Second Quarter 2017

Questions and Answers

July 25, 2017

Cautionary Note Regarding Forward-Looking Statements

This document contains information that may constitute “forward-looking statements” within the meaning of Section 27 of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. We intend the forward-looking statements to be covered by the safe harbor provisions for forward-looking statements in those sections. Generally, we have identified such forward-looking statements by using the words “believe,” “expect,” “intend,” “estimate,” “anticipate,” “project,” “target,” “forecast,” “aim,” “should,” “will” and similar expressions or by using future dates in connection with any discussion of, among other things, operating performance, trends, events or developments that we expect or anticipate will occur in the future, statements relating to volume growth, share of sales and earnings per share growth, and statements expressing general views about future operating results. However, the absence of these words or similar expressions does not mean that a statement is not forward-looking. Forward-looking statements are not historical facts, but instead represent only the Company’s beliefs regarding future events, many of which, by their nature, are inherently uncertain and outside of the Company’s control. It is possible that the Company’s actual results and financial condition may differ, possibly materially, from the anticipated results and financial condition indicated in these forward-looking statements. Management believes that these forward-looking statements are reasonable as of the time made. However, caution should be taken not to place undue reliance on any such forward-looking statements because such statements speak only as of the date when made. Our Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. In addition, forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from our Company's historical experience and our present expectations or projections. These risks and uncertainties include, but are not limited to the risks and uncertainties described in “Item 1A. Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2016, and those described from time to time in our future reports filed with the Securities and Exchange Commission.

References to "we," "us," "our," the "Company," and "U. S. Steel," refer to United States Steel Corporation and its consolidated subsidiaries.

Topical

| |

1. | Where do lead times currently stand? |

Lead times for hot-rolled coil products are currently approximately four and a half weeks. Cold-rolled coil products are approximately eight weeks and coated products are approximately seven and a half weeks.

| |

2. | What was your utilization rate in 2Q 2017, excluding the temporarily idled Granite City Works? |

Our reported Flat-Rolled raw steel capability utilization rate in 2Q 2017 was 64% based on 17 million net tons of annual capability. The Flat-Rolled raw steel capability utilization, excluding the 2.8 million net tons of raw steel capability of Granite City Works that is currently idled, was 77%.

| |

3. | How does the seasonality of iron ore shipments impact your financial results? |

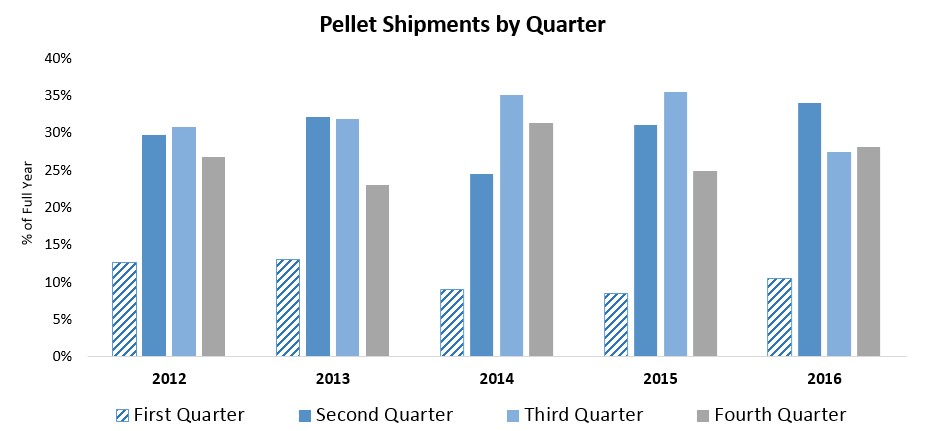

Our mining operations are unable to ship pellets to our blast furnaces in the U.S. and to our third party customers for much of 1Q because the Soo Locks, which connect Lake Superior with the lower Great Lakes, are typically closed from mid-January to late March. Our mining operations still produce pellets in those months, but at a lower volume. This scenario negatively impacts our financial results due to the operating inefficiencies that result from running at lower production volumes with increased spending due to planned maintenance resulting in a higher cost per ton.

The table below illustrates the seasonality of pellet shipments.

| |

4. | What is your current Tubular operating configuration? |

We mitigated losses from the energy sector downturn in our Tubular segment by idling certain facilities within the segment while permanently shutting down other facilities. We permanently shut down the Lorain Tubular #4 mill, Lone Star #1 mill, and Bellville Tubular Operations. The assets at our McKeesport Operations have been sold. We also permanently shut down the Lorain #6 Quench and Temper mill. However, we have decided to relocate the Lorain #6 Quench and Temper equipment to one of several other sites under consideration to optimize our operations.

We are currently operating our seamless mills in Fairfield, AL and Lorain, OH. Our seamless mill in Fairfield produces mid-range diameter pipe, while our Lorain #3 mill produces large diameter pipe that has historically been used for off-shore drilling. We are currently purchasing rounds from third parties to feed our seamless mills. We restarted our Lone Star #2 welded mill in late April.

The construction of the EAF at Fairfield Works, which began in 2Q 2015, was suspended in December 2015 until market conditions in both the oil and gas and steel industries improve. A decision to resume the EAF project would require a sustained improvement in conditions in the oil and gas market, most likely driven by less volatile oil prices that would keep rig counts at consistently high levels.

Should the EAF be completed, it will be part of the Tubular segment operationally and supply rounds to our Fairfield and Lorain seamless mills. The Tubular segment would become self-sufficient for its rounds needs. Given the permanent shut down of over half of our welded capacity, future substrate requirements from the Flat-Rolled segment will be significantly lower than in the past.

We are also evaluating if producing slabs using the EAF could provide more flexibility to meet our Flat-Rolled customers’ needs. In such a scenario, the Tubular segment would be selling slabs to the Flat-Rolled segment at market prices.

Strategic

| |

5. | Can you tell us more about your asset revitalization plan? |

What is it?

Our Flat-Rolled segment asset revitalization program is a comprehensive investment plan with a continuous focus on improving safety, quality, delivery and costs. As we revitalize our assets, we expect to increase profitability, productivity, operational consistency, and reduce volatility.

Why are you doing it?

The performance expectations of our customers are constantly increasing, and we need to be investing in our assets at a pace that will allow us to keep up with these increasing standards. On the quality side, we need to reduce our existing claim rates, and on the delivery side, consistency is the key. We will increase our spending on critical infrastructure in order to reduce major events that disrupt our entire supply chain, and to reduce our unplanned downtime and improve our reliability centered maintenance capabilities.

How are you doing it?

This program is designed to prioritize investment in the areas with the highest returns. Importantly, while this is a large program, the majority of projects are not large, complex projects. This means that projects are easier to execute. Due to the smaller nature of many of the projects, we do not have to complete the entire program in order to start seeing benefits. Also, by breaking the program down into a series of smaller projects, we have greater flexibility to adjust the scope and pace of project implementation based on changes in business conditions.

How long will it take?

In order to ensure that we obtain the desired results from our asset revitalization efforts, it was necessary to properly plan and schedule a large number of projects. The development and scheduling of these projects required the input and coordinated efforts of hundreds of people from across the Flat-Rolled segment footprint. Once the project portfolio was prepared and optimized, actual implementation efforts needed to be coordinated with production and maintenance schedules to minimize the disruption to production operations. The work requires outages on many facilities and we are making sure we can support our customers at the same time as we revitalize our assets. As a result, we expect the implementation schedule will stretch over a period of three to four years.

How much will it cost?

We currently expect capital spending for our asset revitalization program to be approximately $1.2 billion from 2017 through 2020. We are investing in our assets throughout the entire production process, with targeted improvements in operating efficiency, unplanned downtime, reliability, quality and costs. While this program covers a wide range of assets in our Flat-Rolled segment, we are placing a strong emphasis on thirteen of our most critical assets. In iron making, these critical assets are the blast furnaces at Gary Works and Great Lakes Works. In steel making, they are the steel shop and caster at Gary Works and the steel shop at Mon Valley Works. In hot rolling, they are the hot strip mills at Gary Works, Great Lakes Works and Mon Valley Works. In finishing, it is the cold mill at Mon Valley Works.

We currently expect the timing of the capital spending for our asset revitalization program to be as follows:

| |

• | Approximately $200 - $250 million in 2017 |

| |

• | Approximately $450 - $500 million in 2018 |

| |

• | Balance to be spent in 2019 and 2020 |

How does it create value?

Our asset revitalization program covers investments in our existing assets, but is not just sustaining capital and maintenance spending; these projects will deliver both operational and commercial benefits, with most of the benefits coming from operational improvements. The commercial benefits we expect to realize will be driven primarily by things we can control, such as better product quality, improved delivery performance, and increased throughput on constrained assets. Being regarded as a top quartile performer in the eyes of our customers will support sustainable commercial benefits from these investments. After we complete our full asset revitalization program, we will have well maintained facilities with a strong core infrastructure, and strong reliability centered maintenance organizations. We will deliver products to our customers with improved reliability and quality.

While this program only covers our existing assets, it will create a stable foundation for our future as we continue to evaluate strategic growth projects to strengthen our position as the markets we serve continue to grow and evolve.

| |

6. | What is the status of the U. S. Steel Canada (USSC) Companies’ Creditors Arrangement Act (CCAA) process? |

On June 30, 2017, we announced that we had finalized an agreement with Bedrock Industries Group LLC (Bedrock) for the sale and transition of ownership of U. S. Steel Canada Inc. (USSC) (now known as Stelco Inc.) to Bedrock. The transaction was finalized following requisite court and other approvals.

On Sept. 16, 2014, USSC applied for relief from its creditors pursuant to Canada's Companies' Creditors Arrangement Act (CCAA). On June 9, 2017, the Ontario Superior Court of Justice sanctioned a second amended and restated plan of compromise, arrangement and reorganization pursuant to the CCAA (the Plan). In connection with the closing, we received approximately $127 million in satisfaction of our secured claims, including interest, and release of our unsecured claims. The terms of the Plan and closing also included an agreement to provide mutual releases among key stakeholders, as well as a release of all claims against us regarding environmental, pension and other liabilities.

As part of the transition in ownership, we will continue to provide certain transition services to USSC and we have entered into an agreement to supply USSC with all of its requirements for iron ore pellets through January 31, 2022.

| |

7. | How are you responding to the threat from alternate materials and solutions in the auto industry? |

We expect that advanced high strength steel (AHSS) demand in the automotive industry will continue to grow. We believe AHSS provides a strong and viable solution for our customers and we are leading the development and commercialization of AHSS in North America.

Since the creation of our Automotive Commercial Entity in November 2014, we have assembled a strong and experienced technical team that has been working with Original Equipment Manufacturers (OEMs) and tier suppliers on tooling design and requirements. We have made progress developing AHSS for automotive applications up to and including Generation 3 steels that possess unique properties in terms of strength, formability and toughness for light weighting and crash worthiness. We continue to work closely with OEMs, tier suppliers, and prototype shops on specific applications for their use incorporating advanced analytic techniques for geometry, grade and gauge redesign.

The continued development of AHSS, particularly Generation 1+ and Generation 3 AHSS, enables us to provide our automotive customers with a steel intensive total vehicle solution. These solutions will help our customers meet the CAFE and safety standards of future vehicles at a very attractive and competitive value proposition compared with potential alternative materials.

Modeling

| |

8. | Why was there a $16 million tax benefit in the second quarter when you had pretax earnings of $245 million? |

The 2Q 2017 tax benefit of $16 million includes a benefit of $13 million related to the carryback of specified liability losses to prior years.

| |

9. | Can you provide more detail regarding the first-in-first-out (FIFO) inventory impact on second quarter U. S. Steel Europe results? |

The unfavorable impact in 2Q is primarily the result of first-in-first-out (FIFO) inventory adjustments resulting from the volatility of raw materials prices. We had a favorable adjustment in the first quarter and an unfavorable adjustment in the second quarter, resulting in the large quarter-to-quarter variance. Although there was a large quarter-to-quarter variance, the year-to-date net FIFO inventory adjustment is approximately $16 million favorable.

| |

10. | Why did depreciation, depletion, and amortization in second quarter 2017 decline by $16 million compared to first quarter 2017? |

The decline in 2Q 2017 depreciation, depletion, and amortization (DD&A) expense compared to 1Q 2017 was primarily a result of lower DD&A in our Flat-Rolled segment. This was a result of certain assets reaching their full depreciated lives under the unitary method of depreciation as a result of our change in capitalization and depreciation method.

| |

11. | Can you provide more details on your agreements to sell iron ore pellets to third party customers, and how you will be reporting earnings for these sales? |

We have entered into iron ore pellet supply agreements with both domestic and international customers, under various terms and conditions. There are both short-term and multi-year agreements. Pricing terms include both fixed and adjustable arrangements. There also are both fixed and requirements based volume arrangements. Our iron ore mining operations are part of our Flat-Rolled segment. Results from iron ore pellet sales to third party customers are reported in our Flat-Rolled segment results and are not reported separately.

| |

12. | What is your exposure to changes in global metallurgical coal costs? |

Our delivered coal cost for our U.S. operations is expected to increase by $19/ton in 2017 compared to 2016 coal costs.

Our annual coal requirements have decreased as we permanently shut down cokemaking capacity concurrent with the permanent shutdown of steelmaking capacity in 2014. Our current domestic cokemaking operations, plus the Suncoke Gateway operations, running at full capacity would consume approximately 6.5 to 7.0 million tons of coal annually, which would support approximately 16 million tons of raw steelmaking capacity.

We purchase coal for our European operations under arrangements that typically have quarterly pricing resets. Our European cokemaking operations running at full capacity would consume approximately 2 million tons of coal annually, which would support approximately 4.5 million tons of raw steelmaking capacity.

Trade

| |

13. | What is Section 232 and what is the current expectation for action? |

On April 19, 2017, the Secretary of Commerce initiated an investigation under Section 232 of the Trade Expansion Act of 1962 to determine the effects of steel imports on U.S. national security. On May 24, 2017, we testified at the U.S. Department of Commerce (DOC) public hearing and remain active in the investigation. On the basis of a report by the Secretary that imports are harming national security, the President has the authority to act broadly to adjust imports.

We are optimistic that strong action under Section 232 will meaningfully impact the continued unfair trade practices harming domestic steel makers and threatening America’s security. American-made steel provides a foundation of strength for our country. From protecting our military to building critical infrastructure to achieving energy independence, the ability to melt and pour steel domestically is fundamental to ensuring our national and economic security. We cannot afford for our ability to produce steel here in the United States to be undermined by the hostile trade actions of foreign producers and governments. For too long, China and other nations have undercut the American steel industry by subsidizing their steel industries, distorting global markets, and dumping excess steel into the United States. This threat to our national security and economy must be addressed. A comprehensive, broad-based Section 232 remedy is warranted. For example, we believe tubular products such as OCTG merit inclusion as America cannot truly achieve energy independence and security if we become reliant on overseas pipe producers.

We appreciate that DOC officials have stated the Section 232 report will be completed much sooner than the 270 days allowed under the law, yet we also appreciate that the Department must take the time necessary to responsibly conduct its investigation in a thorough manner consistent with the requirements of the law. We look forward to the completed report being sent to the President in the near future.

Upon the announcement of Presidential action under Section 232, we are prepared to respond quickly. Internally, we have completed detailed analyses covering a wide spectrum of outcomes. We will make our assessment of the potential impact of the Section 232 actions taken, and then make the adjustments to our operations necessary to continue to support our customers and responsibly respond to new opportunities.

| |

14. | What is the current status of your Section 337 filing? |

In April 2016, we launched a case under Section 337 of the Tariff Act of 1930 against Chinese steel producers and their distributors. The complaint alleged three causes of action: 1) illegal conspiracy to fix prices and control output and export volumes; 2) the theft of trade secrets through industrial espionage; 3) circumvention of duties by false designation of origin. In February 2017, we voluntarily withdrew our trade secret claim, but preserved the right to refile at a later date.

On November 25, 2016, the Administrative Law Judge (ALJ) issued an order dismissing the antitrust claims. However, the U.S. International Trade Commission (USITC) granted our petition to review the ALJ's initial determination to terminate the antitrust portion of the litigation. All parties submitted their briefs on the antitrust review and oral arguments were held on April 20, 2017. We are awaiting the USITC’s decision.

On January 11, 2017, the ALJ issued an order dismissing the false designation of origin claims. We filed a petition to review the ALJ’s order with the USITC commissioners, and the USITC reinstated the false designation of origin (FDO) claim on February 27, 2017. The current scheduling order sets the hearing (trial) on the FDO claim for October 2017 and a target date to conclude the investigation for May 2018. We have filed a number of motions to compel and motions for sanctions against the Chinese respondents. On July 18, 2017 and July 20, 2017 respectively, two of the respondents filed Motions for Summary Determination. We will be aggressively opposing these motions. Refer to Item 2 "International Trade" in our quarterly report on Form 10-Q for further information.

| |

15. | What are the latest developments regarding the Vietnam circumvention trade case? |

In September 2016, we, along with other steel producers, filed requests with the DOC to investigate whether imports of cold-rolled steel and corrosion resistant steel from Vietnam are circumventing existing antidumping / countervailing duty orders on these products from China. These cases were brought to address concerns that Chinese producers have been diverting merchandise to Vietnam to undergo minor processing, before exporting these products to the United States. The DOC initiated the investigation in November 2016. The DOC has identified and sent questionnaires to Vietnamese producers, requesting confidential quantity and value information. The entire proceeding should be completed within 300 days of the date of publication of its initiation determination, unless the deadline is extended by the DOC. A link to the filing is available on the DOC’s electronic filing site (https://access.trade.gov/). Applicable case numbers include: A-570-026, C-570-027, A-570-029, and C-570-030.

| |

16. | What is the current status of the flat-rolled trade cases? |

We, along with other steel producers, continue to defend the orders imposed in the flat-rolled cases at the Court of International Trade and at the DOC. The affirmative decisions reached in 2016 will directly benefit us by curtailing unfairly traded imports and helping to provide a more level playing field.

Please refer to our Form 10-Q, to be filed with the Securities and Exchange Commission on July 26, 2017, for a detailed discussion of International Trade matters.

Corrosion-Resistant

|

| | | | |

| | Countervailing Duties | | Antidumping Duties |

Country | | Final | | Final |

| July 25, 2016 | | July 25, 2016 |

China | | 39.05 - 241.07% | | 209.97% |

India | | 8.00 - 29.46% | | 3.05 - 4.43% |

Italy | | 0.07 - 38.51% | | 12.63 - 92.12% |

Korea | | 0.72 (de minimis) - 1.19% | | 8.75 - 47.80% |

Taiwan | | 0.00% | | 10.34% |

Source: U.S. Department of Commerce

Cold-Rolled

|

| | | | |

| | Countervailing Duties | | Antidumping Duties |

Country | | Final | | Final |

| July 14/Sept. 20, 2016 | | July 17/Sept. 20, 2016 |

Brazil | | 11.09 - 11.31% | | 19.58 - 35.43% |

China | | 256.44% | | 265.79% |

India | | 10.00% | | 7.60% |

Japan | | --- | | 71.35% |

Korea | | 3.91 - 59.72% | | 6.32 - 34.33% |

Russia1 | | --- | | --- |

United Kingdom | | --- | | 5.40 - 25.56% |

Source: U.S. Department of Commerce

Hot-Rolled

|

| | | | |

| | Countervailing Duties | | Antidumping Duties |

Country | | Final | | Final |

| October 3, 2016 | | October 3, 2016 |

Australia | | --- | | 29.58% |

Brazil | | 11.09 - 11.30% | | 33.14 - 34.28% |

Japan | | --- | | 4.99 - 7.51% |

Korea | | 3.89 - 58.68% | | 3.89 - 9.49% |

Netherlands | | --- | | 3.73% |

Turkey | | ---2 | | 3.66 – 7.15% |

United Kingdom | | --- | | 33.06% |

Source: U.S. Department of Commerce

1 In its final phase investigation, the ITC issued a negative injury determination against Russia. Thus, no AD or CVD Orders were issued against Russia. The DOC’s final countervailing duty rates for Russia were between 0.62 (de minimis) - 6.95% and the final antidumping duty rates for Russia were between 1.04 (de minimis) - 13.36%.

2 In its final phase investigation, the ITC found that imports of hot-rolled steel that were found to be subsidized by the government of Turkey were negligible. Therefore, no CVD order was issued against Turkey.

General

| |

17. | Your stock price has been very volatile. Why is this so and what are you doing to reduce the impact of cyclicality on your results? |

The global steel industry is a cyclical industry and steel selling prices can change fairly quickly. Our operating configuration has significant leverage to steel selling price and volume changes to both the upside and the downside, resulting in significant earnings volatility on a quarter-to-quarter basis. The volatility of our earnings is also affected by the consistency and reliability of our operations. One objective of our Carnegie Way transformation is to create a lower and more flexible cost structure, as well as more flexible and reliable operations in order to mitigate the financial impact of this volatility.

Our asset revitalization program is a comprehensive investment plan with a continuous focus on improving safety, quality, delivery and costs. As we revitalize our assets, we expect to increase profitability, productivity, operational consistency, and reduce volatility.

While we cannot control or reduce the cyclicality of the global steel industry, we can control our costs and create a more flexible business model that will produce stronger and more consistent results across industry cycles.

| |

18. | Is the Carnegie Way just a cost cutting initiative? |

No - it is much more than a cost cutting initiative, improving all our core business processes, including commercial, manufacturing, supply chain, procurement, innovation, and functional support. Carnegie Way is our culture and the way we run the business. We focus on our strengths and how we can create the most value for our stockholders and best serve our customers.

We have achieved sustainable cost improvements that enable us to better serve our customers and reward our stakeholders. Additionally, if we find that changes cannot be implemented and value cannot be created for our customers and stockholders, we exit those underperforming areas. Opportunities are greatest where we make money for our stockholders and our customers. When we deliver value, we can provide good jobs and benefits to our employees and help support the communities in which we do business.

| |

19. | You have mentioned that there is increased focus on earning economic profit. What is the definition of economic profit? |

The term profit typically refers to any positive income for a business enterprise. Economic profit has a higher threshold and refers to income in excess of an enterprise’s weighted average cost of capital, which includes the cost of equity as well as the cost of debt. Economic profit is true value creation as it provides stockholder returns above the weighted average cost of capital.