UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

| Filed by the Registrant x |

| |

| Filed by a Party other than the Registrant ¨ |

| |

| Check the appropriate box: |

| ¨ |

Preliminary Proxy Statement |

| ¨ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ |

Definitive Proxy Statement |

| x |

Definitive Additional Materials |

| ¨ |

Soliciting Material under §240.14a-12 |

| |

| United States Steel Corporation |

| (Name of Registrant as Specified In Its Charter) |

| |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| |

| Payment of Filing Fee (Check the appropriate box): |

| x |

No fee required. |

| ¨ |

Fee paid previously with preliminary materials. |

| ¨ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

The following email was sent to employees of United States Steel

Corporation on March 19, 2024:

| From: USSteelCommunications

Subject: On Behalf of Tara Carraro: Expanded Edition – Articles of Interest

Date: Tuesday, March 19, 2024 9:58:49 AM

Attachments: image001.png

TO: All U.S.-based employees

DATE: Tuesday, March 19, 2024

Nippon Steel’s proposed acquisition of U. S. Steel generated a significant amount of media coverage

over the last week, so we’ve expanded this week’s edition in this series to ensure you see the

strong, continued support being expressed for this deal.

I encourage you to log-in to X App. We’ve included links to recent articles of interest*, along with

statements from organizations and individuals in the business and policy world, gathered in one

place to save you time and help you keep up with the latest news.

Visit BestDealForAmericanSteel.com for additional information about this proposed transaction and

to sign up to receive alerts when updates are posted to the site.

Thank you.

Tara

* Please note: Some articles included in this series may require subscriptions to view. |

The following materials were first posted by United States Steel

Corporation to its internal company news application, X App, on March 19, 2024:

| NSC | USS: Weekly Articles of Interest – March 19, 2024

X App

Headline (80-character limit):

• NEW: Articles of Interest – Nippon Steel | U. S. Steel Proposed Transaction

Sub-headline (80-character limit):

• EXPANDED EDITION for the week of March 18, 2024

Description (300-character limit):

• Nippon Steel’s proposed acquisition of U. S. Steel generated a significant amount of media

coverage over the last week, so we’re super sizing this week’s edition in this series to ensure you

see the strong, continued support being expressed for this deal. Click to read more.

Accompanying visuals:

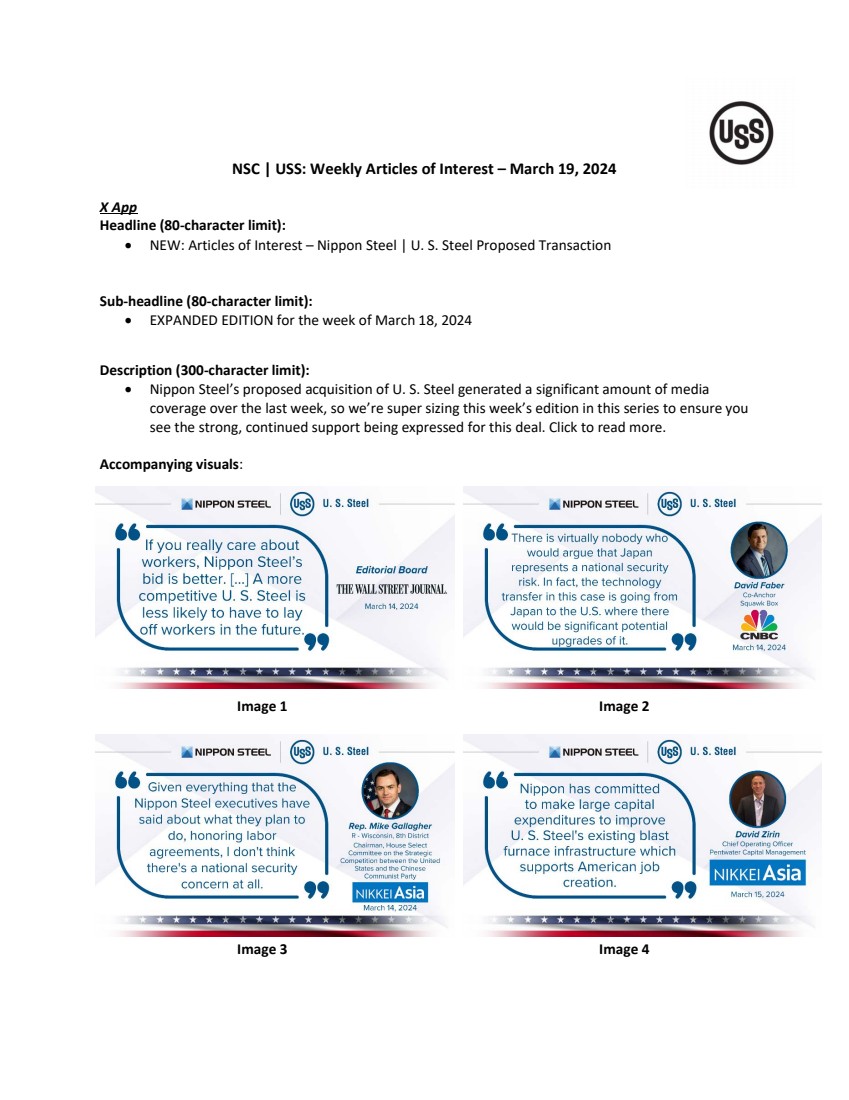

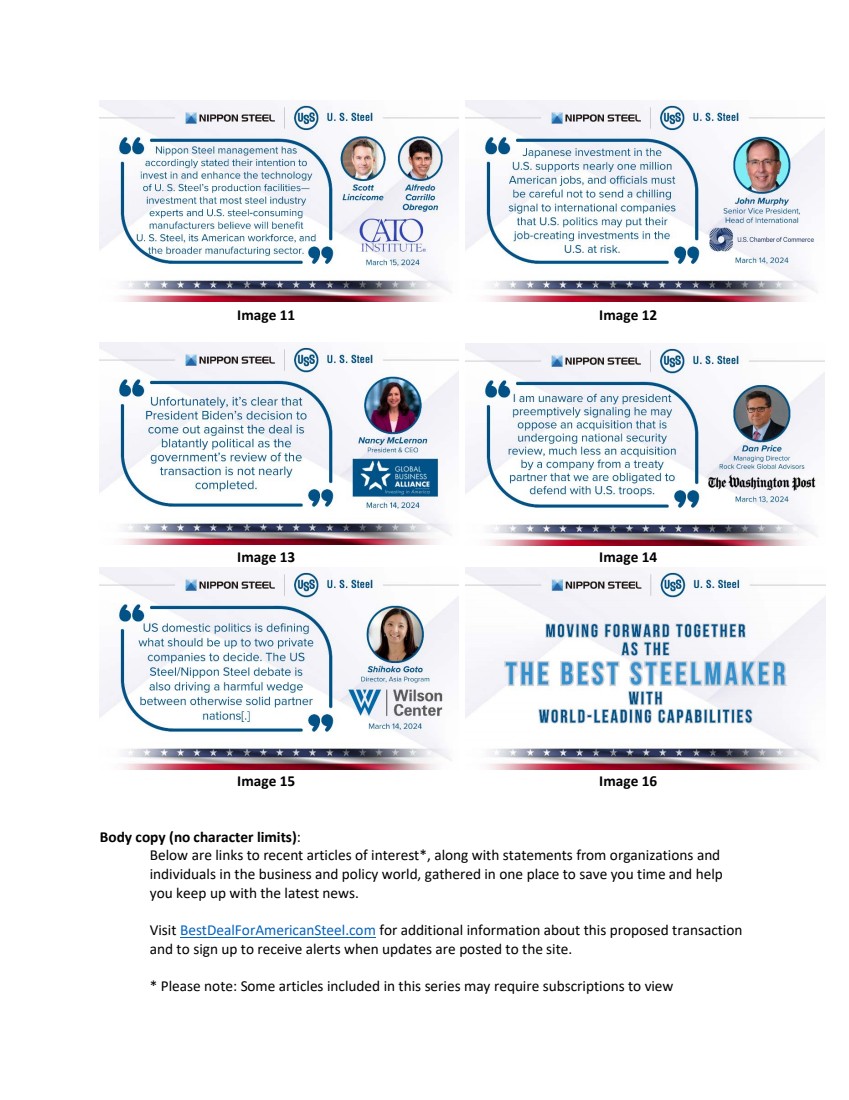

Image 1 Image 2

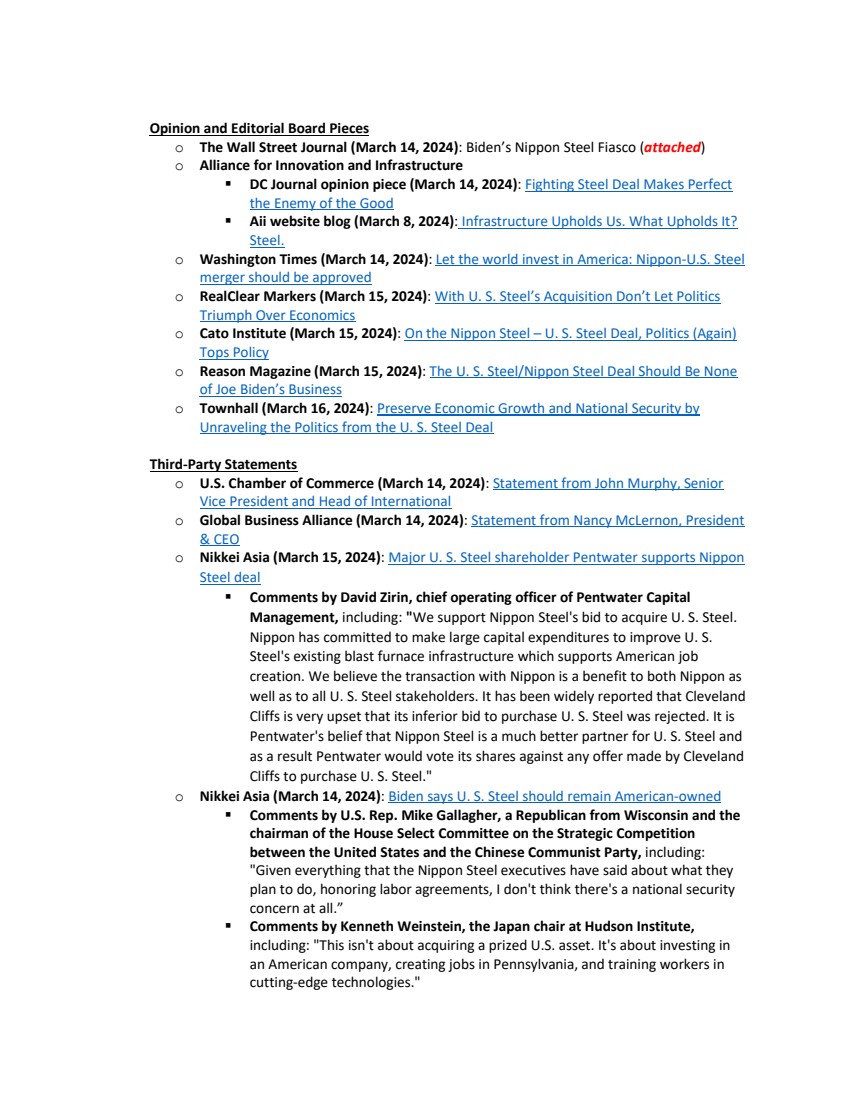

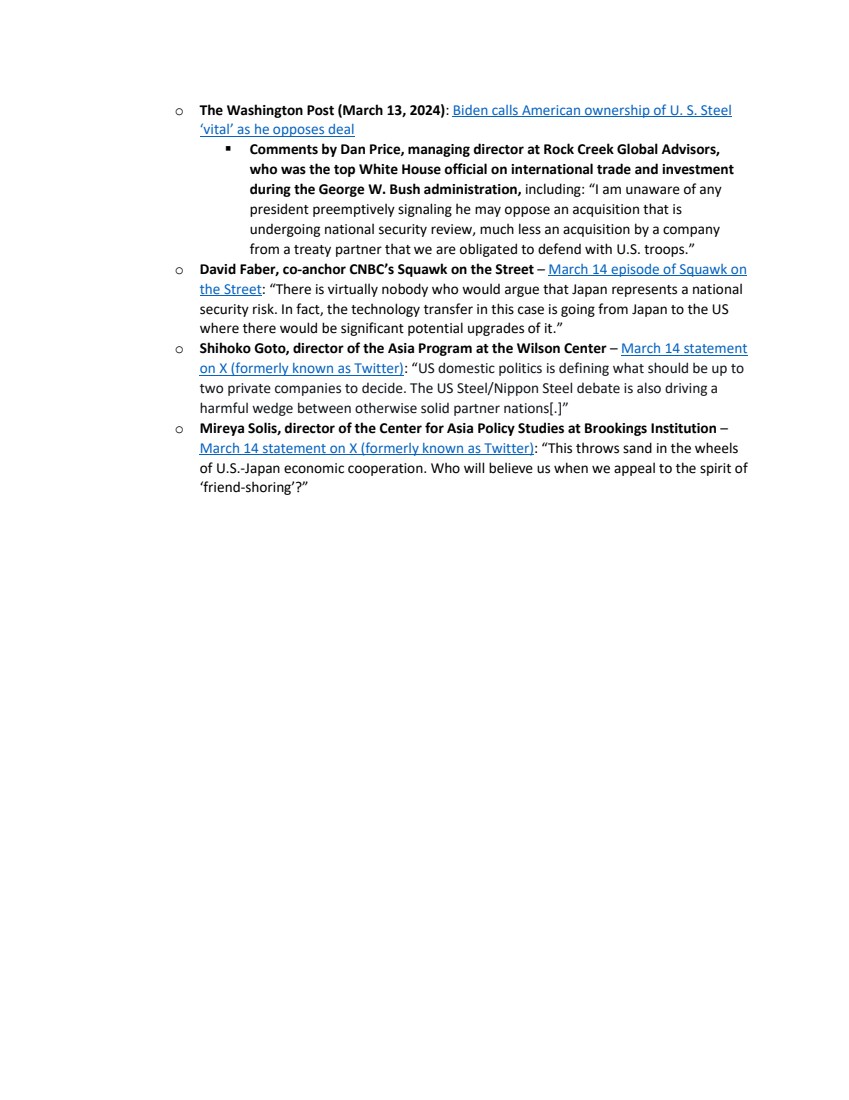

Image 3 Image 4 |

| Image 5 Image 6

Image 7 Image 8

Image 9 Image 10 |

| Image 11 Image 12

Image 13 Image 14

Image 15 Image 16

Body copy (no character limits):

Below are links to recent articles of interest*, along with statements from organizations and

individuals in the business and policy world, gathered in one place to save you time and help

you keep up with the latest news.

Visit BestDealForAmericanSteel.com for additional information about this proposed transaction

and to sign up to receive alerts when updates are posted to the site.

* Please note: Some articles included in this series may require subscriptions to view |

| Opinion and Editorial Board Pieces

o The Wall Street Journal (March 14, 2024): Biden’s Nippon Steel Fiasco (attached)

o Alliance for Innovation and Infrastructure

DC Journal opinion piece (March 14, 2024): Fighting Steel Deal Makes Perfect

the Enemy of the Good

Aii website blog (March 8, 2024): Infrastructure Upholds Us. What Upholds It?

Steel.

o Washington Times (March 14, 2024): Let the world invest in America: Nippon-U.S. Steel

merger should be approved

o RealClear Markers (March 15, 2024): With U. S. Steel’s Acquisition Don’t Let Politics

Triumph Over Economics

o Cato Institute (March 15, 2024): On the Nippon Steel – U. S. Steel Deal, Politics (Again)

Tops Policy

o Reason Magazine (March 15, 2024): The U. S. Steel/Nippon Steel Deal Should Be None

of Joe Biden’s Business

o Townhall (March 16, 2024): Preserve Economic Growth and National Security by

Unraveling the Politics from the U. S. Steel Deal

Third-Party Statements

o U.S. Chamber of Commerce (March 14, 2024): Statement from John Murphy, Senior

Vice President and Head of International

o Global Business Alliance (March 14, 2024): Statement from Nancy McLernon, President

& CEO

o Nikkei Asia (March 15, 2024): Major U. S. Steel shareholder Pentwater supports Nippon

Steel deal

Comments by David Zirin, chief operating officer of Pentwater Capital

Management, including: "We support Nippon Steel's bid to acquire U. S. Steel.

Nippon has committed to make large capital expenditures to improve U. S.

Steel's existing blast furnace infrastructure which supports American job

creation. We believe the transaction with Nippon is a benefit to both Nippon as

well as to all U. S. Steel stakeholders. It has been widely reported that Cleveland

Cliffs is very upset that its inferior bid to purchase U. S. Steel was rejected. It is

Pentwater's belief that Nippon Steel is a much better partner for U. S. Steel and

as a result Pentwater would vote its shares against any offer made by Cleveland

Cliffs to purchase U. S. Steel."

o Nikkei Asia (March 14, 2024): Biden says U. S. Steel should remain American-owned

Comments by U.S. Rep. Mike Gallagher, a Republican from Wisconsin and the

chairman of the House Select Committee on the Strategic Competition

between the United States and the Chinese Communist Party, including:

"Given everything that the Nippon Steel executives have said about what they

plan to do, honoring labor agreements, I don't think there's a national security

concern at all.”

Comments by Kenneth Weinstein, the Japan chair at Hudson Institute,

including: "This isn't about acquiring a prized U.S. asset. It's about investing in

an American company, creating jobs in Pennsylvania, and training workers in

cutting-edge technologies." |

| o The Washington Post (March 13, 2024): Biden calls American ownership of U. S. Steel

‘vital’ as he opposes deal

Comments by Dan Price, managing director at Rock Creek Global Advisors,

who was the top White House official on international trade and investment

during the George W. Bush administration, including: “I am unaware of any

president preemptively signaling he may oppose an acquisition that is

undergoing national security review, much less an acquisition by a company

from a treaty partner that we are obligated to defend with U.S. troops.”

o David Faber, co-anchor CNBC’s Squawk on the Street – March 14 episode of Squawk on

the Street: “There is virtually nobody who would argue that Japan represents a national

security risk. In fact, the technology transfer in this case is going from Japan to the US

where there would be significant potential upgrades of it.”

o Shihoko Goto, director of the Asia Program at the Wilson Center – March 14 statement

on X (formerly known as Twitter): “US domestic politics is defining what should be up to

two private companies to decide. The US Steel/Nippon Steel debate is also driving a

harmful wedge between otherwise solid partner nations[.]”

o Mireya Solis, director of the Center for Asia Policy Studies at Brookings Institution –

March 14 statement on X (formerly known as Twitter): “This throws sand in the wheels

of U.S.-Japan economic cooperation. Who will believe us when we appeal to the spirit of

‘friend-shoring’?” |

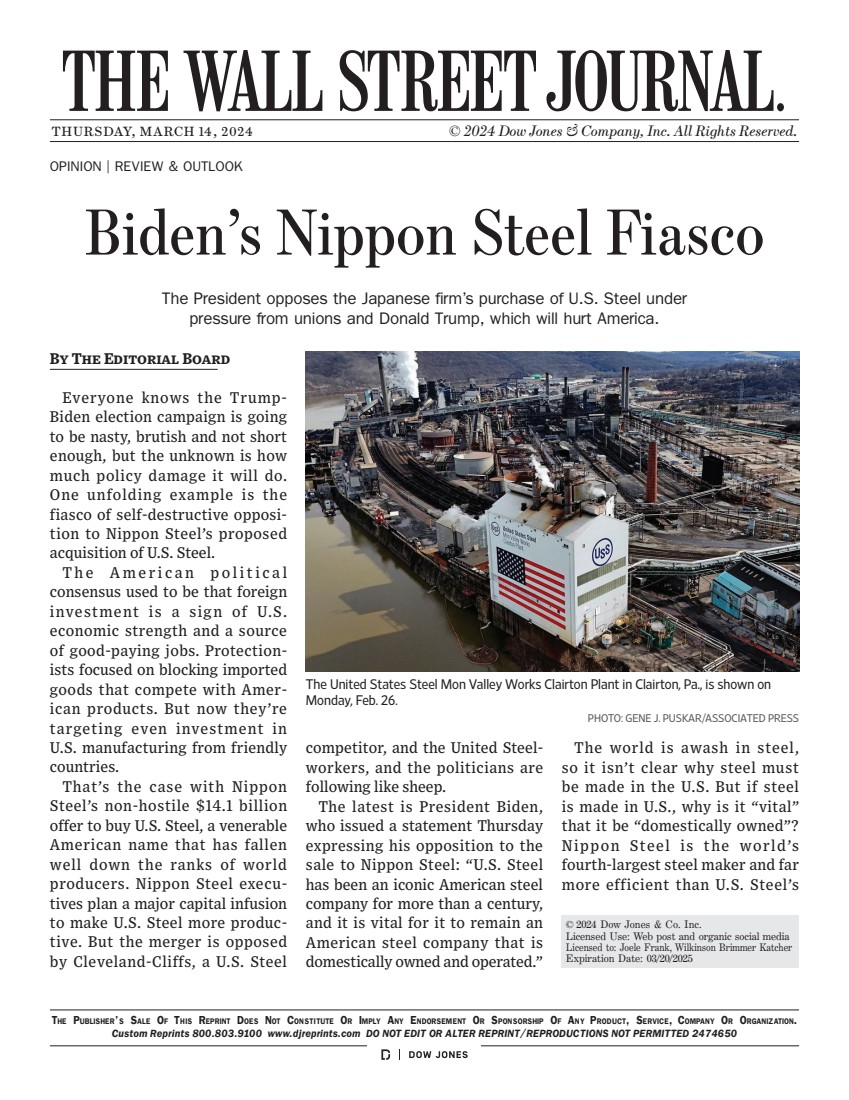

| THURSDAY, MARCH 14, 2024 © 2024 Dow Jones & Company, Inc. All Rights Reserved.

By The Editorial Board

Everyone knows the Trump-Biden election campaign is going

to be nasty, brutish and not short

enough, but the unknown is how

much policy damage it will do.

One unfolding example is the

fiasco of self-destructive opposi-tion to Nippon Steel’s proposed

acquisition of U.S. Steel.

T h e A m e r i c a n p o l i t i c a l

consensus used to be that foreign

investment is a sign of U.S.

economic strength and a source

of good-paying jobs. Protection-ists focused on blocking imported

goods that compete with Amer-ican products. But now they’re

targeting even investment in

U.S. manufacturing from friendly

countries.

That’s the case with Nippon

Steel’s non-hostile $14.1 billion

offer to buy U.S. Steel, a venerable

American name that has fallen

well down the ranks of world

producers. Nippon Steel execu-tives plan a major capital infusion

to make U.S. Steel more produc-tive. But the merger is opposed

by Cleveland-Cliffs, a U.S. Steel

competitor, and the United Steel-workers, and the politicians are

following like sheep.

The latest is President Biden,

who issued a statement Thursday

expressing his opposition to the

sale to Nippon Steel: “U.S. Steel

has been an iconic American steel

company for more than a century,

and it is vital for it to remain an

American steel company that is

domestically owned and operated.”

The world is awash in steel,

so it isn’t clear why steel must

be made in the U.S. But if steel

is made in U.S., why is it “vital”

that it be “domestically owned”?

Nippon Steel is the world’s

fourth-largest steel maker and far

more efficient than U.S. Steel’s

The Publisher’s Sale Of This Reprint Does Not Constitute Or Imply Any Endorsement Or Sponsorship Of Any Product, Service, Company Or Organization.

Custom Reprints 800.803.9100 www.djreprints.com DO NOT EDIT OR ALTER REPRINT/REPRODUCTIONS NOT PERMITTED 2474650

Biden’s Nippon Steel Fiasco

The President opposes the Japanese firm’s purchase of U.S. Steel under

pressure from unions and Donald Trump, which will hurt America.

OPINION | REVIEW & OUTLOOK

© 2024 Dow Jones & Co. Inc.

Licensed Use: Web post and organic social media

Licensed to: Joele Frank, Wilkinson Brimmer Katcher

Expiration Date: 03/20/2025

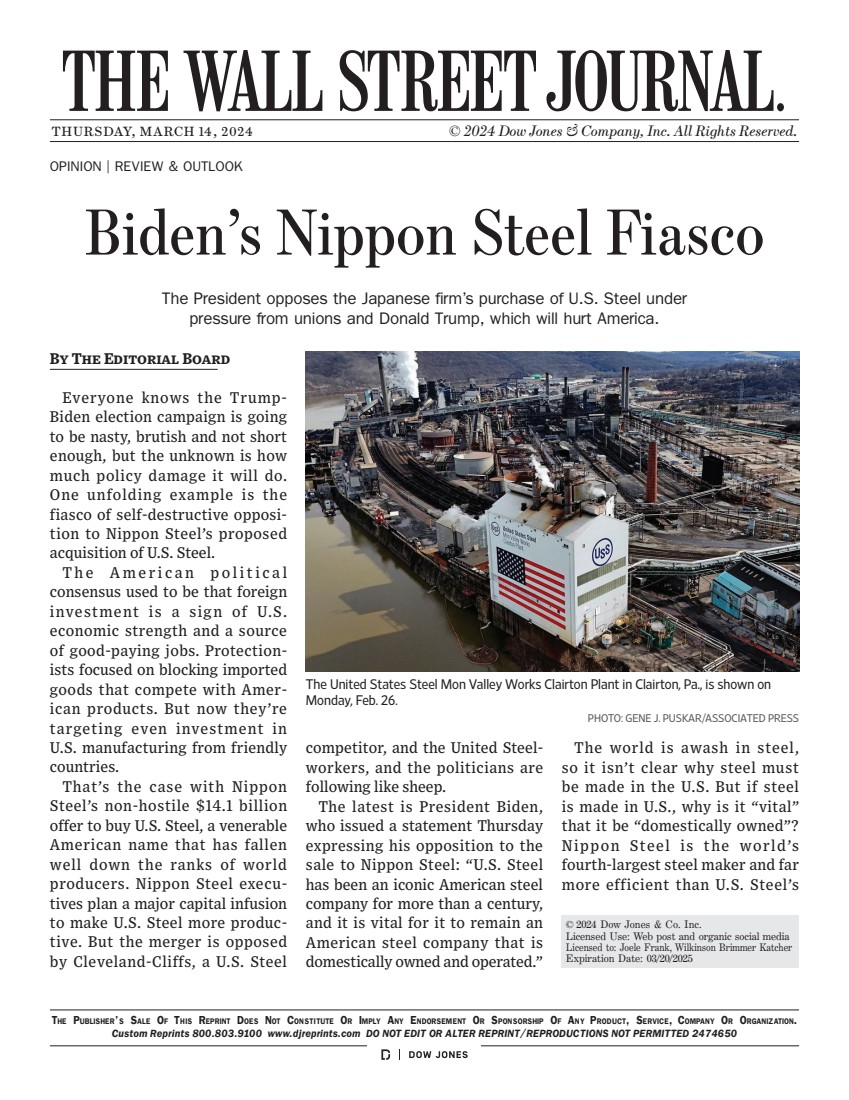

The United States Steel Mon Valley Works Clairton Plant in Clairton, Pa., is shown on

Monday, Feb. 26.

PHOTO: GENE J. PUSKAR/ASSOCIATED PRESS |

| aging plants. Nippon Steel’s

expertise and capital would

enhance U.S. economic strength

by making U.S. Steel’s operations

more competitive.

Nippon Steel already employs

some 4,000 Americans, and it has

wanted to expand here for some

time. One reason is the 25% tariff

on steel imports that Donald

Trump imposed and Mr. Biden

hasn’t lifted. Manufacturers are

moving to the U.S., especially from

Europe, to avoid U.S. tariffs and

take advantage of lower-cost Amer-ican energy and the vast subsidies

for green energy. The U.S. needs

more steel to meet this demand.

But the political opposition

to Nippon Steel isn’t about the

economic merits. It’s about Cleve-land-Cliffs, the steelworkers union

and the electoral competition for

blue-collar workers in November.

Like U.S. Steel, Cleveland-Cliffs

is a unionized U.S. company.

Its CEO, Lourenco Goncalves, is

sore because U.S. Steel rejected

his merger offer as inadequate

last year. Smart move. Nippon

Steel’s bid is roughly double

what Cleveland-Cliffs offered.

Cleveland-Cliffs and its political

patrons in the Ohio and Penn-sylvania Senate delegations are

now lobbying furiously to block

the Japanese company’s purchase.

Donald Trump also opposes the

deal, claiming to be a tribune of

the working man.

I f y o u r e a l l y c a r e a b o u t

workers, Nippon Steel’s bid is

better. The firm has promised to

honor the United Steelworkers

collective-bargaining agreement

and says it won’t move current

U.S. production or jobs overseas.

A more competitive U.S. Steel

is less likely to have to lay off

workers in the future.

Mr. Biden as President is

s u p p o s e d to re p re s e n t t h e

national interest, and maintaining

America’s reputation for inviting

foreign capital really is a “vital”

interest. So is treating allies well,

and mistreating a Japanese firm

as hostile won’t make friends

in Tokyo. Mr. Biden has already

jolted allies with his recent deci-sion to stop approvals for lique-fied natural gas export projects.

Barring Nippon Steel for political

reasons sends a rotten message to

friends—especially since it would

be a boon to Chinese steel makers

that compete with Nippon.

Mr. Biden’s rhetorical interven-tion is also a bad look because

his government’s Committee on

Foreign Investment in the United

States is reviewing Nippon Steel’s

bid. His comments look like an

attempt to tilt the committee,

which is composed of executive

branch agencies, against the

acquisition. It’s the kind of thing

you’d expect from Mr. Trump.

And that may explain it. Mr.

Biden is scared of Mr. Trump’s

trade shadow, which is leading

to many bad economic deci-sions. The political competition

to appear to be populist—while

really being corporatist—is going

to do a lot more harm in the next

seven months. |

The following materials were first displayed by United States Steel

Corporation on digital screens in the company’s facilities on March 19, 2024:

| If you really care about

workers, Nippon Steel’s

bid is better. [...] A more

competitive U. S. Steel is

less likely to have to lay

off workers in the future.

Editorial Board

March 14, 2024 |

| T

h

e

r

e is

vir

t

u

ally

n

o

b

o

d

y

w

h

o

w

o

uld

a

r

g

u

e

t

h

a

t

J

a

p

a

n

r

e

p

r

e

s

e

n

t

s

a

n

a

tio

n

al s

e

c

u

rit

y

ris

k. In

f

a

c

t, t

h

e

t

e

c

h

n

olo

g

y

t

r

a

n

s

f

e

r in

t

his

c

a

s

e is

g

oin

g

f

r

o

m

J

a

p

a

n

t

o

t

h

e

U.S. w

h

e

r

e

t

h

e

r

e

w

o

uld

b

e

sig

nific

a

n

t

p

o

t

e

n

tial upgrades of it. M

a

r

c

h

1

4, 2

0

2

4

D

a

vid

Fa

b

e

r

C

o

-

A

n

c

h

o

r

S

q

u

a

w

k

B

o

x |

| Given everything that the

Nippon Steel executives have

said about what they plan to

do, honoring labor

agreements, I don't think

there's a national security

concern at all.

March 14, 2024

Chairman, House Select

Committee on the Strategic

Competition between the United

States and the Chinese

Communist Party

Rep. Mike Gallagher

R - Wisconsin, 8th District |

| Nippon has committed

to make large capital

expenditures to improve

U. S. Steel's existing blast

furnace infrastructure which

supports American job

creation.

March 15, 2024

David Zirin

Chief Operating Officer

Pentwater Capital Management |

| I am unaware of any president

preemptively signaling he may

oppose an acquisition that is

undergoing national security

review, much less an acquisition

by a company from a treaty

partner that we are obligated to

defend with U.S. troops.

March 13, 2024

Dan Price

Managing Director

Rock Creek Global Advisors |

| Contrary to knee-jerk opposition

based on outdated sentiments,

Nippon's investment will

modernize U. S. Steel's

technological capabilities, foster

innovation, increase productivity,

and improve cost efficiency.

March 16, 2024

Andrew Langer

President

Institute for Liberty |

| Mo v i n g Fo rwa r d Toget h e r

a s t h e

wo r l d -le a d i n g c a p a b ilities

wit h

t h e b est steelma k e r |

| BestDealForAmericanSteel.com

X App (log-in required)

LEARN MORE AT: |

Additional Information and Where to Find It

This communication relates to the proposed transaction between the

United States Steel Corporation (the “Company”) and Nippon Steel Corporation (“NSC”). In connection

with the proposed transaction, the Company has filed and will file relevant materials with the United States Securities and Exchange Commission

(“SEC”), including the Company’s proxy statement on Schedule 14A (the “Proxy Statement”),

a definitive version of which was filed with the SEC on March 12, 2024. The Company commenced disseminating the definitive Proxy Statement

to stockholders of the Company on or about March 12, 2024. The Company may also file other documents with the SEC regarding the proposed

transaction. This communication is not a substitute for the Proxy Statement or for any other document that may be filed with the SEC in

connection with the proposed transaction. The proposed transaction will be submitted to the Company’s stockholders for their consideration.

BEFORE MAKING ANY VOTING DECISION, THE COMPANY’S STOCKHOLDERS ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED OR TO BE FILED WITH

THE SEC, INCLUDING THE PROXY STATEMENT (A DEFINITIVE FILING OF WHICH HAS BEEN MADE WITH THE SEC), AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS

TO THOSE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION

ABOUT THE COMPANY, NSC AND THE PROPOSED TRANSACTION.

The Company’s stockholders will be

able to obtain free copies of the definitive Proxy Statement, as well as other documents containing important information about the Company,

NSC and the proposed transaction once such documents are filed with the SEC, without charge, at the SEC’s website (www.sec.gov).

Copies of the Proxy Statement and the other documents filed with the SEC by the Company can also be obtained, without charge, by directing

a request to United States Steel Corporation, 600 Grant Street, Suite 1884, Pittsburgh, Pennsylvania 15219, Attention: Corporate Secretary;

telephone 412-433-1121, or from the Company’s website www.ussteel.com.

Participants in the Solicitation

NSC, the Company and their directors, and certain of their executive

officers and employees may be deemed to be participants in the solicitation of proxies from the Company’s stockholders in respect

of the proposed transaction. Information regarding the directors and executive officers of the Company who may, under the rules of the

SEC, be deemed participants in the solicitation of the Company’s stockholders in connection with the proposed transaction, including

a description of their direct or indirect interests, by security holdings or otherwise, is set forth in the Proxy Statement, a definitive

version of which was filed with the SEC on March 12, 2024. Information about these persons is included in each company’s annual

proxy statement and in other documents subsequently filed with the SEC, and was included in the definitive version of the Proxy Statement

filed with the SEC. Free copies of the Proxy Statement and such other materials may be obtained as described in the preceding paragraph.

Forward-Looking Statements

This communication contains information regarding the Company and NSC

that may constitute “forward-looking statements,” as that term is defined under the Private Securities Litigation Reform Act

of 1995 and other securities laws, that are subject to risks and uncertainties. We intend the forward-looking statements to be covered

by the safe harbor provisions for forward-looking statements in those sections. Generally, we have identified such forward-looking statements

by using the words “believe,” “expect,” “intend,” “estimate,” “anticipate,”

“project,” “target,” “forecast,” “aim,” “should,” “plan,” “goal,”

“future,” “will,” “may” and similar expressions or by using future dates in connection with any discussion

of, among other things, statements expressing general views about future operating or financial results, operating or financial performance,

trends, events or developments that we expect or anticipate will occur in the future, anticipated cost savings, potential capital and

operational cash improvements and changes in the global economic environment, the construction or operation of new or existing facilities

or capabilities, statements regarding our greenhouse gas emissions reduction goals, as well as statements regarding the proposed transaction,

including the timing of the completion of the transaction. However, the absence of these words or similar expressions does not mean that

a statement is not forward-looking. Forward-looking statements include all statements that are not historical facts, but instead represent

only the Company’s beliefs regarding future goals, plans and expectations about our prospects for the future and other events, many

of which, by their nature, are inherently uncertain and outside of the Company’s or NSC’s control. It is possible that the

Company’s or NSC’s actual results and financial condition may differ, possibly materially, from the anticipated results and

financial condition indicated in these forward-looking statements. Management of the Company or NSC, as applicable, believes that these

forward-looking statements are reasonable as of the time made. However, caution should be taken not to place undue reliance on any such

forward-looking statements because such statements speak only as of the date when made. In addition, forward looking statements are subject

to certain risks and uncertainties that could cause actual results to differ materially from the Company’s or NSC’s historical

experience and our present expectations or projections. Risks and uncertainties include without limitation: the ability of

the parties to consummate the proposed transaction on a timely basis or at all; the timing, receipt and terms and conditions of any required

governmental and regulatory approvals of the proposed transaction; the occurrence of any event, change or other circumstances that could

give rise to the termination of the definitive agreement and plan of merger relating to the proposed transaction (the “Merger

Agreement”); the possibility that the Company’s stockholders may not approve the proposed transaction; the risks and uncertainties

related to securing the necessary stockholder approval; the risk that the parties to the Merger Agreement may not be able to satisfy the

conditions to the proposed transaction in a timely manner or at all; risks related to disruption of management time from ongoing business

operations due to the proposed transaction; certain restrictions during the pendency of the proposed transaction that may impact the Company’s

ability to pursue certain business opportunities or strategic transactions; the risk that any announcements relating to the proposed transaction

could have adverse effects on the market price of the Company’s common stock or NSC’s common stock or American Depositary

Receipts; the risk of any unexpected costs or expenses resulting from the proposed transaction; the risk of any litigation relating to

the proposed transaction; the risk that the proposed transaction and its announcement could have an adverse effect on the ability of the

Company or NSC to retain customers and retain and hire key personnel and maintain relationships with customers, suppliers, employees,

stockholders and other business relationships and on its operating results and business generally; and the risk the pending proposed transaction

could distract management of the Company. The Company directs readers to its Quarterly Report on Form 10-Q for the quarter ended September

30, 2023 and Form 10-K for the year ended December 31, 2023, and the other documents it files with the SEC for other risks associated

with the Company’s future performance. These documents contain and identify important factors that could cause actual results to

differ materially from those contained in the forward-looking statements. Risks related to NSC’s forward-looking statements include,

but are not limited to, changes in regional and global macroeconomic conditions, particularly in Japan, China and the United States; excess

capacity and oversupply in the steel industry; unfair trade and pricing practices in NSC’s regional markets; the possibility of

low steel prices or excess iron ore supply; the possibility of significant increases in market prices of essential raw materials; the

possibility of depreciation of the value of the Japanese yen against the U.S. dollar and other major foreign currencies; the loss of market

share to substitute materials; NSC’s ability to reduce costs and improve operating efficiency; the possibility of not completing

planned alliances, acquisitions or investments, or such alliances, acquisitions or investments not having the anticipated results; natural

disasters and accidents or unpredictable events which may disrupt NSC’s supply chain as well as other events that may negatively

impact NSC’s business activities; risks relating to CO2 emissions and NSC’s challenge for carbon neutrality; the economic,

political, social and legal uncertainty of doing business in emerging economies; the possibility of incurring expenses resulting from

any defects in our products or incurring additional costs and reputational harm due to product defects of other steel manufacturers; the

possibility that we may be unable to protect our intellectual property rights or face intellectual property infringement claims by third

parties; changes in laws and regulations of countries where we operate, including trade laws and tariffs, as well as tax, environmental,

health and safety laws; and the possibility of damage to our reputation and business due to data breaches and data theft. All information

in this communication is as of the date above. Neither the Company nor NSC undertakes any duty to update any forward-looking statement

to conform the statement to actual results or changes in the Company’s or NSC’s expectations whether as a result of new information,

future events or otherwise, except as required by law.