| Legal Disclaimer costs and improve operating efficiency; the possibility of not completing planned alliances, acquisitions or investments, or such alliances. acquisitions or investments not having the antlcipated results: natural disasters and accidents or unpredictable events which may disrupt NSC's supply chain as well as other events that may negatively impact NSC's business activities: risks relating to CO2 emissions and NSCs challenge for carbon neutrality: the economic, political, social and legal uncertainty of doing business in emerging economies; the possibility of incurring expenses r esulting from any defects in our products or incurring additional costs and reputat iona1 harm due to product defects of other steel manufacturers; the possibility that we may be unable to protect our intellectual property rights or face intellectual property infringement claims by third parties; changes in laws and regulations of countries where we operate, including trade laws and tariffs, as well a tax, environmental. health and safety laws; and the possibility of damage to our reputation and business due to data breaches and data theft. All information in this website is as of the date above. Neither the Company nor NSC undertakes any duty to update any forward-looking statement to conform the statement to actual results or changes In the Company's or NSC's expectations whether as a result of new information, future events or otherwise, except as required by law. - |

|

| NIPPON STEEL CORPORATION [NSC]1 AND U.S. STEEL COMBINATION IS THE BEST DEAL FOR AMERICAN STEEL --... NSIC\--ln ... ,,_ ___ •-~------ -~-s.a,._, I ,,_, ___________ _ ..,.,, __ ... __ .,_____ .,._.,,.,. __ .. __ , .. , --------- I ___ __________ ,, ,. __ , _____ _ I __ ,·----------- _____ .. ____ _ -------•ull,- l -----··------- <_.,.., _ __ V5_ ... _..,_....,._ ... _ ... NSC HAS A PROVEN RECORD OF ACQUIRING, OPERATING AND INVESTING IN STEEL MILL FACILITIES IN AMERICA JISt"S.O.-'lW,_S[IC(.UIILUll'.u:tllNIASES,111111(t _,._ .. __ ,._ ----·---- ---·---- __ .... __ _ NSC RECOGNIZES THAT THE COMBINED WORKFORCE IS CRITICAL TO OPERATIONS ANO IS COMMITTED TO HONORING ALL USW COLLECTIVE BARGAINING AGREEMENTS IOlflTSWIDEltEIMSGFTIICUMOOCIA 51 WA6E INCIIEASES UNCAPPED PIIOITT SHAJIINS S0.75/llOUR --- Tll~ TlW1SICTION AEPIIESOOS A1111THER EXAMPl.£0FTllEUIITlllSTATES'STRlTE61C PARTNtRSHIPWITHJANJL ----~-URO- --•UOJ.-... --- --------- ------ ·i _______ .............. ...,. -.-:i--"'9"'f• ------t,ott.1,1, .. --.. ___ ,.,.,,"""._ _ .. ---.. -~ ....... _ .... -----..----· -- STRENGTHENS U.S. STEffS MINED. MELTED ANO MADE IN AMERICA PORTFOLIO OF PRODUCTS l ll,lr,g,..,....._.,._~--- -US-•---•--c--"""""""' _(_,._.._ ... ......... _,.,... ___ ..... ---.. ~ ENHANCING U. S. STEEL I r-_.,,,_.....us-.-.-.,._"'11>- ....-.-.,.,.-. 1=- ---------·-- ·------'°' TltETWSACTIIIIWITHNSCnLENIWICE I.S.STIRITltEFOl.L11¥1111G IIIA'rS: Id(:,._., ________ ... _____ ..... _.,_., ... __ i'l$0: ...... _,._.,s. ______ _ .., __ .,_, _ .... _ ..... -~ .. -OIIC'-____ ,. us.-..-•-•-.. •----"-" _", __ ., ... ____ .. __ ----·--- _, .. _., ___________ _ __ .. ____ UI)_ __..., ________ .. =~=-=-==-=.. ..... .. _....,,, ______ .,_ -----------· __ .. _____ co,_ |

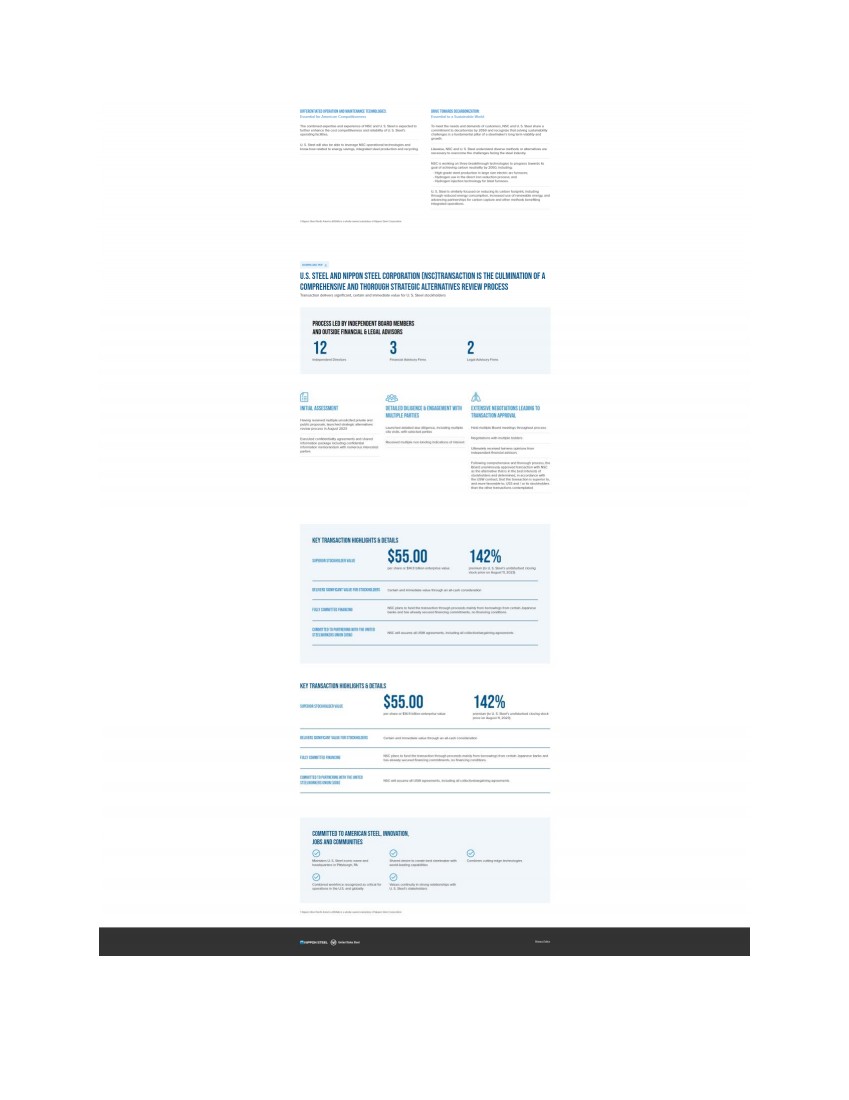

| , lfltBllUII.UU.•Nrtllla ___ ,_ Tlta.a:S l---~~ ••-- ___ ..._ __ ..,. __ .,t«: ... vl.____ .. ...,...,. ___ .,_N$C_,,.,_.....,. .,. ____ ...... _.. _____ .. _____ _ --... _ ... _.,._.,_...., __ _ -··---"'·----- ---•-------- ,._..,NISC-<AI.-----•--- ___ ... __ .,. __ -·--------- ...... ___ ___ ___ ., ____ "" __ _ _ .,. ____ _ UL_,, ______ ------ __ .. ____ .. __ __ _ -- --.------------ U.S. STEEL AND NIPPON STEEL CORPORATION (NSC)TRANSACTION IS THE CULMINATION OF A COMPREHENSIVE AND THOROUGH STRATEGIC ALTERNATIVES REVIEW PROCESS PmSSUO 8YIIIOEPIIIIIIIT 80AIIO ll!IIIOS IJOIIOOTSIIIFIWIClll6U6.llAIMSIIIS 12 "TIAllSS!SSIIIII ------ ------ ---- ---·-- ~----- -------- 3 2 s ,ii IIUl.£11U011li ElliAEIITlfflll ErnJSM:•&OTWIIISI.OINTI llWl\lNID TWISACTIIIIAPPUAI. ------- ----- ------ ......., _____ ... -------- ___________ .,.,. __ .. ......... ___ _______ _ ...... _, ___ _ ------ KEYTIIANSACOON HliHUGtfTS ti onw ~11~.,.• aro snnaM.f -- $55.00 _____ _.., 142% ... __ ,, __ _ _, ___ .,. _________ _ ------------ KEYTWISACTllNHl6HU6HTSfiOCJALS $55.00 142% _.,us-----• _ .. _,.._ tll.llllS-..rNllfMI~ c--------- ---------- ----... ---~-------- _ " ___ _ --- COIIMITTmtolMllll:AllmEI.IIINO'IAllOII, ..QSANII COMMUNITIES 0 -v•---- _.,_,. 0 ___ 0 ......., ___ -..--- --- -=----,,..,. 0 .. 0 __ .. __ _ _ ..... u.1.-- |

| :: TRANSACTION BENEFITS FOR EMPLOYEES U.S. STEEL AND NIPPON STEEL CORPORATION (NSC1 ) COMBINATION IS THE BEST DEAL FDR AMERICAN STEEL ----·- ~------- -------- -- ,.,, S15au:IIINZOZ3 $50111.lJ)N.2023 2Ull.l.OITWCS (Z0.3Ttl'IIUI '" 0 ----- ·•------ W.----~i-......... - --------- ____ .,. __ _ __ ,, ____ __ ·-------- ------ ___ .. __ ·------- ------·- 0 0 0 0 1150 121,000- 12.1 .... ,r.ws [IITDIIJEJ4 1,993 20 0 ·----- ~-------·-- -·-___ .,. __ ------- _.,,_ ·-·--- ____ _ ,. __ _ .. _ ... __ - - ·------- ___ ..., ___ _ 0 0 0 0 |

| NIPPON STEEL TRANSACTION WITH U.S. STEEL SECURES LONG·TERM FUTURE OF UNION JOBS "'"'SIIIIS wtwot ___ loo __ ~ ·---- -------- --------- U$---•-----•- __ ,..., ____ IO<••--- DoM - USW--righ!IO-..IMtr_....,wkn "''" us-----•--•----•-- ---- us _______ ...,., ___ .,.,. --------~-- ... ______ _ Ut. __ ... ,_ _ __ .,. ___ .. _,,. ___ ... ___ .. _,, ____ _ ------ KFl'TIIIISTtlOIM Oo,H NSCrK<>gnin-USW-••-IIMnillin9 ..... ....,., _____ .._ ___ ,.. .. --------.. --- _..,._ , __ .. __ ... ._ .. ..., .... a.... __ ......, ... ____ ..... ...,_ ..... ___ ...._ |

| 11111 -irra,. @ - -- MOVING FORWARD TOGETHER AS THE BEST STEELMAKER WITH WORLO·LEAOING CAPABILITIES ... FOR OUR CUSTOMERS STUTEICIOlflTS 3TIUG:$Tt~ cf ¢ .:~ .__,.CS!MII_IJl'lal m.n1t~sn.catM1• au111••S11B~-- ~--••--l'IJl'NI -----•-tlalllll ... ------- --,--~-"•--- __ -•- ,, ________ ... .,•--·-•-., -------- --u•--•-• .. _.,. ____ _ --------·· ---------· ---··----- ----- __ ... ____ _ ______ ,... --- _________ _____ .. ·----- .,_ .. _ --·----- --------- __ ... ____ _ .,. _,_.,.,. ___ _ ... ___ ,-~ ... -- IIITllRAIWT1l!IISCfllf'UT(,RISIUS»lSSASIISUAI. 06A ------------- __ .,, _________ _ ----- ------.. ------· -----·--- ----------- -· -- -·--- __ ---- .... ____ .. _ .. __ ---------- -----· DELIVERS CERTAIN ANO IMMEDIATE VALUE FOR U. S. STEEL SHAREHOLDERS mw&TUftSC"S ..-rMTOIElMIUIWICU,urrutJll .uala-fEIIIYAI.II flll llSCSIIAIIOaJIIS ,/ ---..... -..... ----·-------------------- |

| 00 ~IJ.S.SIMh ~ -.Dr--~ __ .. RESULT Of U. S. STEEL'S COMPREHENSIVE ANO THOROUGH STRATEGIC ALTERNATIVES PROCESS ~~ DrMnggioba,1----try -dcer-neuo11111y-a.. --~ --•-byl'OSO |

| NIPPON STEEL @ United States Steel HOME BENEFITS OFT HE TRANSACTION v SUPPORT FOR THETRANSACTION NEWSROOM AND MATERIALS CONTACT DOWNLOAD PDF .±. HERE'S WHAT PEOPLE ARE SAYING ABOUT U. S. STEEL'S PROPOSED TRANSACTION WITH NIPPON STEEL CORPORATION (NSC) 1 |

| FROM GOVERNMENT OFFICIALS ... RAHM EMANUEL UNITID STATIS AMBASSADOR TO JAPAN DEC. 18, 2023 "Nippon Steel and U. S. Steel announce ahistoric $14.9 billion transaction. These two iconic companies are defining the future of the key steel industry and forging a strong bond as they face a more competitive environment.While the USA and Japan have been the number one investors in each's country for the past four years, today's announcement will deepen those bonds." 8 FORMER US SEN. FOR PA PAT TOOMEY CARROU TOWNSHIP DEC. 21, 2023 [U. S. Steel) "shareholders consist of Americans of all stripes. The teachers, firemen, truck drivers, who have 401(k)s and pension plans invested in companies including U. S. Steel. [ ... ) This is good for the steel workers. This is good for steel production. This is good for the United States. The fact of the matter is that Nippon Steel would be obligated to follow al of the labor laws that anyone else is obligated to, including the negotiations over new contracts, which is very heavily regulated by the federal government...! think the union workers ought to be glad that a larger parent company with greater resources is going to be there to increase the likelihood that they stay viable. I think it's a big mistake for the unions to conclude somehow they're worse off when it's not at all clear that that's the case." |

| FROM THE ANALYST AND INVESTMENT COMMUNITY ... BANK OF AMERICA q ~ Bank of America analysts said,"X stated that NSC has committed to honor all labor agreements and would maintain X's iconic brand name. From an overall industry perspective. t he deal would increase competition in the domestic market (especially auto/electrical steel) with no material offset from consolidation." DECEMBER 18, 2023 INTHE MEDIA FT FIN"OiCIAL T IMES In the media ... "Japan reasonably thinks of itself asAmerica·s closest ally in Asia. It is the host nation of the largest number of US military outside t he US itself and a gargantuan customer of American hardware. Japan has also recently proved its friendship many times over - most prominently by joining t he US in imposing restrictions on exports of high-end semiconductor production equipment, and by directly helpingWashington rally sign-ups to the lndo-Pacific EconomicFramework trade deal." DECEMBER 19, 2023 II Josh Spoores, steel analyst at CRU Group, told Yahoo Finance the announcement could be good news for buyers. Further consolidation of the US market would have increased prices and pushed manufacturers elsewhere, he said. The deal has the potential to keep the domestic market competitive. which could encourage manufacturers to keep producing in the US and employing US workers. DECEMBER 18. 2023 Pl'IT SBURGI I T RIBUNE-REVIEW " ... shareholders are not the only winners. The UnitedSteelworkers will have their contract honored and a good-faith bargaining partner in the combined U. S.Steel-NSC. Pittsburgh and Pennsylvania get to keep theU. S. Steel jobs that already were here, and our state will maintain its primacy in the American steel industry. Finally, up and down the steel supply chain. buyers will have a competitive marketplace that is not dominated by any one firm. As inflation continues to be a problem, a merger that will help keep prices down is good for consumers." DECEMBER 19, 2023 Morgan Stanley Morgan Stanley analysts said, "Given Nippon has stated it will honor all of U. S. Steel's commitments with its employees. including all collective bargaining agreements in place with the unions, we believe the requirements for any transaction to take place will likely be fulfilled." DECEMBER 18, 2023 Jlittsburgb Jlost-'6ia..ette "Jobs are staying in Pennsylvania instead of leaving. The iconic U. S. Steel brand will continue instead of fading away. The United Steelworkers will continue to represent the hardworking men and women in a combined U.S. Steel - Nippon Steel. Our allied supply chain will be strengthened and Chinese grip on the international steel market will be weakened. What's not to like?" DECEMBER 20, 2023 |

| Jlittsburgb Jlosl-'6.udte " ... this deal may be the best outcome for what was once the world's largest company, for the Pittsburgh region, and for the United States ... Nippon has few operations in the US, so there are no serious antitrust concerns. For southwest Pennsylvania, it's unlikely Nippon just dropped$14 billion - a huge 40% premium on the market value - j ust to shut down the Mon Valley Works. It is more likely that Nippon values owning an American integrated steel operation, maybe even more than U. S. Steel did. Nippon has also committed to making steel as cleanly as possible" DECEMBER 20, 2023 DOWNLOAD PDF .::!:. "The proposed transaction should easily pass muster. Large-scale capital investment by a Japanese company poses no danger to U.S. national or economic security, as the relevant agency - the Committee on Foreign Investment in theUnited States (CFIUS), chaired by Treasury Secretary Janet L. Yellen - has every reason to conclude ... Japan is a U.S. allyand party to a mutual defense pact. The two countries cooperate on the production of microchips and other sensitive technologies." DECEMBER 22. 2023 HERE'S WHAT PEOPLE ARE SAYING ABOUT U. S. STEEL'S TRANSACTION WITH NIPPON STEEL There is broad agreement that the transaction with NSC will support customers, employees and communit ies FROM GOVERNMENT OFFICIALS ... WILBUR ROSS FORMER UNITED STATES SECRETARY OF COMMERCE DEC_ 20. 2023 "Nippon Steel is a very high-tech steel company. If anything, they may have better technology than U. S. Steel.They've pledged to honor the labor contracts, which go through 2026, and they have pledged O carbon by 2050.They're a very, very responsible company and it reminds me back some decades ago when I was at Rothschild.WP rpprpspntPd !hp Rockpfpllpr 34 trust whpn thpy sold Rock CPntpr to thP .fap;mpsp to Mitsui ;md everybody said, "Oh my God, the sky is falling. An American icon owned by the Japanese." Well, you know what the consequences were? Nothing, no consequences, and I don't think there will be any consequences of this." |

| FROM THE ANALYST AND INVESTMENT COMMUNITY ... II John C. Tumazos, metals industry analyst at Very Independent Research, told Pittsburgh Tribune-Review the transaction will not trigger mass layoffs in southwestern Pennsylvania or encourage new owners to id le mills; instead, it will create new jobs, spark investment and invest heavily in upgrading existing facilities." Josh Spoores, steel analyst at CRU Group, said, "I do expect for them (NSC) to come and invest in some production lines in the U.S ... I don't think (those opposing the sale) are seeing the whole picture. I think they're seeing the old, iconic image of U. S. Steel and not what it is today." James Pinkerton, political analyst, said, "The news that Nippon Steel wants to buy U. S. Steel is good news. If money talks, then this offer from a Japanese company speaks loudly. It's a vote of confidence in American manufacturing, in American workers, and in the United States itself... Nippon Steel has pledged to honor collective bargaining agreements with the United Steelworkers union. So that's good news for workers across Pennsylvania and other states." DECEMBER 23. 2023 DECEMBER 23, 2023 FROM POLICY EXPERTS ... SANJAY PATNAIK DIRECTOR OF THE CENlIR ON REGULATION AND MARKETS AT THE BROOKINGS INSTITUTION DEC 22. 2023 "I don't see a compelling national security reason to block it because again, Japan is an ally. And actually.I've seen some information that if the deal goes through, the combined joint company could be a pretty good play on the world market, which would pose a counterweight to the Chinese steelmakers." DECEMBER 22. 2023 WILLIAM CHOU JAPAN FB.LOW AT HUDSON INSTITUTE DEC. 22, 2023 "The sale protects American consumers. Had U. S. Steel merged with Cleveland-Cliffs, the new company would have dominated steel supplies for the auto industry and provided all the steel needed for electric-vehicle motors.The lack of competition would likely mean higher EV costs for consumers ... Nippon Steel plans to maintain U.S.-based production, which will provide Americans with greater economic security." |

| INTHE MEDIA THE WALL S11U1,1' JOURNAL "The merger may enhance U.S. competitiveness. The $15 billion deal would create one of the world's top three steel makers, and it's a direct investment in U.S. manufacturing ... Nippon Steel Is likely to improve U.S. Steel's operations and efficiency. The company headquarters will remain in Pittsburgh. Foreign capital investment in the U.S. is good for the economy and workers." DECEMBER 22, 2023 FT "The acquisition of US Steel by Nippon Steel is a symbolic deal (both comp;mi<>s "'" Aftpr nll nnmPd nft<>r their respective countries, ie "Nippon" means Japan). It is also symbolic in terms of competition in global capital markets, and in the pursuit of scale and efficiency in the steel industry, as well as in terms of economic security between Japan and the US and the western world." ..IANUl,J ry 2. 2024 Bloomberg "The upsides of the deal outweigh the potential drawbacks. The acquisition would lend US Steel the backing of a financially stronger patron and create a steel giant able to hold its own against China's behemoth producers. It's highly unlikely that the Pentagon's needs, which currently account for about 3%of total US steel shipments, would be in any way compromised. Even If Nippon Steel, a private company, were somehow beholden to the Japanese government, there's little reason that Japan would want to weaken the US military at a time when it faces growing threats from China and North Korea" JAH.JAR'f2,202 |

| "U. S. Steel Merger Objections Rooted In A 1970s-Era Perspective" By Ike Brannon Ike Brannon is a former senior economist for the United States Treasury and U.S. Congress. He is president of Capital Policy Analytics, d consulting firm that does research on issues related to public policy and financial markets. Read Full 011-Ed on Forbes "U. S. Steel and Nippon will be Good Partners" By Steve Forbes Steve Forbes is chairman and editor~111-chief of Forbes Media. Read the Full 011-Ed on The WashingJQ!! Examiner "Economic illiteracy and unseemly xenophobia hit the U.S. Steel deal" By George F. Will George F. Will is a columnist at The Washington Post who writes on politics and domestic and foreign affairs since 1977. J../e won the Pulitzer Prize for commenta,y In 1977 and is a regular contributor to MSNC and NBC News. Read the Full Column on The Washington Post "Nippon Steel's Purchase of U. S. Steel Will Improve The Economy" By Wayne Winegarden Wayne Winegarden is a Senior Fellow in Business and Economics at the Pacific Research Institute and the Director of PRl's Center for Medical Economics and Innovation whose research explores the connection between macroeconomic policies and economic outcomes, with a focus on the health care and energy industries. Mr. Winegarden has 25 years of experience advising Fortune 500 companies, medium and small businesses. and trade associations and received his Ph.D. in economics from George Mason University. Read Full Op-Ed on Forbes "Let the watchdogs decide if a foreign U. S. Steel sale works for America" By Marc L. Busch Marc L. Busch is the Karl F. Landegger Professor of International Business Diplomacy at the Walsh School of Foreign Servfce. Georgetown University, and a global fellow at the Wt/son Center's Wahba Institute for Strategic Competition. Read Full OQ:Ed on The Hill "Why there's no reason to worry about the Japanese takeover of U.S. Steel" By The Editorial Board Read Full Editorial on The Washington Post "Biden's Foolish Snub of Nippon Steel" By William Chou Mr. Chou is a Japan Chair fellow at the Hudson Institute. Read Full 011-Ed on The Wall Street Journal "The U. S. Steel Acquisition Is Good for America" By Bruce Thompson Bruce Thompson was a U.S. Senate aide, assistant secretary of Treasury for legislative affairs, and the director of government relations for Merrill Lynch for 22 years. Read Full OR-Ed on Real Clear Markets "Biden Shouldn't Block the Nippon Steel Deal" By The Editorial Board Read Full Editorial on Bloomberg |

| "Multinationals urge Janet Yellen not to let politics stop US Steel deal" By Aime Williams Aime Williams covers foreign policy. trade and climate for the Financial Times. Read the Full Article on Financial Times "They've pledged to honor the labor contracts, which go through 2026, and they have pledged 0 carbon by 2050. They're a very, very responsible company ... " Wilbur Ross Former United States Secretary of Commerce Watch Video "U. S. Steel-NSC Merger a good deal for workers, consumers and Pa." By Ryan Costello Ryan Costello is a former member of Congress from Pennsylvania. Read Full Op-Ed on Trib Live t Nippon Steel North America (NSNA) is a wholly-owned subsidiary of Nippon Steel Corporation "This is good for steelworkers, this is good for steel production, it's good for the United States. I don't get the argument against it." Pat Toomey Former U.S. Senator for Pennsylvania Watch Video i,111111 NIPPON STEEL @ Umtell States Steel Privacy Pol icy |

| NIPPON STEEL @ United States Steel PRESS RELEASE HOME BENEFITS OF THE TRANSACTION v SUPPORT FOR TNE TRANSACTION NEWSROOM AND MATERIALS CONTACT NIPPON STEEL CORPORATION INSCJ TO ACQUIRE U.S. STEEL, MOVING FORWARD TOGETHER AS THE 'BEST STEELMAKER WITH WORLD-LEADING CAPABILITIES' DECEMBER 18. 2023 |

| INVESTOR PRESENTATION + TRANSCRIPTS STAKEHOLDER RESOURCES NSC INVESTOR CAU TRANSCRIPT DECEMBER 19, 2023 NSC- U.S. STEEL TRANSACTION INVESTOR CALL TRANSCRIPT DECEMBER 18. 2023 NSC -U.S. STEEL TRANSACTION INVESTOR PRESENTATION DECEMBER 18. 2023 ENHANCING US STEEL FACT SHEET [1 OVERVIEW FACT SHEET [1 WHAT PEOPLE ARE SAYING FACT SHEET #1 [1 WHAT PEOPLE ARE SAYING FACT SHEET #2 [1 PROCESS FACT SHEET [1 UNITED STEELWORKERS FACT SHEET [1 |

| FILINGS U.S. STEEL SEC FILINGS ~ PRELIMINARY PROXY STATEMENT ~ JANUARY 24. 2024 DAVE BURRITT LITTER TO EMPLOYEES ~ JANUARY 15, 2024 MERGER AGREEMENT ~ DECEMBER 18, 2023 DAVE BURRITT LITTER TO EMPLOYEES ~ DECEMBER 18, 2023 8-K REGARDING A LETTER TO STOCKHOLDERS FROM DAVE BURRITT ~ AUGUST 29, 2023 LETTER TO STOCKHOLDERS ~ 8-K OUTLINING BLA WITH USW ~ AUGUST 22. 2023 ASSOCIATED EMPLOYEE LETTER ~ "' NIPPON STEEL ~ Un1led Stales Steel Pnva Pol c, |

| NIPPON STEEL @ United States Steel HOME BENEFITS OF THE TRANSACTION v SUPPORTFOR THETRANSACTION NEWSROOM IND MATER IALS CONTACT |

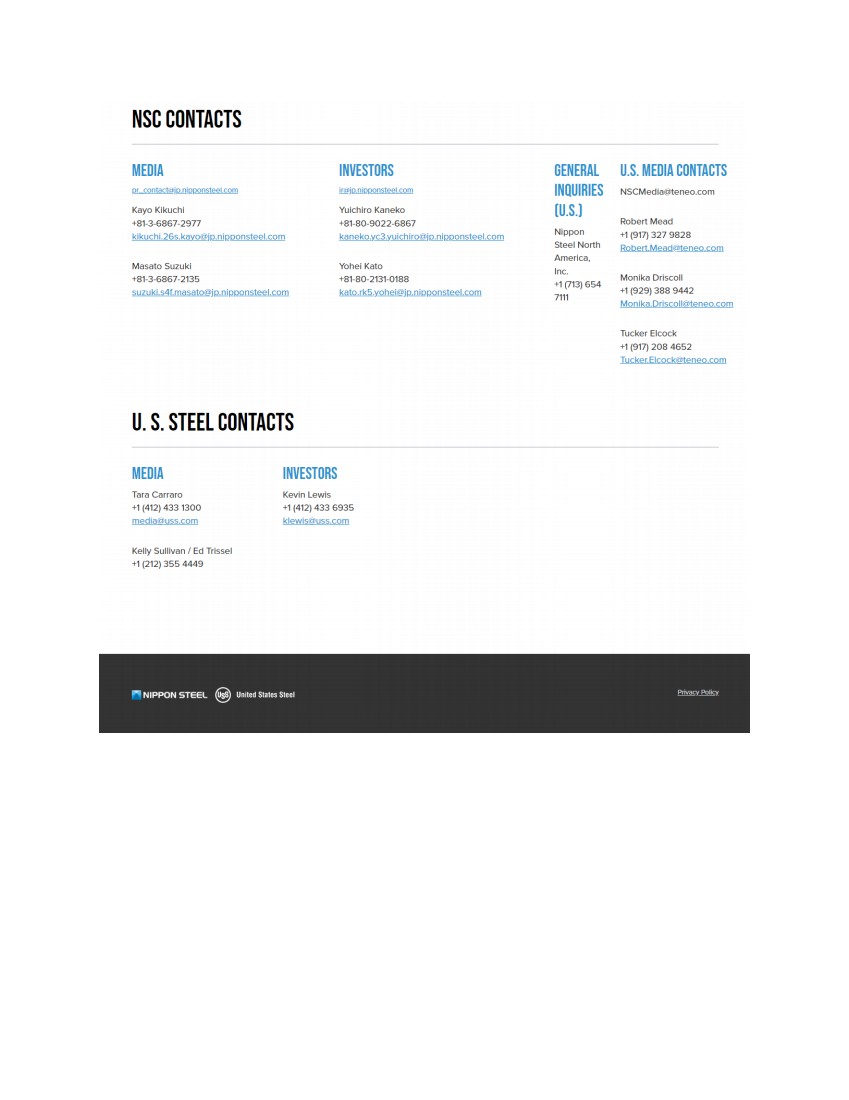

| NSC CONTACTS MEDIA Rf contact1ajMii:u~nstee1.com Kayo Kikuchi +81-3-6867-2977 kikuchi.26s.kayo_@jr.1.nir.1r.1ons1eel.com Masato Suzuki +81-3-6867-2135 suzuki.s4f.masato@jp.niRROnsteel.com U.S.STEELCONTACTS MEDIA INVESTORS Tara Carrara Kevin Lewis INVESTORS i@jlW.iRQQnsteel.com Yuichiro Kaneko +81-80-9022-6867 kaneko.ys;l;/_uichiro@jr.1.nir.1r.1onsteel.com Yohei Kato +81-80-2131-0188 kato.rk5.ymi.ei@jr.i.nir.iRonsteel.com +1 (412) 433 1300 media@uss.com +1 (412) 433 6935 klewis@uss.com Kelly Sullivan / Ed Trissel +1 (212) 355 4449 GENERAL U.S. MEDIA CONTACTS INQUIRIES NSCMedia@teneo.com [U.S.) Robert Mead Nippon +1 (917) 327 9828 Steel North Robert.Mead@leneo.com America, Inc. Monika Driscoll +1 (713) 654 +1 (929) 388 9442 7111 Monika.Driscoll@teneo.com Tucker Elcock +1 (917) 208 4652 Tucker.Elcock@teneo.com " NIPPON STEEL ~ Un1led Slates Steel PllVa~ Pohg |