Securities and Exchange Commission

June 3, 2016

Page 1

June 3, 2016

Mr. Terence O’Brien

Accounting Branch Chief

Division of Corporation Finance

United States Securities and Exchange Commission

100 F St., NE

Washington, DC 20549-7010

| |

Re: | United States Steel Corporation |

Form 10-K for the Fiscal Year Ended December 31, 2015, filed February 29, 2016

File No. 1-16811

Dear Mr. O’Brien:

United States Steel Corporation (“U. S. Steel”, “we”, “us”, “our” or the “Company”) hereby submits responses to the comments of the staff (the “Staff”) of the Securities and Exchange Commission (the “Commission”) regarding the above-referenced filing (the “Form 10-K”), set forth in your letter dated May 19, 2016 (the “Comment Letter”).

In responding to the Comment Letter, we acknowledge that:

| |

1. | We are responsible for the adequacy and accuracy of the disclosure in our filings with the Commission; |

| |

2. | Staff comments or changes to disclosure in response to Staff comments do not foreclose the Commission from taking any action with respect to our filings, and |

| |

3. | We may not assert Staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States of America. |

Our responses to the Staff’s comments are set forth in the numbered paragraphs below and correspond to the numbered comments in the letter, with your comments presented in bold and quotation marks.

Form 10-K for the year ended December 31, 2015

10-K Summary, page 4

| |

1. | “For the presentation of adjusted EBITDA on page 5, please revise the order and manner of your current presentation to provide a balanced presentation and discussion of operating performance measures prepared in accordance with US GAAP versus non-GAAP measures in accordance with Item 10(e)(1)(i)(a) of Regulation S-K. Please also note that Question 103.01 of the Non-GAAP Financial Measures Compliance & Disclosure Interpretations states that the most comparable US GAAP measure to EBITDA and its variations is net (loss) income. Please address both of these items throughout your Form 10-K, including the reconciliations for the non-GAAP measures.” |

Response:

In future filings in which we present adjusted EBITDA, we will reconcile adjusted EBITDA and its variations with net (loss) income attributable to United States Steel Corporation, the most comparable U.S. GAAP measure to EBITDA and its variations. In future filings, U. S. Steel will provide U.S. GAAP operating

Securities and Exchange Commission

June 3, 2016

Page 2

performance measures, in addition to non-GAAP measures, within the annual bridge chart presentation of adjusted EBITDA, if this chart is included in future filings.

The Carnegie Way benefits amount is a non-GAAP measure used by U. S. Steel to capture value creation efforts that have led to a year-over-year reduction in our cost structure. Measuring Carnegie Way benefits is part of the entity-wide effort to achieve sustainable improvements through the application of six sigma and lean principles. There is no comparable U.S. GAAP measure to Carnegie Way benefits, and there are no accounting entries recorded as a direct result of Carnegie Way related initiatives.

| |

2. | “Please revise your disclosures to provide more robust, company-specific disclosures that clearly explain why Adjusted EBITDA is useful to investors regarding your operating performance in accordance with Item 10(e)(1)(i)(c) of Regulation S-K. Please also address this comment for each of your non-GAAP measures presented throughout your Form 10-K.” |

Response:

In future filings, U. S. Steel will revise its disclosure as underlined below to more clearly explain why adjusted EBITDA is useful to investors. Additionally, in future filings, U. S. Steel will provide the same disclosure for each of our other non-GAAP measures, including EBITDA, adjusted net earnings (loss), and adjusted net earnings (loss) per diluted share presented in our annual reports on Form 10-K and our quarterly reports on Form 10-Q.

"Adjusted EBITDA is a non-GAAP measure that is used to enhance the understanding of our operating performance, particularly cash generating activity, and facilitate a comparison with that of our competitors. U. S. Steel’s management considers adjusted EBITDA useful in providing insight into the Company’s ongoing operating performance because it excludes the impact of items that management believes are outside of the normal course of business operations, and it is widely used by professional analysts and sophisticated investors in evaluating steel companies. Adjusted EBITDA should not be considered a substitute for net income or other financial measures as computed in accordance with U.S. GAAP and is not necessarily comparable to similarly titled measures used by other companies."

We will provide the following disclosure in our future annual reports on Form 10-K and our quarterly reports on Form 10-Q with respect to our Carnegie Way benefits non-GAAP measure:

"Carnegie Way benefits is a non-GAAP measure that is used as a means to quantify value creation from initiatives undertaken as part of the Carnegie Way, an entity-wide effort to drive sustainable improvements. The Carnegie Way benefits amount is useful in providing insight into our ongoing operating performance by enhancing visibility into our changing cost structure. It is used by both buy-side investors and sell-side analysts to refine and improve the accuracy of their financial models."

Key Performance Indicators, page 6

Reconciliation of EBITDA and Adjusted EBITDA, page 17

| |

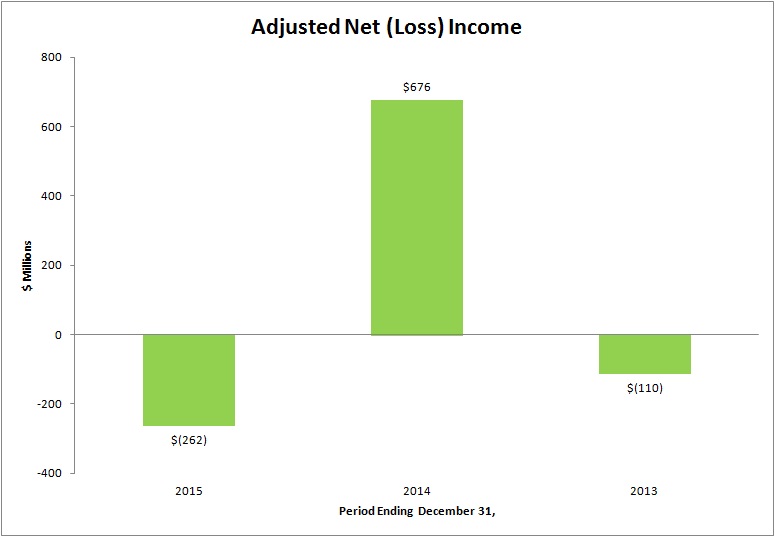

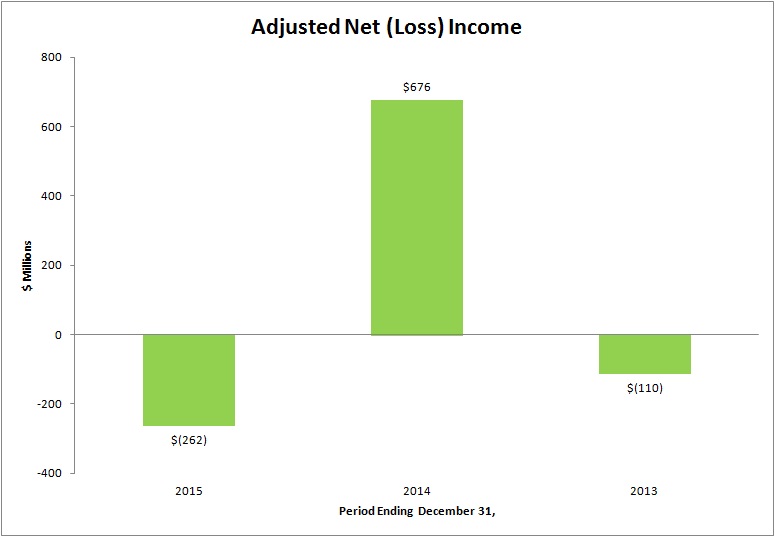

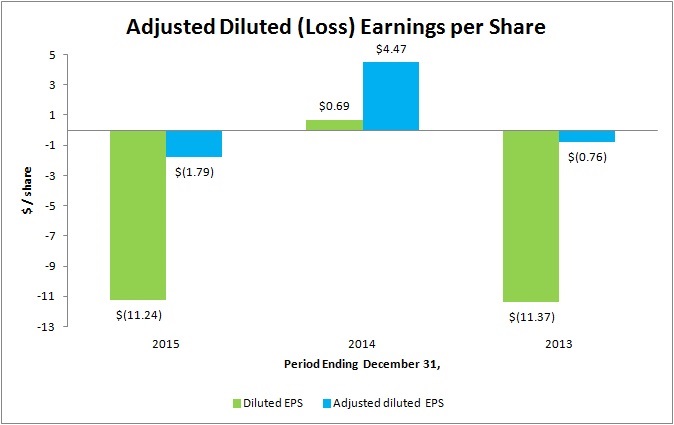

3. | “Please revise the page titles to include a reference to the losses recognized for your presentation of adjusted net (loss) income on page 9 and adjusted diluted (loss) earnings per share on page 10, since two out of the three years presented are in loss positions.” |

Securities and Exchange Commission

June 3, 2016

Page 3

Response:

In future filings, we will revise the page titles to include a reference to losses when losses exist in any of the years included in the presentation of adjusted net (loss) income and diluted (loss) earnings per share, in the manner presented below.

| |

4. | “Please revise your reconciliations beginning on page 15 to begin with the US GAAP measure.” |

Response:

In future filings, we will revise our reconciliations of non-GAAP financial measures to begin with the most directly comparable U.S. GAAP measure in the manner presented below.

Securities and Exchange Commission

June 3, 2016

Page 4

|

| | | | | | | | | | | |

RECONCILIATION OF ADJUSTED NET (LOSS) EARNINGS(a) |

| | | | | |

| | | Year Ended December 31, |

| | | | | |

(Dollars in millions) | | 2015 | 2014 | 2013 |

Reconciliation to net (loss) earnings attributable to | | | | |

United States Steel Corporation | | | | |

| | | | | |

Net (loss) earnings attributable to | | | | |

United States Steel Corporation, as reported | | $ | (1,642 | ) | $ | 102 |

| $ | (1,645 | ) |

| | | | | |

Losses associated with U. S. Steel Canada Inc. | | (266 | ) | (385 | ) | — |

|

Loss on shutdown of Fairfield Flat-Rolled operations(b) (c) | | (53 | ) | — |

| — |

|

Loss on shutdown of coke production facilities (c) | | (65 | ) | — |

| (258 | ) |

Restructuring and other charges (c) (d) | | (64 | ) | — |

| — |

|

Granite City Works temporary idling charges | | (99 | ) | — |

| — |

|

Postemployment benefit actuarial adjustment | | (26 | ) | — |

| — |

|

Impairment of equity investment | | (18 | ) | — |

| — |

|

Loss on retirement of senior convertible notes | | (36 | ) | — |

| — |

|

Deferred tax asset valuation allowance | | (753 | ) | — |

| — |

|

Impairment of carbon alloy facilities (c) | | — |

| (161 | ) | — |

|

Litigation reserves | | — |

| (46 | ) | — |

|

Write-off of pre-engineering costs at Keetac (c) | | — |

| (30 | ) | — |

|

Loss on assets held for sale | | — |

| (9 | ) | — |

|

Gain on sale of real estate assets (e) | | — |

| 45 |

| — |

|

Curtailment gain | | — |

| 12 |

| — |

|

Impairment of goodwill | | — |

| — |

| (1,795 | ) |

Repurchase premium charge (f) | | — |

| — |

| (22 | ) |

Environmental remediation charge | | — |

| — |

| (21 | ) |

Write-off of equity investment | | — |

| — |

| (15 | ) |

Tax benefits (g) | | — |

| — |

| 561 |

|

Supplier contract dispute settlement | | — |

| — |

| 15 |

|

Total Adjustments | | $ | (1,380 | ) | $ | (574 | ) | $ | (1,535 | ) |

Adjusted net (loss) earnings attributable to | | | | |

United States Steel Corporation | | $ | (262 | ) | $ | 676 |

| $ | (110 | ) |

|

(a) The adjustments included in this table have been tax affected at the quarterly effective tax rate with the exception of the fourth quarter of 2015 items which have been tax affected at a 0% tax rate due to the recognition of a full valuation allowance in the fourth quarter of 2015. |

(b) Fairfield Flat-Rolled Operations includes the blast furnace and associated steelmaking operations, along with most of the flat-rolled finishing operations at Fairfield Works. The slab and rounds casters remain operational and the #5 coating line continues to operate. |

(c) Included in restructuring and other charges on the Consolidated Statement of Operations. |

(d) The 2015 amount consists primarily of employee related costs, including costs for severance, supplemental unemployment benefits and continuation of health care benefits. The 2013 amount is related primarily to the shut down of the iron and steelmaking facilities at Hamilton Works. |

(e) Gain on sale of surface rights and mineral royalty revenue streams in the state of Alabama. |

(f) Related to the repurchases of $542 million principal amount of our 2014 Senior Convertible Notes. |

(g) Related to a tax restructuring and other items. |

Securities and Exchange Commission

June 3, 2016

Page 5

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations, page 62

Critical Accounting Estimates, page 62

Goodwill and identifiable intangible assets, page 62

| |

5. | “Regarding your testing of identifiable intangible assets with finite lives for impairment during the fourth quarter of fiscal year 2015, please expand your disclosures to: |

| |

• | Quantify the carrying value of the identifiable intangible assets tested for impairment; |

| |

• | Identify the specific events and/or circumstances that indicated the carrying value may not be recoverable; and |

| |

• | Quantify the percentage by which the recoverable amount exceeded the carrying value. |

Please refer to Item 303(a)(3)(ii) of Regulation S-K and Sections 501.02, 216, and 501.14 of the Financial Reporting Codification for guidance.”

Response:

In our annual report on Form 10-K for the fiscal year ending December 31, 2016, we will provide the following disclosure which includes additional underlined language:

"Identifiable intangible assets with finite lives are amortized on a straight-line basis over their estimated useful lives and are reviewed for impairment whenever events or circumstances indicate that the carrying value may not be recoverable. During the fourth quarter of 2015, due to a significant decline in energy prices and high levels of tubular imports, U. S. Steel completed a review of its identifiable intangible assets with finite lives, primarily customer relationships with a carrying value of $80 million. As the recoverable amount of these customer relationships exceeded the carrying value by 27%, U. S. Steel determined that the assets were not impaired."

In future filings with the Commission, to the extent the Company tests intangible assets with finite lives for impairment, we will include expanded disclosure to address the circumstances that warranted the additional testing, and will quantify the carrying value of the intangible assets that were tested and the percentage by which the recoverable amount exceeds the carrying amount.

Inventories, page 63

| |

6. | “Please expand your disclosures to provide a discussion of the critical estimates associated with the LIFO method of inventory costing. Please refer to Section 501.14 of the Financial Reporting Codification for guidance.” |

Response:

In our annual report on Form 10-K for the fiscal year ending December 31, 2016, we will expand our disclosure to include the following marked language:

"LIFO (last-in, first-out) is the predominant method of inventory costing for inventories in the United States and FIFO (first-in, first-out) is the predominant method used in Europe. Since the LIFO inventory valuation methodology is an annual calculation, interim estimates of the annual LIFO valuation are required. We recognize the effects of the LIFO inventory valuation method on an interim basis by estimating the year end inventory amounts. The projections of annual LIFO inventory amounts are updated quarterly. Changes in

Securities and Exchange Commission

June 3, 2016

Page 6

U.S. GAAP rules or tax law, such as the elimination of the LIFO method of accounting for inventories, could negatively affect our profitability and cash flow."

Equity Method Investments, page 63

| |

7. | “Please expand your disclosures to include the carrying value of the equity method investment associated with the $18 million impairment charge. Please also provide a discussion of the facts and circumstances that led to the other than temporary impairment charge. Please refer to Item 303(a)(3)(ii) of Regulation S-K and Section 501.14 of the Financial Reporting Codification for guidance.” |

Response:

In our annual report on Form 10-K for the fiscal year ending December 31, 2016, we will expand our disclosure to include the underlined language below, explaining the carrying value of the equity method investment for which the $18 million impairment charge was recorded as well as the facts and circumstances that led to the other than temporary impairment charge.

"U. S. Steel evaluates impairment of its equity method investments whenever circumstances indicate that a decline in value below carrying value is other than temporary. Under these circumstances, we would adjust the investment down to its estimated fair value, which then becomes its new carrying value. During the fourth quarter of 2015, U. S. Steel completed a review of its equity method investments and determined there was an other than temporary impairment of an equity investee within a non-core operating segment of U. S. Steel. The other than temporary impairment resulted from a decision in the fourth quarter of 2015 to cease the funding of the long-term development plans of the equity investment, due to our intent to sell the particular investment, thereby inhibiting sufficient recovery of the market value. Accordingly, U. S. Steel recorded an impairment charge of $18 million, which reduced the carrying amount of the equity investment to $3 million, in the fourth quarter of 2015."

Additionally, during the fourth quarter of 2015, U. S. Steel began negotiations for the sale of this investment at a price within the range of $3 million to $5 million which was a factor considered in the adjusted carrying value of the equity investment.

Long-lived assets, page 65

| |

8. | “Please expand your disclosure to clarify the level at which you have grouped your assets for impairment testing. |

Response:

In our annual report on Form 10-K for the period ending December 31, 2016, we will expand our disclosure to clarify the level at which we have grouped our assets for impairment testing by adding the following underlined language to our disclosure:

"U. S. Steel evaluates long-lived assets, primarily property, plant and equipment for impairment whenever changes in circumstances indicate that the carrying amounts of those productive assets exceed their projected undiscounted cash flows. We evaluate the impairment of long-lived assets at the asset group level. Our primary asset groups are Flat-Rolled, seamless tubular, welded tubular and U. S. Steel Europe (USSE). During 2015, U. S. Steel completed a review of its long-lived assets and determined that the assets were not impaired. Management will continue to monitor market and economic conditions for triggering events that may warrant further review of long-lived assets."

Securities and Exchange Commission

June 3, 2016

Page 7

| |

9. | Regarding your testing of the welded tubular and seamless tubular asset groups within the Tubular segment for impairment, please expand your disclosures to: |

| |

• | Quantify the carrying value of each asset group tested for impairment; |

| |

• | Quantify the percentage by which the recoverable amount exceeded the carrying value; |

| |

• | Provide a description of the key assumptions used to estimate the recoverable amount of each asset group, which should be specific to the asset group; and |

| |

• | Provide a discussion of the potential events and/or circumstances that are reasonably likely to occur and result in a recoverable amount that is less than the carrying value for each asset group. |

Please refer to Item 303(a)(3)(ii) of Regulation S-K and Sections 501.02, 216, and 501.14 of the Financial Reporting Codification for guidance.

Response:

In our Annual Report on Form 10-K for the period ending December 31, 2016, or our quarterly reports on Form 10-Q filings for the second and third quarter of 2016, if management concludes foreshadowing is required, we will add the following underlined disclosure:

As a result of the significant decline in energy prices and high levels of tubular imports, U. S. Steel conducted a review of its seamless tubular and welded tubular asset groups within its Tubular segment and determined that the assets were not impaired as of December 31, 2015. The seamless tubular asset group had a carrying value of $359 million at December 31, 2015 and the recoverable amount exceeded this carrying value by 627%. The welded tubular asset group had a carrying value of $559 million at December 31, 2015 and the recoverable amount exceeded this carrying value by 73%. The key assumption used to estimate the recoverable amounts for both the seamless and welded tubular asset groups was the forecasted price of oil over the 15-year average remaining useful lives of the assets within the asset groups. The price of crude oil would have to remain at historically low levels for a prolonged period of time for the carrying amount of our seamless tubular and welded tubular asset groups to be impaired. U. S. Steel management will continue to monitor market and economic conditions for triggering events, including further weakening in the oil sector over the long-term, that may warrant further review of its long-lived assets.

While oil prices did fall below $30 a barrel in January and February of 2016, they were the lowest oil prices since 2003. Oil prices have been increasing each month and approximated $49 a barrel at the end of May of 2016.

| |

10. | Please expand your disclosures to quantify the carrying value of the assets associated with the facilities that have been idled. Please refer to Item 303(a)(3)(ii) of Regulation S- K and Sections 501.02, 216, and 501.14 of the Financial Reporting Codification for guidance.” |

Response:

In our quarterly report on Form 10-Q for the period ending June 30, 2016, we will add the following underlined disclosure:

During the first half of 2016, the Company continued adjusting its operating configuration by temporarily idling production at certain of its tubular facilities. Certain other organizational realignments were also undertaken to further streamline our operational processes and reduce costs. As of June 30, 2016, the following facilities are idled:

Indefinitely Idled:

Securities and Exchange Commission

June 3, 2016

Page 8

Bellville Tubular Operations

McKeesport Tubular Operations

Temporarily Idled:

Lone Star Tubular

Tubular Processing

Granite City Works Steelmaking Operations

Keetac Iron Ore Operations

The carrying value of the long-lived assets associated with the idled facilities listed above total approximately $600 million.(a)

(a) Amount disclosed is as of March 31, 2016 and is being used as a point of reference for this response.

Operating Expenses, page 69

Restructuring and Other Charges, page 71

| |

11. | “We note that you incurred $250 million in restructuring and other charges during fiscal year 2014, which you expected would result in a positive impact on your annual cash flows of approximately $39 million. Please confirm that the $39 million annual cash savings were achieved during fiscal year 2015. Otherwise, please provide disclosures that clarify the annual cash savings were not achieved as expected, the reasons the savings were not achieved as expected, and the impact to your consolidated financial statements. Please address this comment for your fiscal year 2015 restructuring activities in your fiscal year 2016 periodic reports. Please refer to SAB Topic 5:P.4 for guidance.” |

Response:

During 2014 the Company implemented several restructuring efforts that led to permanent employee headcount reductions. Management’s estimate of the cost savings and the cash flow impacts associated with these reductions was approximately $39 million, consisting primarily of reduced payroll and benefit costs. These estimated cost savings and the associated cash flow impacts were realized by the Company during fiscal 2015. In our 2016 quarterly and annual reports on Form 10-Q and Form 10-K, respectively, we will expand our restructuring disclosures to include the cost savings and cash flow impacts of our 2015 restructuring efforts to ensure that our disclosures provide a more clear explanation of the outcome of the Company’s restructuring activities in accordance with the disclosure requirements of SAB Topic 5:P.4.

Gross Margin by Segment, page 73

| |

12. | “We note your statement on page 6 that the $815 million of Carnegie Way benefits realized in 2015 was not enough to fully overcome some of the worst market and business conditions you have seen. We further note from your disclosures within your segment results analysis on pages 74 to 78 that you achieved $575 million of Carnegie Way benefits and were able to recognize profits. Please expand your disclosures to provide investors with a more balanced discussion about your operating results by explaining why a lower amount of benefit recognized during fiscal year 2014 led to profitable results and a higher amount of benefits for fiscal year 2015 did not.” |

Securities and Exchange Commission

June 3, 2016

Page 9

Response:

The Company’s business is highly sensitive to changes in pricing and shipment volumes. As disclosed in Management’s Discussion and Analysis (MD&A) on pages 73 through 78 of the Form 10-K, the Company experienced significant losses in our three reportable segments in 2015, which was a direct result of significant decreases in pricing and/or shipments. Noted in our analysis below, the Flat-Rolled and Tubular reportable segments had decreases in pricing and shipments which were significant when compared to 2014. The significant decrease in pricing experienced by USSE was not overcome by the small increase in shipments.

|

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| Flat-Rolled | | USSE | | Tubular |

| | | | | | | | |

| 2015 | 2014 | | 2015 | 2014 | | 2015 | 2014 |

Avg. Realized Price per Ton | $ | 695 |

| $ | 772 |

| | $ | 516 |

| $ | 667 |

| | $ | 1,464 |

| $ | 1,538 |

|

Shipments(a) | 10,595 |

| 13,908 |

| | 4,357 |

| 4,179 |

| | 593 |

| 1,744 |

|

| | | | | | | | |

Change in Avg. Realized Price per Ton | $ | (77 | ) | $ | 37 |

| | $ | (151 | ) | $ | (39 | ) | | $ | (74 | ) | $ | 8 |

|

Percent Change in Avg. Realized Price per Ton | (10 | )% | 5 | % | | (23 | )% | (6 | )% | | (5 | )% | 1 | % |

| | | | | | | | |

Change in Shipments(a) | (3,313 | ) | (738 | ) | | 178 |

| 179 |

| | (1,151 | ) | (13 | ) |

Percent Change in Shipments | (24 | )% | (5 | )% | | 4 | % | 4 | % | | (66 | )% | (1 | )% |

| | | | | | | | |

(a)Amounts are thousands of tons | | | | | | | | |

Management’s implementation of the Carnegie Way is an entity-wide effort to achieve sustainable value creation, which includes cost reduction, through the application of six sigma and lean principles. For 2014, our cost reduction efforts in concert with our average realized price per ton and shipment volumes, which were significantly better as compared to our 2015 average realized price per ton and shipping volumes, enabled the Company to recognize approximately $102 million of net income. As noted, although the Company was able to realize $815 million of benefits in 2015 through our Carnegie Way efforts, the average realized price per ton and shipment levels were significantly lower as compared to our 2014 results and therefore, the Company was not able to generate net income in 2015, even with the additional Carnegie Way benefits.

In future filings with the Commission, we will clarify and expand our disclosures to ensure the analysis contained within the MD&A addresses our Carnegie Way efforts and the extent of its impact on our results of operations.

Liquidity, page 84

| |

13. | “We note that the quarterly inventory turnover days for fiscal year 2015 and the first quarter of fiscal year 2016 have significantly increased over the comparable prior year periods. As inventories is 52.9% of total assets as of December 31, 2015, please provide an analysis of the realizability of inventories, including an analysis of material changes in the measure management uses to monitor inventories (e.g., inventory turnover days). To the extent that management is aware of future LIFO layer liquidations that could materially impact operating results, disclosure should be provided. Please refer to Items 303(a)(1) and 303(a)(3)(ii) of Regulation S-K and Section 501.13 of the Financial Reporting Codification for guidance.” |

Securities and Exchange Commission

June 3, 2016

Page 10

Response:

Our inventory turnover as disclosed on page 82 of the Form 10-K was approximately 5 for 2015 and 6 for 2014. As disclosed on page 31 of our quarterly report on Form 10-Q for the period ended March 31, 2016, the inventory turnover was 5 for the twelve months ended March 31, 2016 and 6 for the twelve months ended March 31, 2015. For both the year-ended 2015 as compared to 2014 and the twelve month periods ended March 31, 2016 and 2015, as compared to our year-end 2015 and 2014 periods, the turnover metrics have remained consistent and have not significantly increased. Further we note the inventory balance as disclosed in our Form 10-K is approximately 22.6% of our total assets and 52.9% of current assets.

Management’s key control over potential lower of cost or market (LCM) issues is performed on a quarterly basis by comparing the replacement cost of the Company’s inventory to the last-in, first-out (LIFO) cost of inventory. We note the replacement cost of the inventory for the year-ended 2015 was approximately $2.5 billion versus our LIFO cost of approximately $1.6 billion. At the quarter ended March 31, 2016, our replacement cost of inventory was approximately $2.2 billion as compared to a LIFO cost of approximately $1.4 billion. In both instances, there is a significant difference, $900 million at year-end and $800 million at the quarter end, which means that our replacement cost would have to decrease more than $900 million and $800 million, respectively, before the Company may have to make an LCM adjustment. Further it should be noted that the Company has LIFO layers dating back to 1941, which would make an LCM adjustment unlikely even with the current lower pricing conditions we are experiencing.

To the extent management is aware of material decrements in our LIFO inventory, which will not be replaced by the end of the year, we will enhance our disclosure to include this fact. We note that on page 92 of our Form 10-K, we disclosed that based on current market conditions, we expect approximately $500 million of cash benefits from working capital improvements in 2016, primarily related to better inventory management. We believe this disclosure provided appropriate foreshadowing of potential decreases in our inventory levels in 2016 that could materially impact our operating results.

Consolidated Statements of Operations, page F-4

| |

14. | “Please remove the parenthetical, (EBIT), from the end of the line item titled, (loss) earnings before interest and income taxes, as EBIT is commonly considered a non-GAAP measure title. Please refer to Items 10(e)(1)(ii)(a) and 10(e)(1)(ii)(c) of Regulation S-K.” |

Response:

In future filings, we will remove the parenthetical (EBIT) reference.

| |

15. | “We note that you recognized a loss before interest and income taxes for fiscal year 2015 of $1,202 million. We further note in your earnings press release included as an exhibit to the Form 8-K filed on January 26, 2016, and the conference call and webcast presentation included as an exhibit to the Form 8-K filed on January 27, 2016, that you reported a loss before interest and income taxes for fiscal year 2015 of $1,055 million. The difference appears to relate to an adjustment to increase selling, general and administrative expenses by $26 million and an adjustment to increase losses associated with U.S. Steel Canada Inc. by $121 million, which resulted in a 13.9% increase to loss before interest and income taxes. Please explain why there appears to be a material discrepancy between the information contained in your earnings release (and related Form 8-Ks) and the disclosure contained in the Form 10-K. Please also address the impact the error has on your certifying officers’ conclusions regarding the effectiveness of your disclosure controls and procedures. Lastly, please tell us how you intend to rectify the disclosure inaccuracies identified here.” |

Securities and Exchange Commission

June 3, 2016

Page 11

Response:

The changes noted in our loss before income taxes and interest in the January 26, 2016 earnings release as compared to the Form 10-K, were a result of an actuarial adjustment related to Worker’s Compensation and a change in our estimated Retained Interest in U. S. Steel Canada Inc. (USSC). Following the filing of the earnings release on January 26, 2016 on Form 8-K, management continued the year-end closing process, including evaluation of subsequent events. This led the Company to conclude that adjustments of $26 million to our SG&A expense line item and $121 million to our Losses associated with U. S. Steel Canada Inc. line item in our 2015 Consolidated Statements of Operations were necessary. We note the control certifications signed by our executive management team were for the financial statements that are included in the Company’s annual report on Form 10-K and not the earnings release.

As previously noted in our quarterly reports on Form 10-Q filed with the Commission, we disclosed that our claims related to USSC were being challenged by several parties. Specifically, in our quarterly report on Form 10-Q for the quarter ending March 31, 2015 and subsequent 2015 filings, we disclosed the following: “The Company’s claims have been challenged by a number of interested parties which, if successful, could result in the reclassification of those claims or modifications to the values of those claims.” The trial to determine the classification and amounts of the Company’s secure and unsecured claims of approximately $2.2 billion occurred during 2016, with a decision expected in late February 2016. Subsequent to the filing of the earnings release on Form 8-K, our assessment of the judiciary proceedings continued and based on these proceedings and discussion with legal counsel, it was concluded that an additional reserve was required. Because a decision had not been rendered at the time the Form 10-K was filed, the Company evaluated the potential of reclassification of its secured claims, determined there was a significant contingency in realizability of the claims, as a result of the court proceedings in 2016 and our review of the recoverability of claims, and made a good faith judgment to reduce the retained interest in USSC.

Subsequent to the filing of the Form 10-K on February 29, 2016, the Ontario Superior Court of Justice (the Canadian Court) denied the challenges to U. S. Steel's claims and verified our secured claims in the amount of approximately $119 million and unsecured claims of approximately C$1.8 billion and $120 million, which we have disclosed in our quarterly report on Form 10-Q for the quarter ending March 31, 2016. The interested parties have appealed the determinations of the Canadian Court.

Segment Information, page F-15

| |

16. | “Please revise your disclosure to provide the reason that the CODM does not receive asset information for the reportable segments for purposes of assessing performance and deciding how to allocate resources in accordance with ASC 280-10-50-26.” |

Response:

As disclosed in our Form 10-K and our Form 10-Q filings, our Chief Operating Decision Maker (CODM) does not review segment asset information. In future filings with the Commission, we will expand our segment disclosure to include the following underlined language:

"Information on segment assets is not disclosed, as it is not reviewed by the chief operating decision maker. The chief operating decision maker assesses the Company’s assets on an enterprise wide level, based upon the projects that yield the greatest return to the Company as a whole, and not on an individual segment level."

Securities and Exchange Commission

June 3, 2016

Page 12

USSC Retained Interest and Other Related Charges, page F-20

| |

17. | “Please expand your disclosure to disclose the carrying value of the loans, interest receivable, and trade accounts receivable and the associated allowance for doubtful accounts as of the balance sheet dates presented.” |

Response:

The Retained Interest, which includes the Company’s trade accounts receivables, loan receivables, and interest receivables in USSC, is a component of the current and long term receivables from related parties, less an allowance for doubtful accounts line item on the face of the Consolidated Balance Sheet. In future filings with the Commission, we will provide enhanced disclosures to allow financial statement users to better understand the carrying values of the trade accounts receivables, the loans, and the interest associated with the USSC Retained Interest.

| |

18. | “You disclose that the $392 million losses associated with USSC includes the write-down of the retained interest ($255 million during the second quarter), Stelco funding charge ($16 million during the third quarter) and other related charges. The fourth quarter earnings release states that fiscal year 2015 losses associated with USSC were $271 million. Please tell us the reason(s) for the additional $121 million loss and explain the material components of that incremental amount.” |

Response:

The additional loss of $121 million associated with USSC was a result of an evaluation of subsequent events related to contingencies surrounding our USSC retained interest. As a result of this evaluation, an additional reserve was made which resulted in the $121 million loss. Please reference the response to comment 15 for details of the adjustment related to USSC and the associated Retained Interest.

Selected Quarterly Financial State (Unaudited), page F-58

| |

19. | “Please expand your presentation to include gross profit as required by Item 302(a)(1) of Regulation S-K.” |

Response:

In future filings with the Commission, we will include gross profit as a component of the quarterly disclosures as noted in Item 302(a)(1) of Regulation S-K.

| |

20. | “Please provide disclosures for all material fourth quarter events and transactions either as a footnote to this table or within MD&A. As an example, we note that you recognized a loss of $121 million during the fourth quarter of fiscal year 2015 related to the losses associated with U.S. Steel Canada Inc. Please refer to Item 302(a)(3) of Regulation S-K and ASC 270-10-50-2 for guidance.” |

Response:

In future filings with the Commission, to the extent they are material, we will disclose fourth quarter events in accordance with Item 302(a) of Regulation S-K. Please see the response to comment 15 above for the details related to USSC and the $121 million loss.

Securities and Exchange Commission

June 3, 2016

Page 13

Please contact me (412-433-5394), or, in my absence, Kim Fast, Assistant Corporate Controller (412-433-5572) with any questions. With respect to any legal issues, please contact Arden Phillips, Corporate Secretary & Associate General Counsel (412-433-2890) directly.

Sincerely,

/s/ Colleen M. Darragh

Colleen M. Darragh

Vice President and Controller

cc: David B. Burritt

Kimberly D. Fast

Arden T. Phillips, Esq.