First Quarter 2018

Questions and Answers

April 26, 2018

Cautionary Note Regarding Forward-Looking Statements

This document contains information that may constitute “forward-looking statements” within the meaning of Section 27 of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. We intend the forward-looking statements to be covered by the safe harbor provisions for forward-looking statements in those sections. Generally, we have identified such forward-looking statements by using the words “believe,” “expect,” “intend,” “estimate,” “anticipate,” “project,” “target,” “forecast,” “aim,” “should,” “will” and similar expressions or by using future dates in connection with any discussion of, among other things, operating performance, trends, events or developments that we expect or anticipate will occur in the future, statements relating to volume

growth, share of sales and earnings per share growth, and statements expressing general views about future operating results. However, the absence of these words or similar expressions does not mean that a statement is not forward-looking. Forward-looking statements are not historical facts, but instead represent only the Company’s beliefs regarding future events, many of which, by their nature, are inherently uncertain and outside of the Company’s control. It is possible that the Company’s actual results and financial condition may differ, possibly materially, from the anticipated results and financial condition indicated in these forward-looking statements. Management believes that these forward-looking statements are reasonable as of the time made. However, caution should be taken not to place

undue reliance on any such forward-looking statements because such statements speak only as of the date when made. Our Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. In addition, forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from our Company's historical experience and our present expectations or projections. These risks and uncertainties include, but are not limited to the risks and uncertainties described in “Item 1A. Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2017, and those described from time to time in our future reports filed with the Securities and Exchange Commission. References to "we," "us," "our," the "Company," and "U. S. Steel," refer to United States Steel Corporation and its consolidated subsidiaries.

| |

1. | What is the status of the Section 232 investigation on steel imports? |

On March 8, 2018, the President issued a proclamation implementing a 25% global tariff on all steel imports from all countries, except Canada and Mexico, effective March 23, 2018. On March 22, 2018, the President issued a second proclamation that exempted Argentina, Australia, Brazil, Canada, the European Union, Korea and Mexico from the 25% global tariff until May 1, 2018 to allow for negotiation of potential alternative arrangements (quotas). The U.S. Trade Representative (USTR) has responsibility for negotiating quotas with countries.

The U.S. Department of Commerce (DOC) is responsible for managing a process in which U.S. companies may request, and oppose, temporary product exclusions from the 25% tariff.

We continue to advocate for strong action against imports that undermine America’s capacity to produce the steel necessary for our country’s national and economic security.

| |

2. | What is the status of the recently announced restart of one blast furnace and the steelmaking facilities at Granite City Works? |

On March 7, 2018, we announced the restart of one of the two blast furnaces (“B” blast furnace) and the steelmaking facilities at Granite City Works in Granite City, Illinois. Market conditions continue to be supportive of the restart. The production from Granite City Works will improve our ability to serve our customers as we continue with our asset revitalization efforts.

The Granite City Works restart is dependent on three key variables.

| |

1. | People – The return to work process is progressing in line with expectations. We are working with all stakeholders, including the United Steelworkers (USW), to safely, rapidly and efficiently staff and restart the “B” blast furnace and steelmaking facilities. We have received an excellent response from our employees and are glad to see them returning to work after more than two years. |

| |

2. | Assets – Our inspections of critical assets have not revealed any unexpected challenges. |

| |

3. | Raw Materials – Raw materials staging from our iron ore mines and coke making operation is progressing as expected. |

We anticipate incremental shipments of approximately 100,000 per month from Granite City Works once the restart process is completed, and expect the benefits from these actions will be primarily reflected in our results in the second half of the year.

| |

3. | What is the status of legal proceedings from the Midwest Plant chromium releases that occurred last year? |

Immediately following the April 2017 discharge, we began to repair and replace components of the chrome wastewater treatment piping and trench systems at Midwest in order to prevent future incidents. On April 2, 2018, a Consent Decree was filed which contained the agreement between the Company, U. S. EPA and I.D.E.M. (Indiana Department of Environmental Management). In the Consent Decree, the Company agreed to a series of operational and process improvements to prevent future wastewater incidents at Midwest. We also agreed to reimburse several governmental entities for response costs, loss of use costs and to pay a civil penalty in the total approximate amount of $1.25M. A public comment period of sixty days is currently underway, and we expect to finalize the Consent Decree sometime in the third quarter of this year. While the Consent Decree is being litigated, the City of Chicago and Surfriders citizens lawsuits have been stayed.

| |

4. | Why is your reporting of postretirement benefit (expense) income changing in 2018, and how will the change impact your financial results? |

Effective January 1, 2018, U.S. Generally Accepted Accounting Principles (U.S. GAAP) has changed how an employer who offers defined benefit and postretirement benefit plans reports the service cost component of the net periodic benefit cost and the other components of net periodic benefit cost (ASU 2017-07). Service cost will be reported in the same line item or items as other compensation cost arising from services rendered by employees during the period, primarily cost of sales. The other components of net periodic benefit costs will be presented on a retrospective basis in the income statement separately from the service cost component and will be reported in net interest and other financial costs.

The adoption of this new accounting standard will not have an impact on our net earnings (loss), but it will result in a reclassification from a line on the income statement within earnings (loss) before interest and income taxes to a line on the income statement below earnings (loss) before interest and income taxes.

The table on the next page shows the pro-forma impact of reporting under ASU 2017-07 on our 2016 and 2017 results.

| |

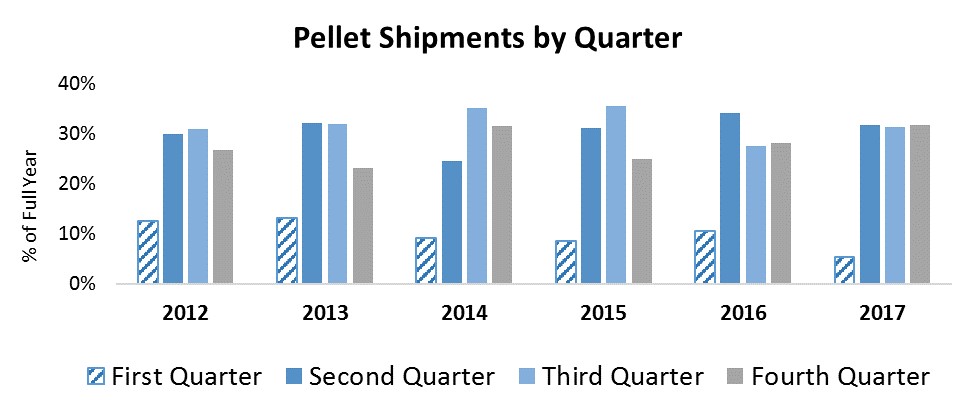

5. | How does the seasonality of iron ore shipments impact your financial results? |

Our mining operations are unable to ship pellets to our blast furnaces in the U.S. and to our third-party customers for much of 1Q because the Soo Locks, which connect Lake Superior with the lower Great Lakes, are typically closed from mid-January to late March. Our mining operations still produce pellets in those months, but at a lower volume. This scenario negatively impacts our financial results due to the operating inefficiencies that result from running at lower production volumes with increased spending due to planned maintenance resulting in a higher cost per ton.

The graphic below illustrates the seasonality of pellet shipments.