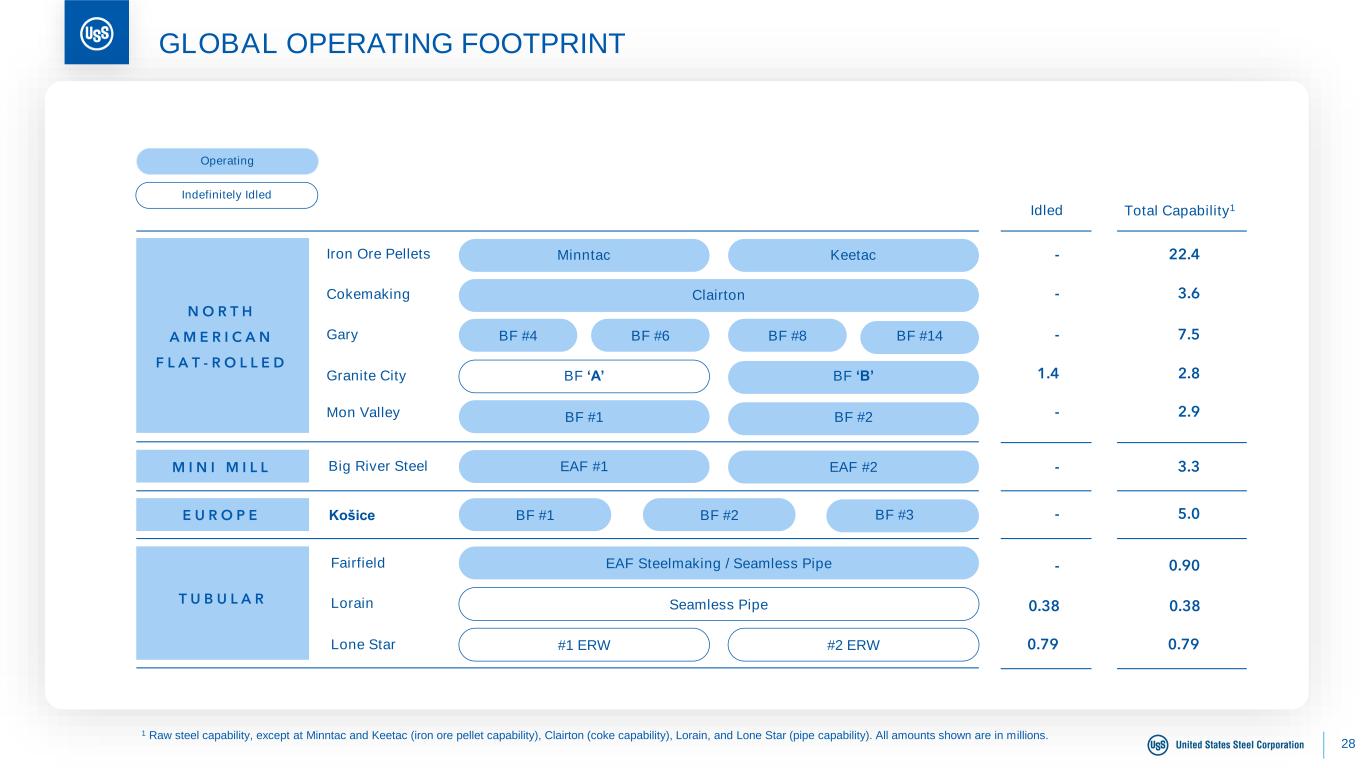

28 GLOBAL OPERATING FOOTPRINT Minntac M I N I M I L L T U B U L A R Clairton Keetac BF #4 BF #6 BF #8 BF #14 BF ‘A’ BF ‘B’ N O R T H A M E R I C A N F L A T - R O L L E D BF #1 BF #2 EAF #1 EAF #2 BF #1 BF #3BF #2 Seamless Pipe #1 ERW #2 ERW EAF Steelmaking / Seamless Pipe Indefinitely Idled Operating 1 Raw steel capability, except at Minntac and Keetac (iron ore pellet capability), Clairton (coke capability), Lorain, and Lone Star (pipe capability). All amounts shown are in millions. 22.4 3.6 7.5 2.8 2.9 - - - 1.4 - 0.90 0.38 0.79 - 0.38 0.79 5.0- 3.3- Iron Ore Pellets Cokemaking Gary Granite City Mon Valley Big River Steel Košice Lorain Lone Star Fairfield E U R O P E Idled Total Capability1

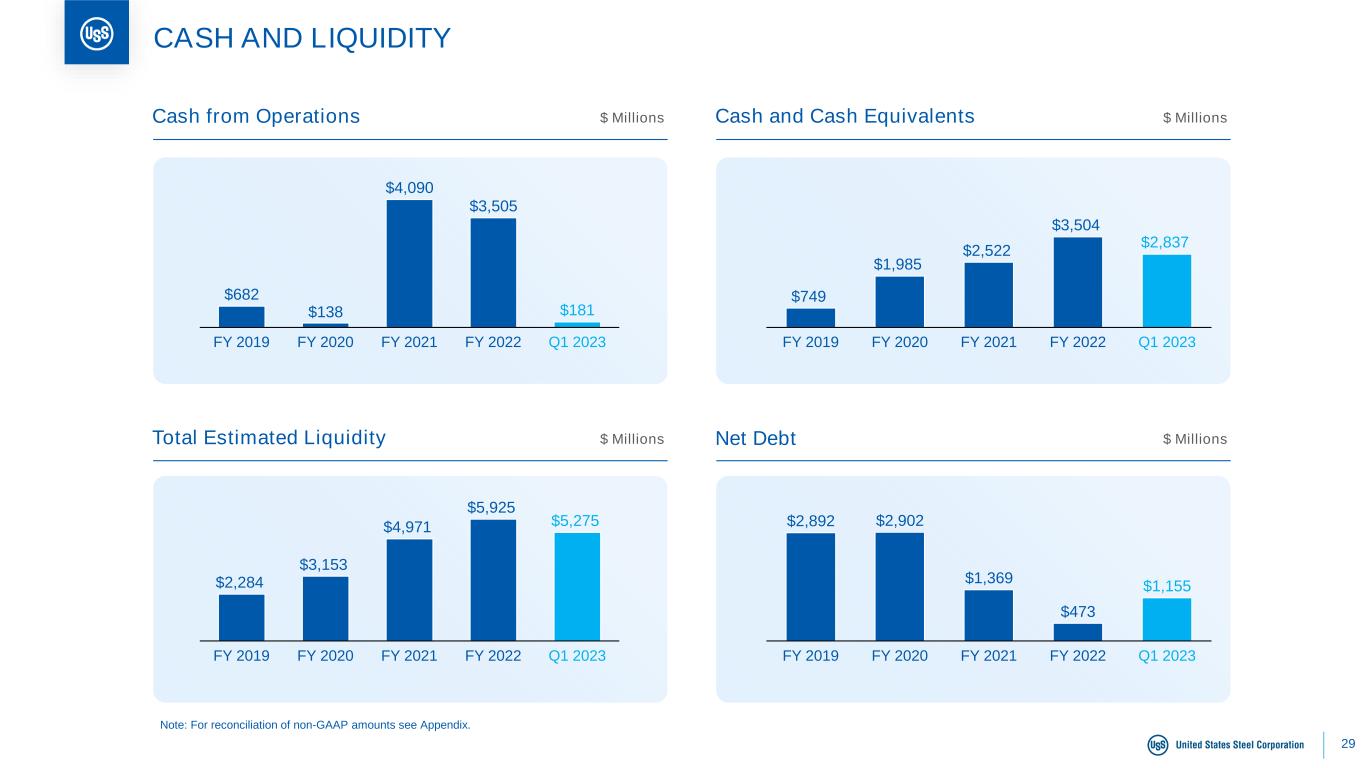

29 CASH AND LIQUIDITY Note: For reconciliation of non-GAAP amounts see Appendix. $682 $138 $4,090 $3,505 $181 FY 2021FY 2019 FY 2020 FY 2022 Q1 2023 $749 $1,985 $2,522 $3,504 $2,837 FY 2022FY 2021FY 2019 FY 2020 Q1 2023 $2,284 $3,153 $4,971 $5,925 $5,275 FY 2022FY 2019 FY 2020 Q1 2023FY 2021 $2,892 $2,902 $1,369 $473 $1,155 FY 2020FY 2019 FY 2021 FY 2022 Q1 2023 Cash from Operations Cash and Cash Equivalents$ Millions $ Millions Total Estimated Liquidity Net Debt$ Millions $ Millions

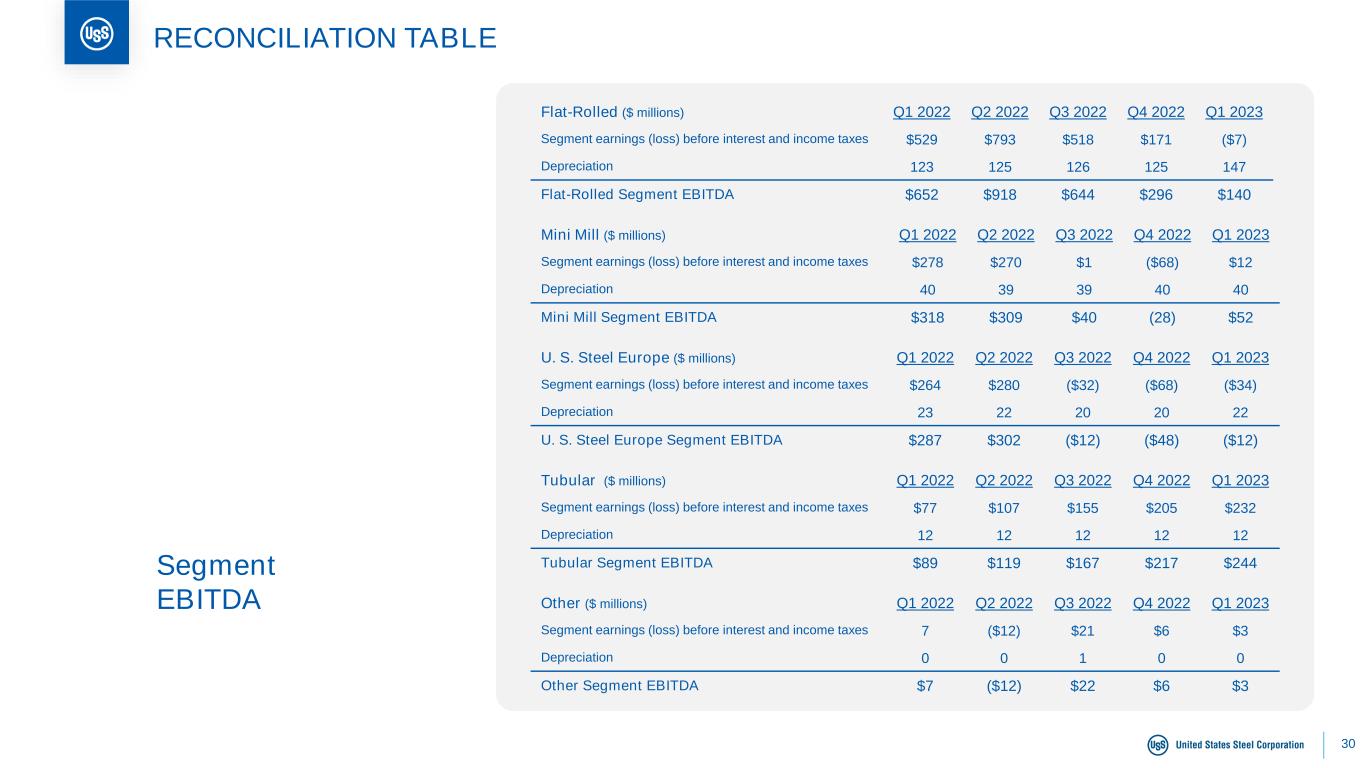

30 RECONCILIATION TABLE Flat-Rolled ($ millions) Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Segment earnings (loss) before interest and income taxes $529 $793 $518 $171 ($7) Depreciation 123 125 126 125 147 Flat-Rolled Segment EBITDA $652 $918 $644 $296 $140 Tubular ($ millions) Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Segment earnings (loss) before interest and income taxes $77 $107 $155 $205 $232 Depreciation 12 12 12 12 12 Tubular Segment EBITDA $89 $119 $167 $217 $244 Other ($ millions) Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Segment earnings (loss) before interest and income taxes 7 ($12) $21 $6 $3 Depreciation 0 0 1 0 0 Other Segment EBITDA $7 ($12) $22 $6 $3 Mini Mill ($ millions) Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Segment earnings (loss) before interest and income taxes $278 $270 $1 ($68) $12 Depreciation 40 39 39 40 40 Mini Mill Segment EBITDA $318 $309 $40 (28) $52 Segment EBITDA U. S. Steel Europe ($ millions) Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Segment earnings (loss) before interest and income taxes $264 $280 ($32) ($68) ($34) Depreciation 23 22 20 20 22 U. S. Steel Europe Segment EBITDA $287 $302 ($12) ($48) ($12)

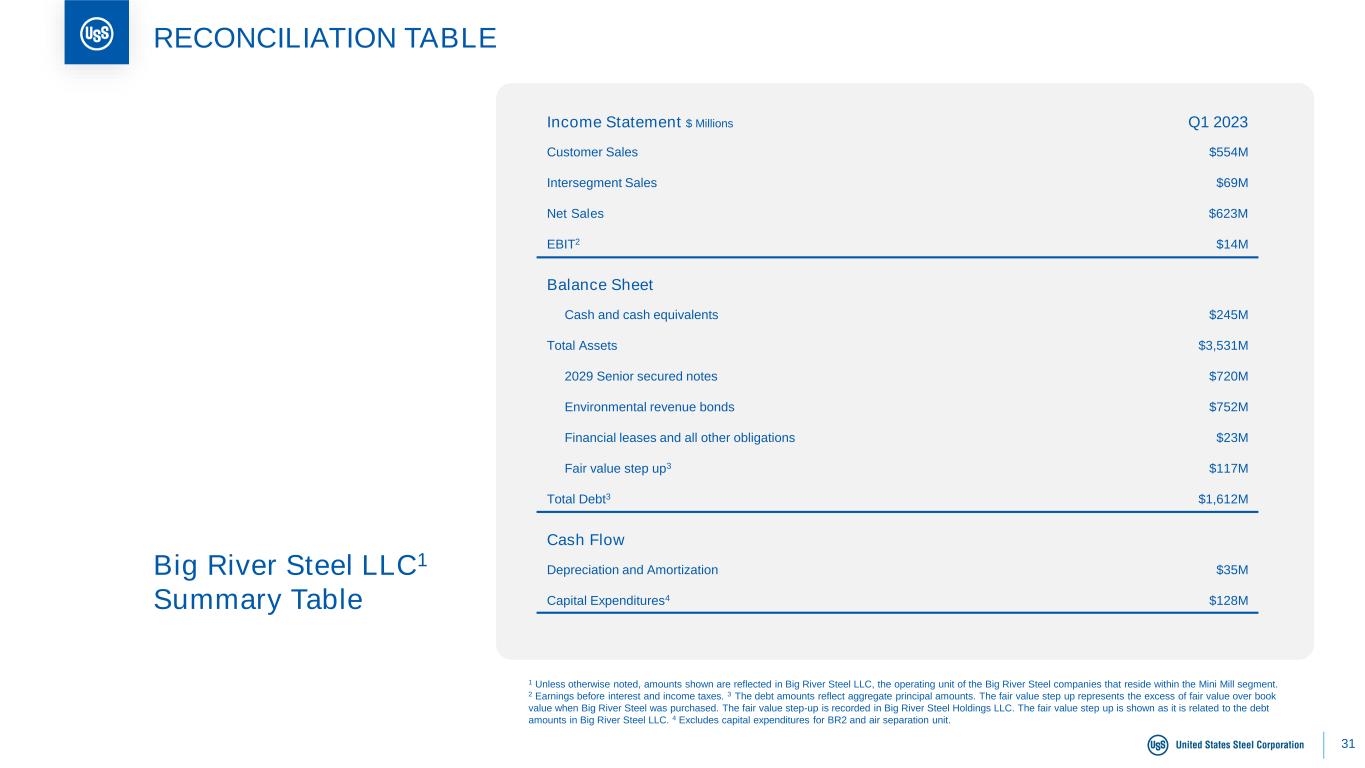

31 RECONCILIATION TABLE Big River Steel LLC1 Summary Table Customer Sales Intersegment Sales Net Sales EBIT2 $554M $69M $623M $14M Income Statement $ Millions Q1 2023 Cash and cash equivalents Total Assets 2029 Senior secured notes Environmental revenue bonds Financial leases and all other obligations Fair value step up3 Total Debt3 $245M $3,531M $720M $752M $23M $117M $1,612M Balance Sheet Depreciation and Amortization Capital Expenditures4 $35M $128M Cash Flow 1 Unless otherwise noted, amounts shown are reflected in Big River Steel LLC, the operating unit of the Big River Steel companies that reside within the Mini Mill segment. 2 Earnings before interest and income taxes. 3 The debt amounts reflect aggregate principal amounts. The fair value step up represents the excess of fair value over book value when Big River Steel was purchased. The fair value step-up is recorded in Big River Steel Holdings LLC. The fair value step up is shown as it is related to the debt amounts in Big River Steel LLC. 4 Excludes capital expenditures for BR2 and air separation unit.

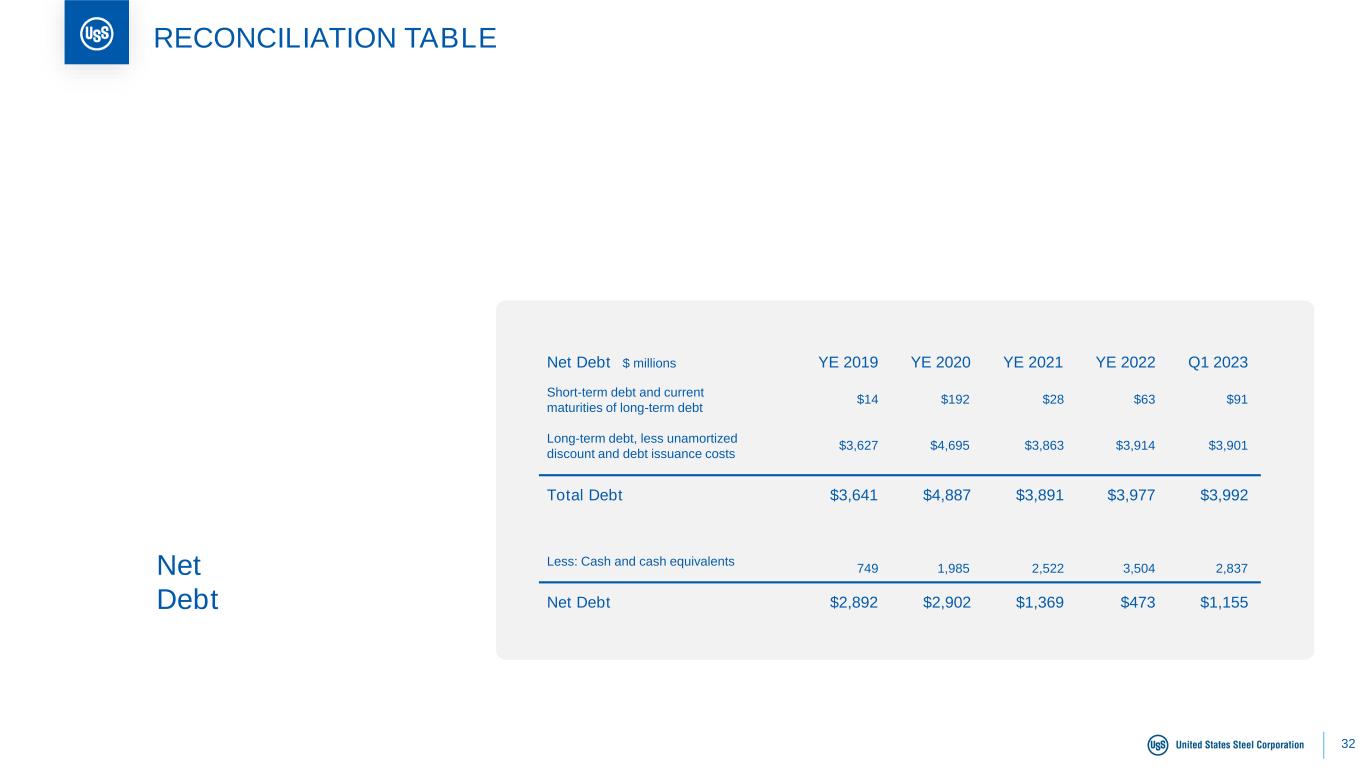

32 RECONCILIATION TABLE Short-term debt and current maturities of long-term debt Long-term debt, less unamortized discount and debt issuance costs Net Debt $ millions Q1 2023YE 2022YE 2021YE 2020 $14 $3,627 YE 2019 $192 $4,695 $28 $3,863 $63 $3,914 $91 $3,901 Total Debt $3,992$3,977$3,891$4,887$3,641 Less: Cash and cash equivalents 749 1,985 2,522 3,504 2,837 Net Debt $1,155$473$1,369$2,902$2,892 Net Debt

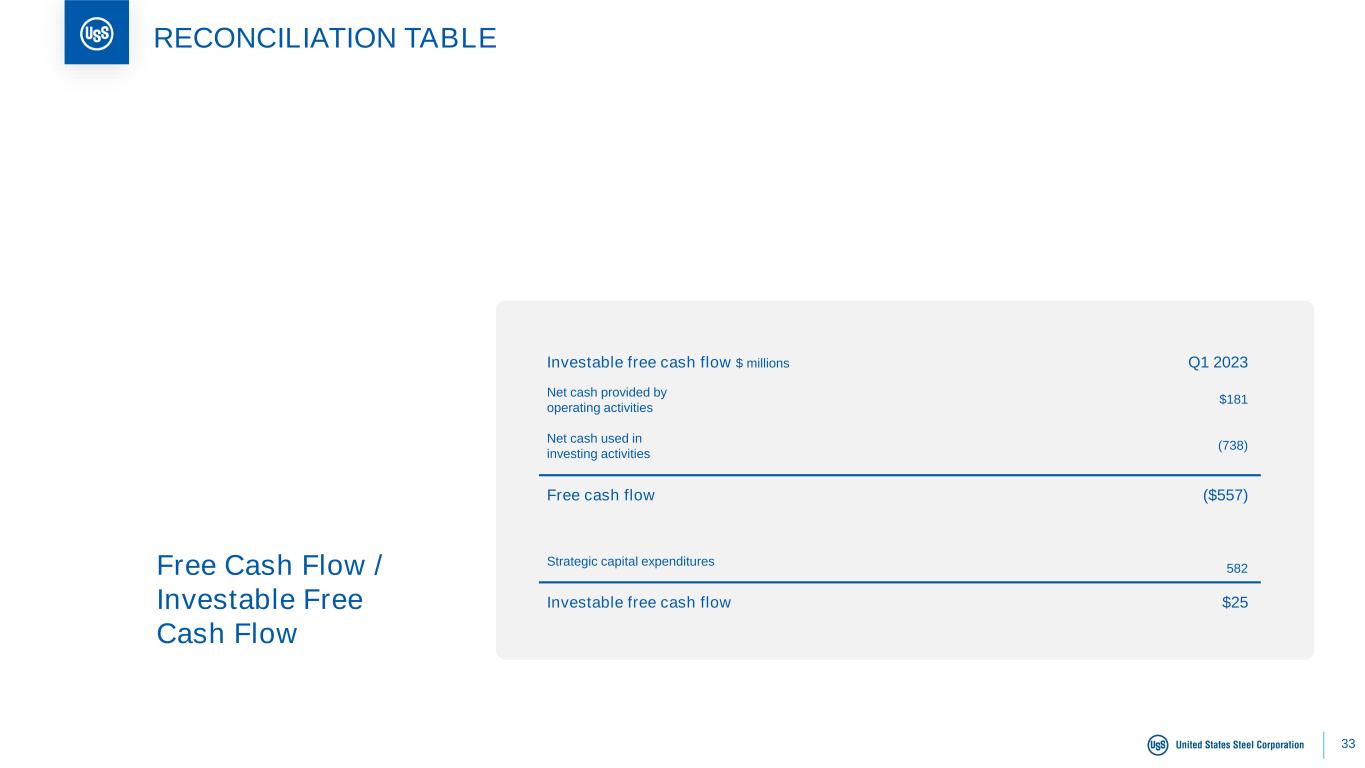

33 RECONCILIATION TABLE Net cash provided by operating activities Net cash used in investing activities Investable free cash flow $ millions Q1 2023 $181 (738) Free cash flow ($557) Strategic capital expenditures 582 Investable free cash flow $25 Free Cash Flow / Investable Free Cash Flow

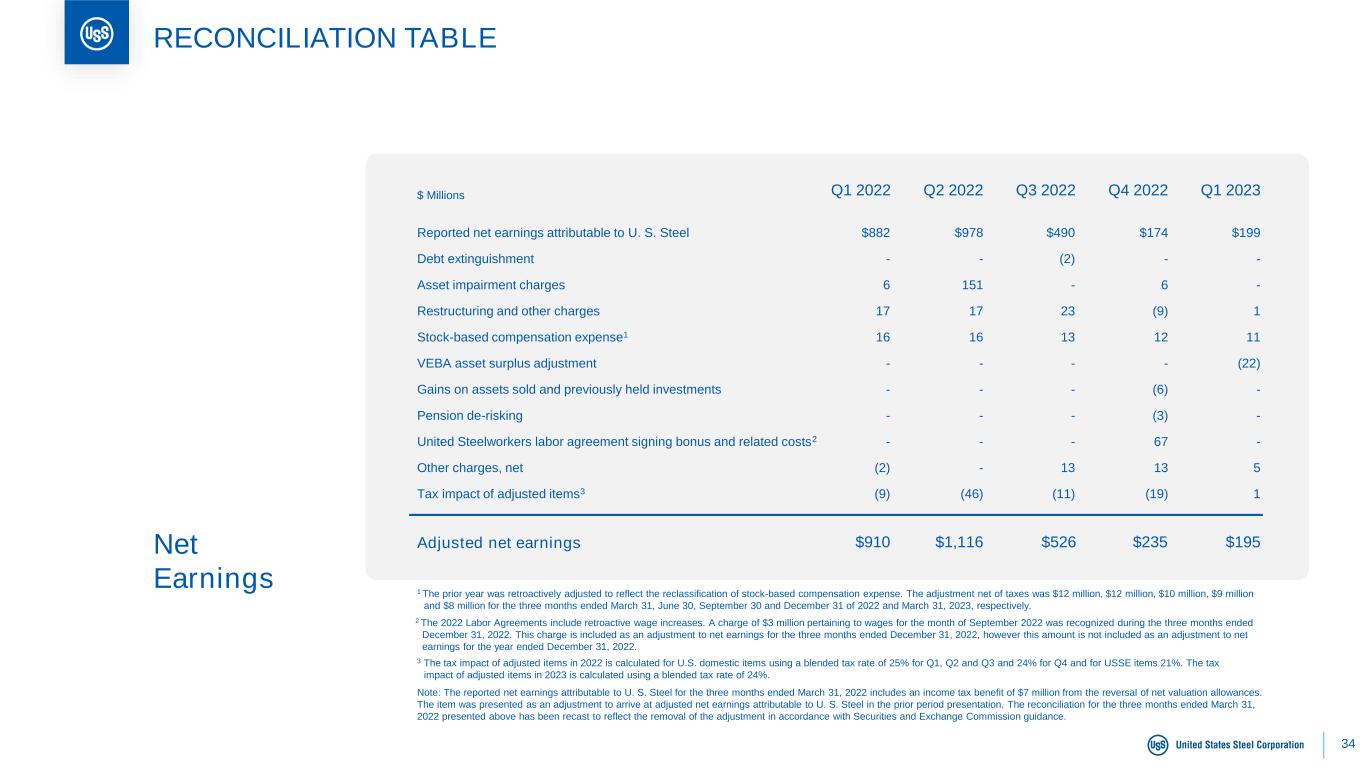

34 RECONCILIATION TABLE $ Millions Adjusted net earnings Note: The reported net earnings attributable to U. S. Steel for the three months ended March 31, 2022 includes an income tax benefit of $7 million from the reversal of net valuation allowances. The item was presented as an adjustment to arrive at adjusted net earnings attributable to U. S. Steel in the prior period presentation. The reconciliation for the three months ended March 31, 2022 presented above has been recast to reflect the removal of the adjustment in accordance with Securities and Exchange Commission guidance. 3 The tax impact of adjusted items in 2022 is calculated for U.S. domestic items using a blended tax rate of 25% for Q1, Q2 and Q3 and 24% for Q4 and for USSE items 21%. The tax impact of adjusted items in 2023 is calculated using a blended tax rate of 24%. 2 The 2022 Labor Agreements include retroactive wage increases. A charge of $3 million pertaining to wages for the month of September 2022 was recognized during the three months ended December 31, 2022. This charge is included as an adjustment to net earnings for the three months ended December 31, 2022, however this amount is not included as an adjustment to net earnings for the year ended December 31, 2022. Q1 2023Q4 2022Q3 2022Q2 2022Q1 2022 $195$235$526$1,116$910 $882 - 6 17 16 - - - - (2) (9) Reported net earnings attributable to U. S. Steel Debt extinguishment Asset impairment charges Restructuring and other charges Stock-based compensation expense1 VEBA asset surplus adjustment Gains on assets sold and previously held investments Pension de-risking United Steelworkers labor agreement signing bonus and related costs2 Other charges, net Tax impact of adjusted items3 $978 - 151 17 16 - - - - - (46) $490 (2) - 23 13 - - - - 13 (11) $174 - 6 (9) 12 - (6) (3) 67 13 (19) $199 - - 1 11 (22) - - - 5 1 Net Earnings 1 The prior year was retroactively adjusted to reflect the reclassification of stock-based compensation expense. The adjustment net of taxes was $12 million, $12 million, $10 million, $9 million and $8 million for the three months ended March 31, June 30, September 30 and December 31 of 2022 and March 31, 2023, respectively.

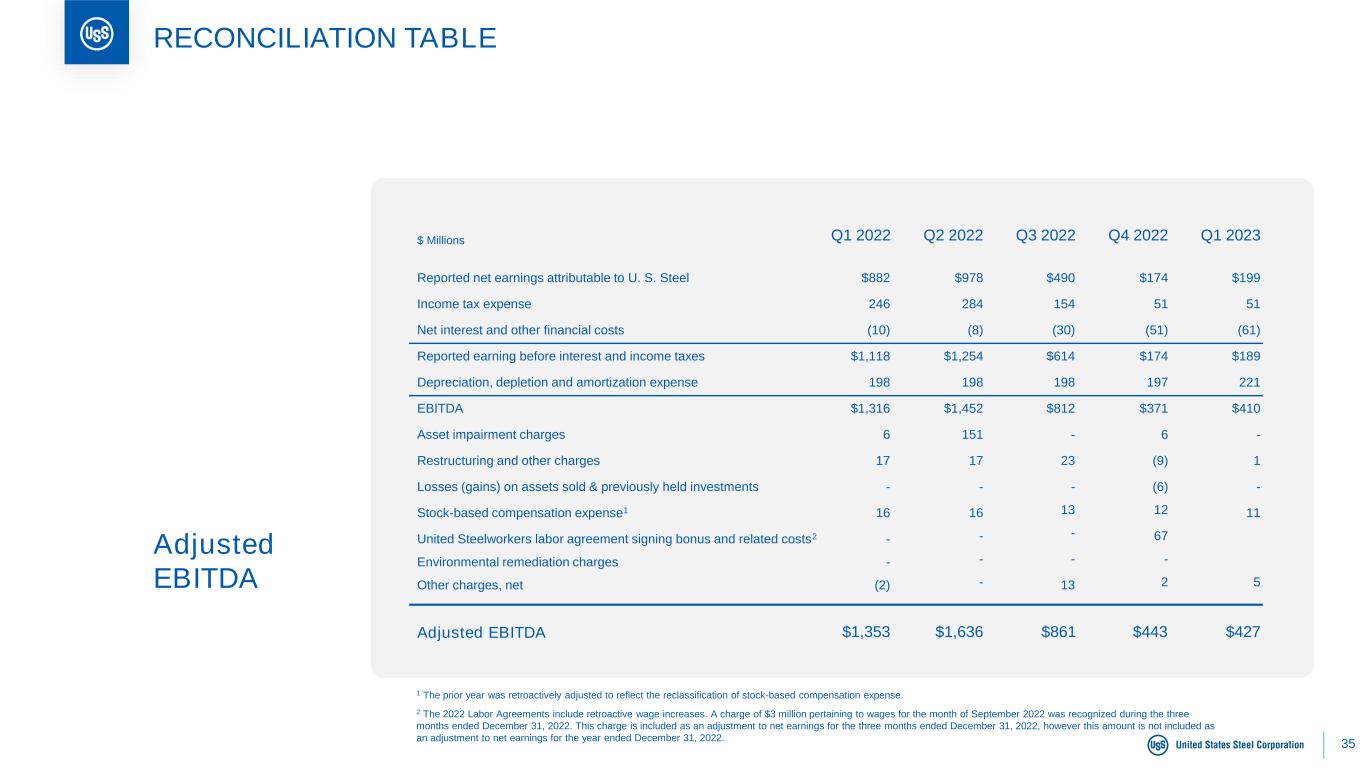

35 RECONCILIATION TABLE $ Millions Adjusted EBITDA Adjusted EBITDA Q1 2023Q4 2022Q3 2022Q2 2022Q1 2022 $427$443$861$1,636$1,353 $882 246 (10) $1,118 198 $1,316 6 17 - 16 - - (2) Reported net earnings attributable to U. S. Steel Income tax expense Net interest and other financial costs Reported earning before interest and income taxes Depreciation, depletion and amortization expense EBITDA Asset impairment charges Restructuring and other charges Losses (gains) on assets sold & previously held investments Stock-based compensation expense1 United Steelworkers labor agreement signing bonus and related costs2 Environmental remediation charges Other charges, net $978 284 (8) $1,254 198 $1,452 151 17 - 16 - - - $490 154 (30) $614 198 $812 - 23 - 13 - - 13 $174 51 (51) $174 197 $371 6 (9) (6) 12 67 - 2 $199 51 (61) $189 221 $410 - 1 - 11 5 2 The 2022 Labor Agreements include retroactive wage increases. A charge of $3 million pertaining to wages for the month of September 2022 was recognized during the three months ended December 31, 2022. This charge is included as an adjustment to net earnings for the three months ended December 31, 2022, however this amount is not included as an adjustment to net earnings for the year ended December 31, 2022. 1 The prior year was retroactively adjusted to reflect the reclassification of stock-based compensation expense.

36 Kevin Lewis VP – Finance klewis@uss.com 412-433-6935 Eric Linn Director – Investor Relations eplinn@uss.com 412-433-2385 INVESTOR RELATIONS

37